In 25 years of investing in the stock market, I’ve seen my fair share of ‘bubbles’. From dotcom internet companies to crypto miners, I’ve seen a lot of stocks surge to unsustainable valuations (and then come crashing down).

Looking at the market today, I reckon there are bubbles brewing in certain areas. Here are some stocks I believe investors need to be careful with.

Quantum computing stocks

Over the last month or so, many small quantum computing stocks have shot up spectacularly. Believe it or not, some are up more than 1,000% in a month.

I get why there’s a high level of excitement here. Quantum computing is an incredibly exciting technology and right now, Big Tech companies like Amazon and Alphabet are getting involved.

Yet currently, some valuations are insanely high. Quantum Computing stock, for example, has a price-to-sales ratio of around 5,500 (a ratio of 20 is usually considered high!)

Now, there’s no doubt that quantum computing (the technology, not the stock) has a lot of potential. However, I think shares in this area of the market have moved too far, too fast.

I’ve seen this movie before (many times) and it always ends in tears.

The last couple of weeks… it felt a little bubbleish

Rick Rieder, Global Chief Investment Officer of Fixed Income at BlackRock

Unprofitable tech stocks

Quantum computing isn’t the only area of technology that looks bubbly to me though. To my mind, a lot of unprofitable tech companies are approaching bubble territory.

An example here is SoundHound AI, which offers voice artificial intelligence (AI) solutions. Over the last month, this stock has surged about 250%. As a result, it now trades on a price-to-sales ratio of about 120. This company has some interesting technology, but at that multiple, I think it’s a risky investment.

I’ll point out that I’m very bullish on the AI theme. Currently, my portfolio is loaded with AI stocks.

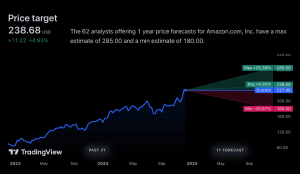

However, I’m focused on profitable AI companies such as Amazon, Alphabet, Apple, and Nvidia. One thing I’ve learnt over the years is that it’s much safer to stick with profitable companies when investing in themes.

Tesla

Finally, I’m going to say that, after a huge share price spike since the US election, Tesla (NASDAQ: TSLA) is now approaching bubble territory. At current levels, the stock has a price-to-earnings (P/E) ratio of about 170 and that looks way too high to me.

Back in April, Tesla was trading near $140. Today, however, it’s at $420 (and it was at $480 in mid-December).

Is that 200% rise justified?

Sure, CEO Elon Musk is in a powerful position because he’s pals with Donald Trump. And the company has a lot of potential on the autonomous driving side of things.

But Tesla’s electric vehicle (EV) business isn’t looking great now. According to the European Automobile Manufacturers’ Association (ACEA), for the first 11 months of 2024, Tesla recorded a 15% year-on-year decrease in registrations.

Meanwhile, it could be a while before we actually see Tesla’s driverless cars on the road. Recently, a lot of drivers have been highlighting problems with the company’s self-driving technology.

Now, obviously, this is an exciting company and it could turn out to be a good long-term investment. But for me, Tesla stock has risen too far, too soon, so I won’t be touching it.

This post was originally published on Motley Fool