The recent stock market dip makes now a brilliant time for investors wanting to generate a second income from FTSE 100 shares. Many top blue-chips offer sky-high dividend yields at reduced prices. Fund manager Schroders (LSE: SDR) looks like one of the most tempting of all.

I’ve had my eye on the stock for several years, and today it looks more tempting than ever. Should I finally take the plunge and buy it?

I’m glad I didn’t buy it before. The Schroders share price is down 50.51% over three years and 22.86% in the last 12 months.

Will Schroders shares ever stop falling?

I love buying top FTSE 100 shares after they’ve been sold off. It’s like hitting the sales and finding all those goodies I wanted to buy before Christmas are suddenly available at reduced prices. Actually, it’s better.

When share prices fall, dividend yields rise through simple mathematics. So I get a higher rate of passive income too. I don’t get that an income when I buy a discounted jacket or pair of shoes, or whatever. Retailers should look into this.

And while most purchases depreciate over time, my stock picks should grow in value. Provided I choose well.

When I looked at Schroders on 31 October, it looked nicely set. Assets under management had jumped 6.56% a year to £773.7bn, thanks to “positive market conditions and a robust investment performance”, according to first-half results published on 1 August .

My finger hovered over the Buy button but then I noted a 7.7% dip in operating profits and decided not to click. Which was lucky for me because Schroders published its Q3 results on 5 November, less than a week later, and they were horrible.

Investor outflows hit £2.3bn, reversing the £1.6bn inflows enjoyed in the first nine months of the year. A positive stock market and strong investment performance drove assets under management to a record £777.4bn, but the shares still plunged almost 12% on the day.

Should I buy this FTSE 100 dividend income stunner?

The ‘Trump bump’ hasn’t helped, I’m afraid, as tariff threats could inflict serious damage on non-US markets, and Schroders has exposure to China’s struggles.

The shares look reasonable value with a price-to-earnings ratio of 12.7. Although I hoped they might be cheaper. A forecast yield of 6.8% is a bigger attraction. That’s a blockbuster rate of income but it’s thinly covered just 1.1 times by earnings.

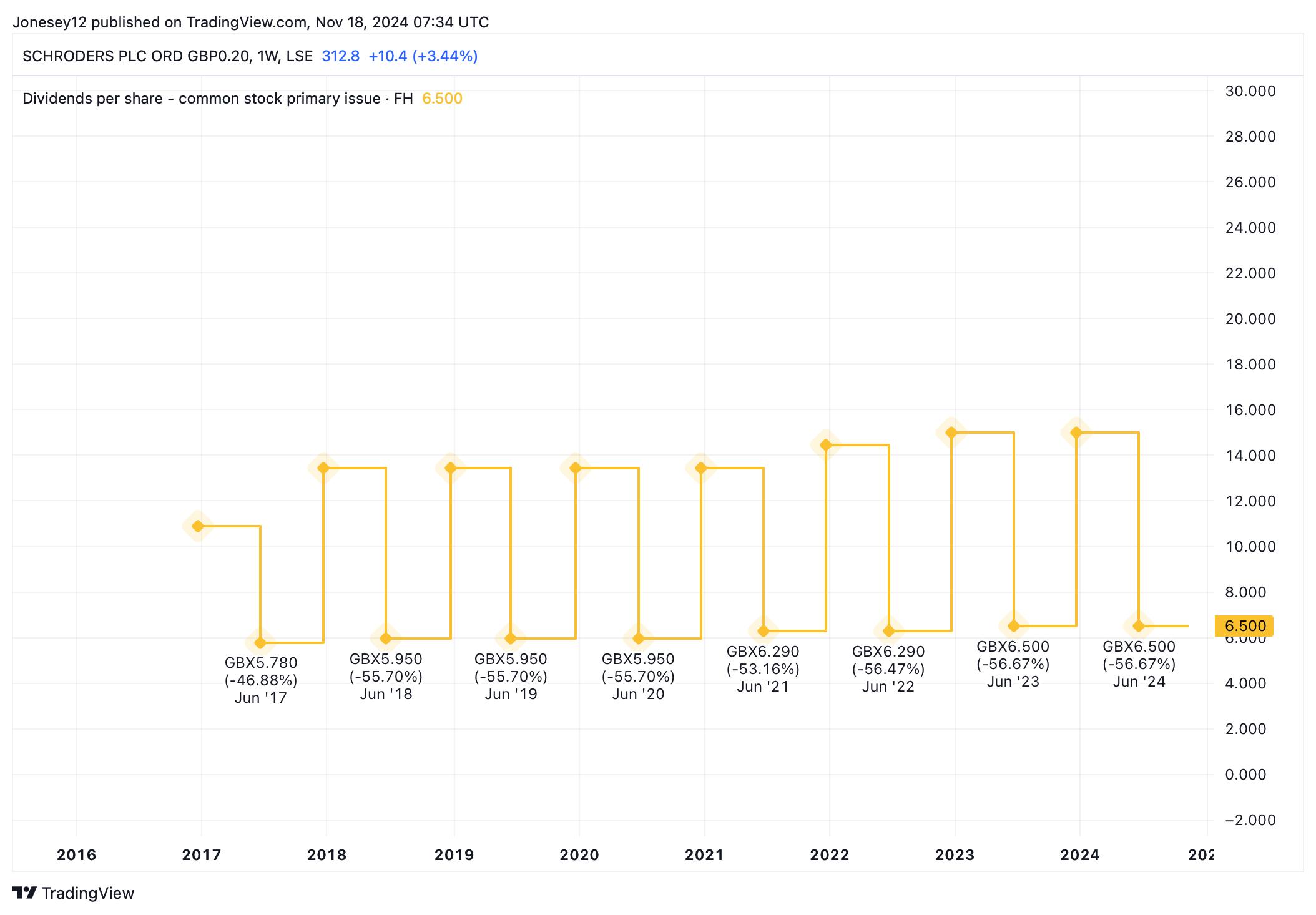

As this chart shows, Schroders has a steady but not spectacular track record of dividend growth.

Chart by TradingView

Schroders faces a further £8bn outflows in Q4 when a legacy Scottish Widows mandate ends, plus another £2bn in notified outflows from other clients. At least these are priced in. Further outflows could inflict more damage.

Today’s low expectations could work in favour of the Schroders share price. As a fund manager, it’s likely to perform when investment sentiment picks up. I’m considering buying the stock, but I’ll check out the FTSE 100 for other opportunities first. I might get myself an equally good second income, but with less share price volatility.

This post was originally published on Motley Fool