Yesterday (3 September), the Nvidia (NASDAQ:NVDA) share price fell 9%.

Normally, I wouldn’t pay too much attention to such movements. Although I do have a small exposure to the company via an artificial intelligence investment trust, I accept that stock prices will fluctuate from one day to the next. It’s the long-term trend that’s of more interest to me.

But Nvidia seems to have a hold over the market that’s making me nervous.

It used to be said that if America catches a cold, the whole world sneezes. In other words, if the US economy starts to falter, the effects will be felt everywhere.

Now it seems that if the chipmaker’s share price wobbles, entire stock markets move into the red. And that affects everyone, including me.

Going from strength to strength

But as frustrating as I find this, I have sympathy with Nvidia’s shareholders. Life must seem very unfair to them.

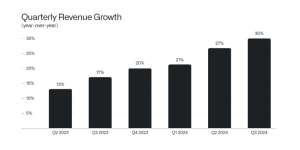

Last Wednesday (28 August), the company’s share price fell 6% in after-hours trading following the announcement of its results for the three months ended 28 July 2024.

Given the market’s reaction, you’d have thought it was bad news.

Not so. In fact, it comfortably beat expectations — again.

During the quarter, it reported revenue of $30bn, compared to the consensus of analysts’ forecasts of $28.7bn. Similarly, earnings per share were 68 cents — 3 cents higher than expected.

Nobody could really explain the reaction of investors. Eventually, most journalists seemed to settle on the line that although the results were good, they weren’t better than the most bullish of estimates.

But are we really to accept that $175bn was wiped off its valuation because one analyst decided to be much more optimistic than the others? I suspect the truth of the matter is that many shareholders wanted to bank some profits.

Prior to the announcement, the company’s share price had increased 160% since the beginning of 2024. And earnings releases are often a time when investors take stock of their portfolio and decide whether to buy or sell.

But despite the recent turbulence, it’s easy to forget that the over the past month, its stock price is still up 7%.

And its current market cap is higher than the combined value of the FTSE 100.

Out of my control

Unfortunately, there’s nothing I can do about the apparent obsession with Nvidia’s stock price. But history tells me that — eventually — people will lose interest and attention will move elsewhere.

The American giant’s growth will inevitably slow as markets become more saturated and competitors start to get a foothold. And there’s no guarantee that it will be able to come up with new, innovative designs. For example, there are some doubts as to whether its new Blackwell chip will be as successful as its predecessors.

But don’t get me wrong, I think it’s a great company that will continue to deliver over the long term, albeit at a much slower pace.

I think it will succeed because it makes the hardware used by the artificial intelligence industry. There’s still some uncertainty as to who will be able to make the most money from the software side but all of these applications will require semiconductors to function.

This post was originally published on Motley Fool