I had to buy a T-shirt I didn’t want by midnight. The Platinum Card® from American Express in my wallet carried a $50 credit at Saks Fifth Avenue every six months, so there I was, wading through designer clothing I didn’t want and sorting by price, “lowest to highest” in order to take advantage of my credit before it expired. Enrollment required. Terms apply.

Welcome to the weird new world of “travel” card benefits.

The pandemic changed the travel industry in many ways. Airlines now offer more flexible tickets. Masks are mandatory for the indefinite future. And so-called travel cards shifted to offering benefits for homebodies, from food delivery perks credits to Saks credits.

Getting more benefits sounds like a good thing on the surface, but it creates a problem that I encountered while feverishly shopping for stuff I didn’t want or need. In short: travel card benefit fear of missing out.

How to evaluate unused travel card benefits

Do the math

The logic of getting a travel card (or any card that carries benefits) is simple. If the total value you get from the card exceeds the annual fee, then it’s worth having. For example, if a card offers $200 in travel credits per year and the annual fee is $100, then that card is probably worth getting if you usually spend at least $200 on travel annually.

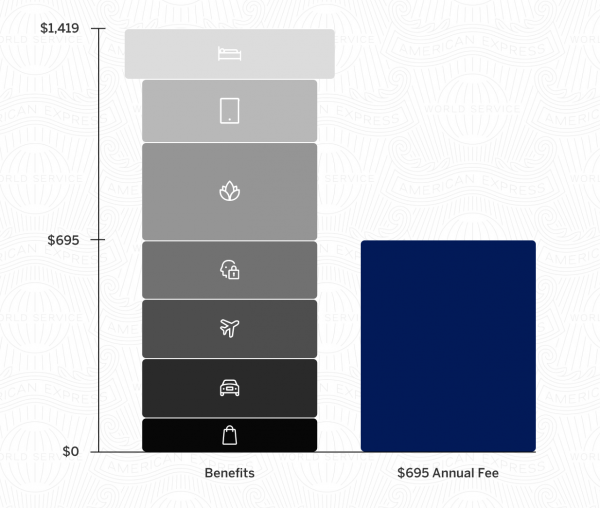

In fact, The Platinum Card® from American Express even makes this math explicit, showing a comparison between the value of the benefits the card offers and its $695 annual fee on its product page. Terms apply.

In this instance, American Express is effectively doing the math for you, showing that the card’s high annual fee can be more than offset with its many benefits.

American Express isn’t offering free money (or it wouldn’t stay in business very long). Rather, it’s offering a challenge: If you can use some or all of these benefits, you can get more out than you put in.

Yet there’s a piece of this math problem that doesn’t break down to pure dollars and cents. It’s what we mean by “value.”

Don’t confuse dollars for value

Warren Buffett said in a 2008 letter to investors, “Price is what you pay; value is what you get.”

That is, just because something costs a certain amount doesn’t mean it’s worth that much.

Take the T-shirt I ordered from Saks. I paid about $50 for it, which is the price. But is that the value I received? This is where things take a turn toward the squishy and subjective. For me, the shirt probably carries far less value than $50 because I’m not somebody who cares much about fancy clothes. A T-shirt is pretty much a T-shirt as far as I’m concerned (and my 6-month-old vomits on my clothing daily, which significantly reduces its value).

The same logic applies to other seemingly valuable card benefits. The Chase Sapphire Reserve® offers a complimentary DoorDash DashPass subscription, which knocks down fees on food delivery. But this benefit carries more value the more you order takeout, creating a twisted incentive if you’re trying to cook at home more.

That is, you only get value from this benefit if you use it a lot. But using it a lot might not align with your other priorities (like spending less on takeout).

Focus on your current spending

The Platinum Card® from American Express carries a $300 annual credit for an Equinox gym membership and a $20 monthly credit for a few particular digital streaming services. Terms apply.

That’s great if you already have an Equinox membership or are subscribed to the eligible streaming services. But not so much if you aren’t. Equinox memberships run about $300 per month, so that $300 annual offset is a relatively modest discount.

And here’s the core of the card-benefit FOMO conundrum: It might feel like failing to use the Equinox credit leaves money on the table. After all, $300 sounds like a lot of money. But just the opposite is true — signing up for every service associated with your card and trying to get the most out of them might not only be a headache but financially unwise.

As a rule of thumb, you should get (or keep) the travel card that aligns with your current spending rather than aligning your spending to the benefits offered by a card.

That doesn’t mean you shouldn’t order a “free” T-shirt with a card benefit. But it does mean you shouldn’t become a frequent Saks shopper just because your card offers a $100 annual credit.

The takeaway

Back in the Before Times, picking and using a travel credit card was a relatively straightforward proposition. Not so much in the COVID era. For one thing, many of these cards offer benefits that have nothing whatsoever to do with travel.

Don’t get swept up in benefit-maximization mania. Yes, it’s good to take advantage of as many of your card’s perks as possible, but that doesn’t mean you should bend your priorities around whatever oddball benefits a card decides to include.

Which reminds me, it’s a new year, which means it’s time to order a new shirt from Saks for my baby to throw up on.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2022, including those best for:

This post was originally published on Nerd Wallet