So brokers reckon a FTSE 100 growth stock that’s plunged 50% over five years, and 30% in the last 12 months, will turn things around on a massive scale. I hope they’re right because I hold the stock. But I’m sceptical.

I like buying stocks when they’ve fallen out of favour, and that’s why I bought sportswear and trainer specialist JD Sports Fashion (LSE: JD) this time last year. The board had just issued a profit warning after a disappointing Christmas, and I thought this was an opportunity to get in on the cheap.

All I did got was a heap of worries, as those profit warnings continued to roll in. Yet analysts continue to believe in the former stock market darling.

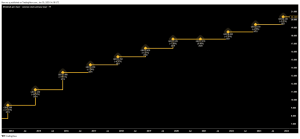

The share price keeps taking a beating

The 16 brokers offering one-year share price forecasts have produced a median target of just over 131p. If correct, that’s an increase of almost 60% from today. Is this just wishful thinking?

Let’s start with the numbers. JD Sports is currently trading at a rock-bottom price-to-earnings (P/E) ratio of just 6.7, a figure that screams ‘cheap’. The problem is that it was screaming cheap all last year, and only got cheaper.

There’s usually a reason why a stock gets this battered. In JD’s case, it’s clear: falling sales, a declining profit outlook and a nagging concern that trainers and athleisurewear aren’t the fashion force they were.

The company’s recent trading update, released on 14 January, hit confidence again. Revenue for the critical November-December period dropped 1.5%, a big blow during what’s supposed to be the busiest shopping season.

While JD managed to claw back some momentum in December, with like-for-like sales up 1.5%, it wasn’t enough to offset earlier declines.

Adding to my unease, it downgraded its full-year pre-tax profit forecast to £915m-£935m. That’s down from the already-lowered guidance of £955m-£1.035bn. I’m not the only investor wondering if the company’s golden growth era’s over.

So why are analysts so optimistic? JD’s core strategy of maintaining discipline in a highly promotional retail environment has shielded gross margins. While this approach might hurt short-term sales, it positions the company to rebound when market conditions improve.

Can this former FTSE 100 favourite fight back?

The group’s international operations are providing a glimmer of hope. The Sporting Goods and Outdoor segment’s holding up, while stronger growth in Europe and Asia Pacific has partially offset weakness in the UK and North America. Diversification‘s working in its favour.

Finally, there’s the possibility of a broader market rally if interest rates fall and consumer confidence picks up later in 2025. JD Sports shares could lead the charge if spirits rise. No guarantees though.

While we wait, the vultures are circling chief executive Régis Schultz, whose vision of turning JD into a “global sports-fashion powerhouse” keeps receding. A new broom might do some good.

I’m not going to bank my 30% loss. JD Sports has had a major wake-up call. I still think it has a huge opportunity, particularly in the US. Analysts aren’t completely mad. But they’re a lot more optimistic than I am.

This post was originally published on Motley Fool