The National Grid (LSE: NG.) share price fell hard on FY results day on 23 May.

It had slipped a few days earlier too, and at the time of writing it’s down 24% since a 52-week high on 17 May.

Stock dilution

Nothing has gone wrong, but the firm’s latest move has shocked the market. It’s all about a new stock issue, aimed at raising £7bn in new capital.

What’s it all for? CEO John Pettigrew spoke of “significant opportunities for National Grid today, over the next five years and for decades to come.“

He added that the board’s “new five-year investment plan will deliver long-term value and returns for our shareholders, support over 60,000 more jobs, and accelerate the decarbonisation of the energy system for the digital, electrified economies of the future.“

Dividend and valuation

There was talk of the dividend being rebased in line with the new shares, and the ‘R’ word is something that income investors really don’t like.

But what does the valuation look like now?

Existing shareholders will be able to buy seven new shares for every 24 they currently own, for just 645p each.

Anyone who bought at the close price the day before the results would have paid 991p per share. If they then take up the new rights issue, they’ll end up with an average buy price of 913p.

That’s about 5% above the share price as I write. So if we buy now, we could get a better deal.

A cheap buy?

So is it worth buying National Grid shares today? I think it’s worth considering.

It’s valid for the price to have fallen to allow for the new, cheaper shares. But I reckon the market has overreacted, as it so often does.

Part of it will be down to those who just wanted a quiet stream of passive income without all this fuss. I can’t blame them. I think selling and moving the cash elsewhere is a perfectly rational response for someone in that position.

But even with the rebasing, I think National Grid might be an even better long-term dividend investment now.

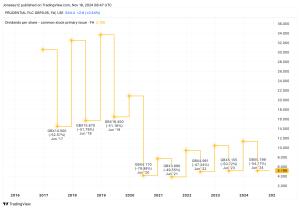

Dividend forecasts

Forecasts show the expected dividend dip in 2025, but we’d still be looking at a 5.3% yield. And beyond that, the City expects it to get back to growth and reach 5.8% by 2027.

We also see a price-to-earnings (P/E) ratio of 12.5 for 2025, dropping below 11 by 2027.

That’s all on today’s fallen price. So do we need to get in now, before it recovers any of the losses?

Well, I see a risk that the share price could be in for a weak spell now. After all, the picture of a boring-but-steady income stock that never causes waves has been shattered.

The stock issue

So yes, it might take some time for confidence to return.

I don’t own any National Grid shares, though they’ve been on my list of possibilities for a long time. But a family member owns some, and I expect he’ll be taking up the issue. I know I would.

This post was originally published on Motley Fool