Rolls-Royce (LSE: RR) stock has lost a sizeable chunk of its value since the start of the year. Nonetheless, the share price staged a 9% recovery last month. As air travel continues to ramp up, Rolls-Royce shares could be worth a buy this August.

Wind’s blowing in the right direction

The FTSE 100 firm is set to report its half-year results in a couple of days (4 August). So, this could be a buying opportunity for me, before the stock potentially rallies. Analysts in the UK don’t always publish earnings estimates for quarterly or half-year periods. But the upcoming H1 earnings can serve as an indicator as to whether guidance laid out by management for the year can be achieved by the year end.

| Metrics | Guidance & Consensus (FY22) | FY21 |

|---|---|---|

| Underlying earnings per share (EPS) | 1.50p | 0.11p |

| Revenue growth | 3.5% | -4.4% |

| Operating margin | 3.8% | 3.8% |

| Free cash flow | “Modestly positive” | -£1.44bn |

| Net debt | £3.5bn | £6.1bn |

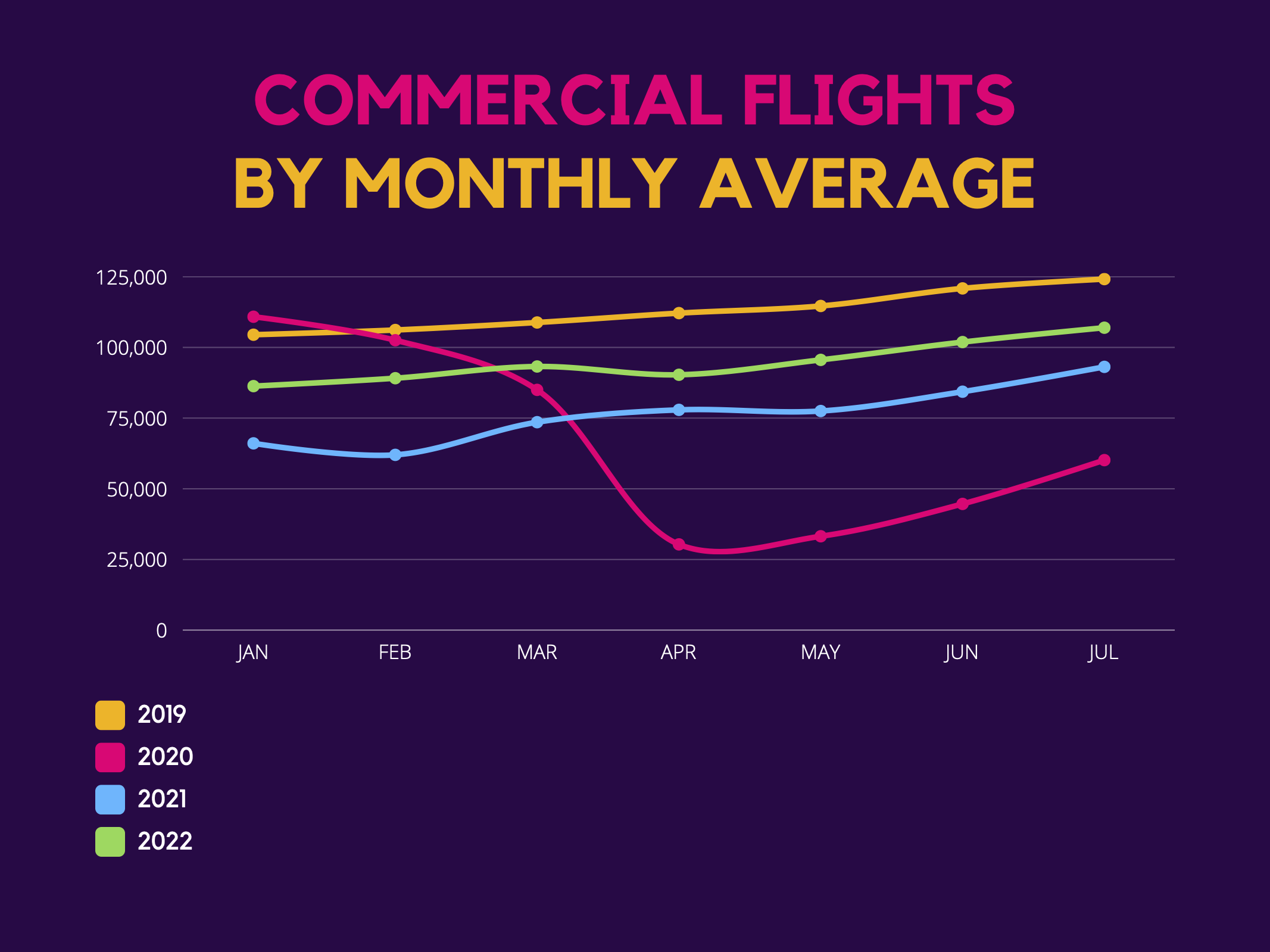

Given that Rolls-Royce earns a substantial amount of its revenue from servicing commercial aircraft engines, the return of global air travel towards pre-pandemic levels should do its top line an abundance of good. This has also been evident with the engine supplier tying up a number of TotalCare deals with airlines in July.

Additionally, the UK government is expecting to increase its defence budget to 3% of total GDP by 2030. The current budget sits at 2.25%. If this were to happen, Rolls-Royce could stand to benefit from a further stream of government contracts.

A valuable asset

Rolls-Royce also recently announced the successor to its current CEO, in Tufan Erginbilgic, who will be taking over in January. The appointment is a bit of a head-scratcher though, considering Erginbilgic’s lack of experience in the aerospace and defence field. He spent 20 years at BP, and served as its CEO for over five years.

Nevertheless, Erginbilgic is known for his creation of “significant value“. During his tenure at BP, he managed to quadruple profits, while holding a strong track record of execution and delivery. With plenty of exciting and unproven projects in the pipeline for Rolls-Royce, I’ll be hoping that he can help to deliver these new ventures. He will also have an incentive to improve the manufacturer’s profitability, as 30% of his £1.25m salary will be paid in Rolls-Royce shares. As such, I’m eager to see how he plans to navigate the company out of its mountain of debt.

Rolling in cash?

Speaking of debt, Rolls-Royce has a ton of it. That being said, if it manages to achieve positive free cash flow (FCF) by the end of the year, the British-based company may be well equipped to start paying off its debt in 2024. This would then give it the dry powder to fund its future projects.

| Metrics (FY21) | Figures |

|---|---|

| Debt-to-equity ratio | -132% |

| Debt | £6.1bn |

| Cash and equivalents | £2.6bn |

| Free Cash Flow | -£813m |

Taking everything into consideration, should I buy Rolls-Royce shares in August then? Well, it’s got plenty of exciting developments, and everything seems to be pointing in the right direction for the time being. This would normally entice me into investing. However, its financial position does leave me worried, as its earnings potential could be hindered by its debt repayments.

So, while I’m feeling rather upbeat about Rolls-Royce’s long-term future, I think there’s a possibility that its revenue and FCF could come in below expectations in H1 due to a slower than expected recovery in flying hours. For that reason, I’ll be putting Rolls-Royce on my watchlist for now.

This post was originally published on Motley Fool