I think I’ve found a hidden gem. It’s called MP Evans Group (LSE:MPE) and three analysts currently cover it. The average 12-month price target these bankers have on the shares indicates a 32% increase in price. Furthermore, with a 5% dividend yield for passive income, if those forecasts are right, I could have a total return of 37% on my hands in just one year.

The palm oil business

MP Evans focuses on producing sustainable crude palm oil in five provinces across Indonesia. It also has a stake in a property company in Malaysia. The company’s shares trade on the AIM market of the London Stock Exchange.

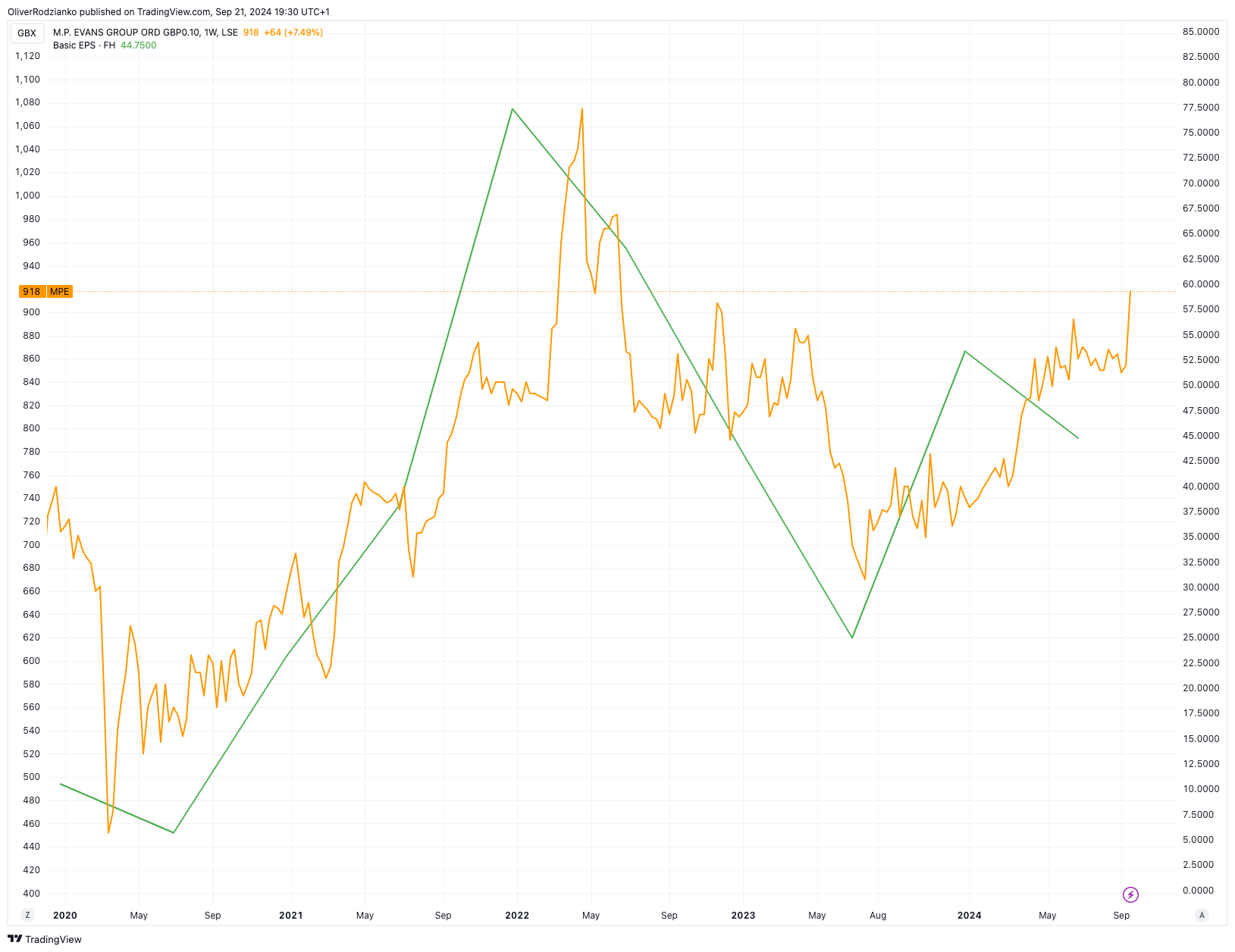

As a cyclical business, it experiences fluctuations in output due to crop maturity and weather conditions, among other factors. This can lead to share price volatility. For example, after strong expansion from 2020 to 2023, the company faced a dip from 2023 to 2024. Now, it’s entering a new phase of moderate growth.

Cheap, growing, and cash flow generating

Here are two core highlights of why I think this investment is worth my cash:

- It has a three-year average annual earnings per share (EPS) growth rate of 41%.

- It has a low price-to-earnings (P/E) ratio of 9.5, which is much lower than the industry median of nearly 18.

However, that high historical growth isn’t likely to last. In fact, analysts predict that the company will generate just a 6.2% average annual EPS growth rate over the next three to five years. This is a big reason why the shares have fallen in price recently.

Low prices mean bargain opportunities

Just because a price has fallen doesn’t mean that it’s bad for investors. Instead, a lower price can open up a better valuation. There’s a lot of merit in Warren Buffett’s saying: “Be greedy when others are fearful”.

In the case of MP Evans, its leading valuation ratios, namely the P/E and the price-to-sales (P/S) ratio, are near the lowest they’ve been since January 2020.

This opens up a big opportunity for me. It gives me a margin of safety in the price, meaning that any operational failures are unlikely to hit the shares as severely as if they were richly valued.

Also, my returns are likely to be higher. The fact that the valuation is so low and analysts are expecting better earnings growth over the next few years is likely a big reason why bankers have such high price targets for the stock right now.

What could go wrong?

In my opinion, this is a low-risk investment. However, there is one big issue that stands out to me.

While the shares have seen a long-term uptrend in price since 1988, as I mentioned earlier, they’ve also shown considerable volatility. With its price going up and down over time, its even more important I buy at an appropriate valuation.

Furthermore, its dividend payouts are not usually as high as right now. I suspect such a substantial 5% yield will be transitory, so I can’t rely on this investment for cash flow stability.

It’s a Buy for me

I consider this one of the best hidden gems on the UK stock market right now. It’s at the top of my watchlist, and it’s a likely addition to my portfolio at the beginning of October.

This post was originally published on Motley Fool