The Rentokil Initial (LSE:RTO) share price jumped 10% on Thursday (17 October) after a solid trading update. So investors might be wondering if the worst is over after a tough few years.

After the FTSE 100 firm went out of its way to issue a profits warning last month, the report for Q3 is no worse than expected. And a positive long-term outlook puts the stock on my buying radar.

Q3 trading update

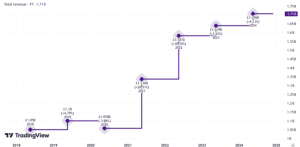

The headline news for Rentokil is that revenues came in at £1.38bn – exactly where they were a year ago. But this doesn’t tell the full story.

A big factor in this is shifting exchange rates, which investors might hope will roughly average out over time. Leaving these aside, the company’s sales were up 3.6%.

The main strength came from the firm’s international operations. Europe (+4.7%), UK (+4.2%), and Asia (+6.5%) all posted impressive growth numbers.

But these only account for around 40% of Rentokil’s revenues. North America – which makes up around 60% – recorded sales growth of just 1.4%.

Terminix integration

Rentokil is in something of a transition period. It’s in the process of integrating Terminix – a US competitor it acquired in 2022 – into its operations and investors are waiting to see the benefits.

On that subject, CEO Andy Ransom said the following:

The Terminix integration continues to progress well and we have a full programme of activity for the remainder of 2024. In the New Year, we will review the early results of Q4 integration activities… Post integration, we remain strongly optimistic that our business will lead a highly resilient, growing market.

I feel the idea that the integration process ‘continues’ to progress well is a slightly strange one. The share price over the last 12 months indicates, investors don’t think it’s been going well at all.

Nonetheless, there are tangible signs of progress. New pay schemes for technicians and the introduction of satellite branches could bring lower costs, boosting profits as a result.

Outlook

Over the long term, management thinks Rentokil has a strong position in a growing market. For the time being though, investors are in something of a holding pattern.

It’s still going to be a while before the benefits of the Terminix acquisition start to show up in the firm’s financial performance. Profits before tax for 2024 are unchanged at around £700m.

The company is hoping that things will move forward in 2025. But a review of the integration process during the first quarter means these won’t show up immediately.

Ultimately, investors are in something of a holding pattern. And the risk is that further delays could cause the stock to start falling again.

Still a buying opportunity?

I’ve thought the Rentokil share price has been at a bargain level for some time. And while I think the latest jump is a slight overreaction, my underlying view of the stock hasn’t changed.

The latest results look more solid than spectacular, I believe. In particular, I’m looking for clearer signs of progress around the integration of Terminix over the next year or so.

Despite this, I’m still planning on buying the stock at current prices. Considering the firm’s competitive position and long-term growth prospects, I think it looks like a bargain.

This post was originally published on Motley Fool