Taylor Wimpey (LSE: TW.) lifted its full-year house completions guidance on Wednesday (31 July), and it gave the share price a small boost — up 2% in early trading.

The company now puts its target “towards the upper end of the previous guidance range of 9,500 to 10,000“.

The operating profit outlook, though, remains “in line with current market expectations“. Is that why the market reacted so weakly?

Tough times

Upbeat guidance can’t hide the fact that 2024 is still a hard year for house builders. Taylor Wimpey’s first-half figures are down across the board.

Revenue dipped by 7.3%, which isn’t too bad. But it led to to a 22.6% decline in operating profit.

And profit before tax fell by 58% to just £99.7m, from £237.7m for the first half in 2023. Basic earnings per share (EPS) lost a similar 58%, though the adjusted EPS figure was down just 24% to 3.8p.

Plus, quite concerningly, the firm’s return on net operating assets plunged from 19.7% at the 2023 interim stage, to just 10.9%.

The bright side

It’s not all doom and despair, though. In fact, looking to the future, I’d say not even close. I see brighter skies ahead.

The interim dividend comes in at 4.8p per share, steady from last year’s 4.79p. It’s all part of Taylor Wimpey’s policy of returning 7.5% of net assets annually.

The cash is there to pay for it, too. The company reached the midway point with £548m net cash on the balance sheet. That’s net cash, and not net debt the way so many companies suffer when their sectors are squeezed.

Looking forward

The key thing that must surely help get Taylor Wimpey and the others back on track is an interest rate cut. So far, the Bank of England’s ‘higher for longer’ approach has hit the mortgage market hard.

But there’s one other thing that could also make a big difference.

Since the new government came to power, Chancellor Rachel Reeves wants to see 1.5 million new homes being built over the next five years. The aim is to revamp planning to make building easier. And in its latest update, Taylor Wimpey sounds optimistic on that front.

Still, until government words turn into action and we see results, that has to remain an unknown.

A cheap buy?

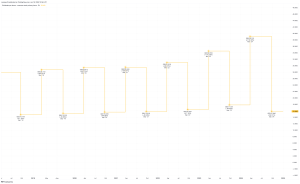

The Taylor Wimpey share price has pulled back much of its decline of 2021 and 2022, but it’s still a good way below its pre-cash peaks of early 2020.

Even so, with earnings lower now, the shares are trading at 19 times forecast earnings. That could drop to around 13 by 2026 if earnings get back on track the way forecasts suggest.

The forward dividend yield stands at 6%, and analysts expect it to be maintained in the next few years.

On balance, I think many will see the shares as fully valued now. Given the short-term uncertainties, they might be right.

But I reckon long-term investors could do well to consider Taylor Wimpey right now.

This post was originally published on Motley Fool