Shares in Rightmove (LSE:RMV) are roughly where they were five years ago. As a result, the stock has underperformed the FTSE 100.

But the business itself has done very well. However, there’s a key challenge coming in 2025 that I think means this is a make-or-break year for the stock.

A wonderful business

Rightmove is an outstanding business and the foundation of this is its huge market share. It accounts for 86% of the UK online property search market, which virtually makes it a monopoly.

As traffic to its platform increases, the firm’s position strengthens. More visits brings in more listings, which attracts even more buyers and the cycle continues.

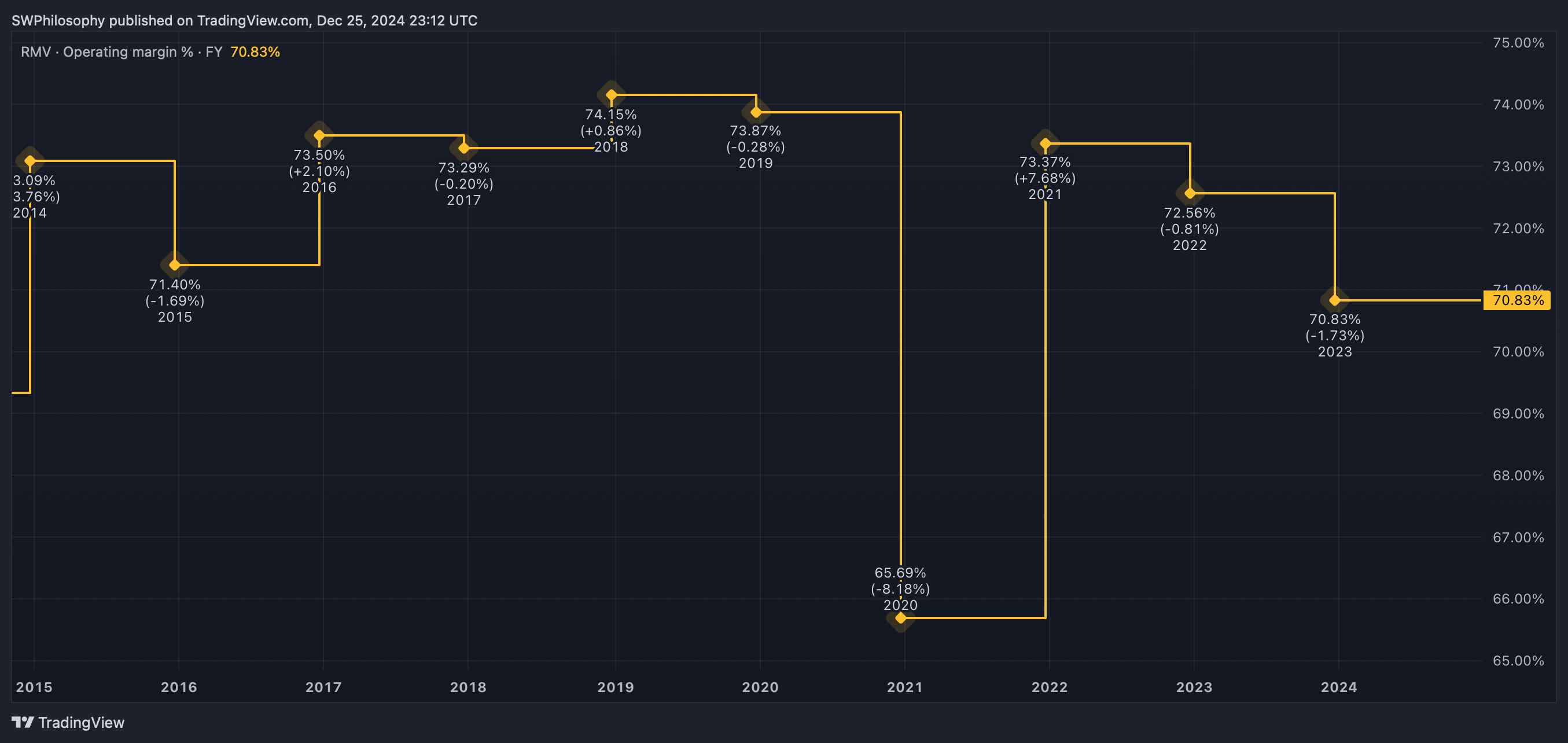

Rightmove’s dominance shows up in its operating margins. At over 70%, these are well above Nvidia (54%), Microsoft (45%) and – for the time being – Palantir (5.4%).

High operating margins mean a firm is able to charge a significant premium for its product or service over what it costs it to deliver. And this indicates the business is way ahead of the competition.

Rightmove operating margins 2014-24

Created at TradingView

Leaving aside the Covid-19 pandemic, Rightmove has consistently been strong in this area for a long time. That indicates its competitive advantage is a durable one and the business is hard to disrupt.

Over the long term, the firm’s ability to maintain high margins depends on it holding on to its lead in traffic. And 2025 is set to be a key year on this front.

The challenge

About a year ago, OnTheMarket (a relative minnow) was acquired by US property analytics firm CoStar Group. And this raises questions about the FTSE 100 company’s future dominance.

CoStar’s ambition is to turn OnTheMarket into the UK’s leading online property platform. And it’s a big company that’s able to invest heavily into building a significant challenger to Rightmove.

As I see it, one of two things can happen. Either Rightmove’s position proves impossible to disrupt, or OnTheMarket becomes a meaningful competitor and the FTSE 100 firm’s margins come under pressure.

If that happens, the equation might start to look a lot less favourable. So I think anyone considering investing in Rightmove shares should pay close attention to what’s going on with OnTheMarket.

The early signs for the challenger are positive. CoStar announced in October that total visits were up 90% in the 12 months up to the end of September and the number of agents on the site was up 27%.

OnTheMarket is clearly a long way from achieving its stated ambition. But while its traffic almost doubled, Rightmove saw a 1% decline.

2025: a key year

The early signs are encouraging for OnTheMarket, but I think 2025 will be a crucial year. If it keeps growing and cutting into Rightmove’s lead, investors will have to take notice.

By contrast, if the FTSE 100 firm can defend its market share, this will be a big show of strength. And in that situation, I’ll be looking to buy the stock.

This post was originally published on Motley Fool