Investing in FTSE 250 shares can be a wild ride. But over the long term, picking shares from the UK’s second-tier share index can be a highly profitable strategy.

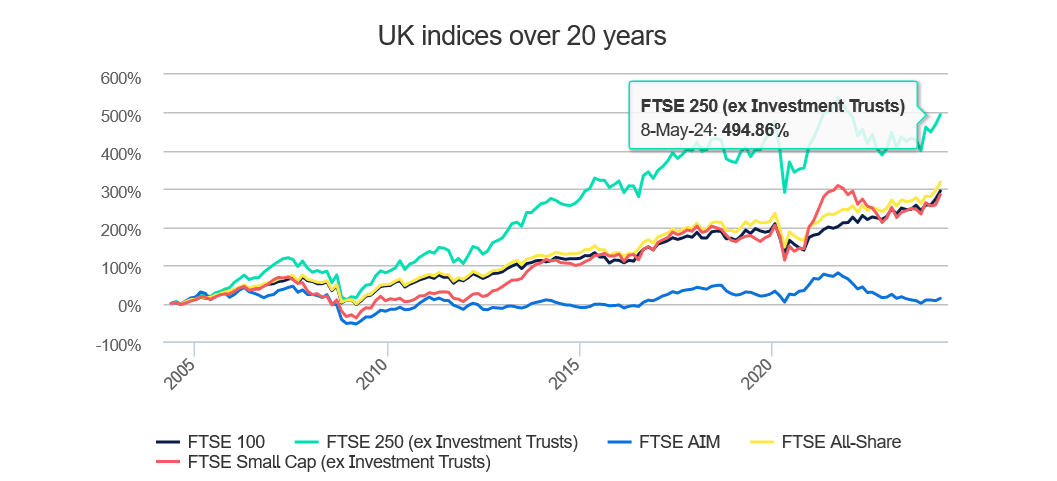

Hargreaves Lansdown analysts have been crunching the numbers. And their research shows that the index has provided a return of almost 500% over the past 20 years.

This is ahead of the FTSE 100‘s return of around 300% over the period. It also beats the FTSE All-Share, FTSE Small Cap, and FTSE AIM categories.

Is investing in FTSE 250 shares still a good idea today?

Pros and cons

Well this strategy has its advantages and its disadvantages.

The FTSE 250 has less of an international flavour than the Footsie. So its performance is closely linked to that of the domestic economy, which is a problem as Britain’s GDP struggles for traction.

The FTSE 100 also has a higher concentration of stable companies with market-leading positions, multiple revenue streams, and robust balance sheets than the FTSE 250. This helps the index perform more strongly during economic downturns.

On the other hand, the medium-sized companies that dominate the FTSE 250 often have more room for growth compared to the larger, more established Footsie businesses. What’s more, because it comprises a broader range of sectors that the FTSE 100, the FTSE 250 can be a more effective way for investors to manage risk.

A top FTSE 250 stock

I believe that creating a diverse portfolio of shares from both indexes is an effective way to balance risk with opportunity. It’s a strategy I myself have pursued through regular investment in my Individual Savings Account (ISA) and Self-Invested Personal Pension (SIPP).

At this moment, I’m looking for more FTSE 250 shares to buy. And Games Workshop (LSE:GAW) is near the top of my shopping list. I think it could be one of my best bets to achieve a 500% return in the coming decades.

Past performance isn’t a guarantee of future success. But the business has grown its share price by a stunning 1,350% during the past 20 years. I’m confident it will continue rising strongly, too, as it expands its global store estate.

The company has 535 stores on its books today, and plans 30 new openings this year alone to capitalise on the fantasy boom. It is also investing heavily in the fast-growing online channel, and launched a new website back in October.

I’m also excited by Games Workshop’s plans to accelerate licencing of its Warhammer intellectual property. In particular, a film and TV deal it recently signed with Amazon has the potential to supercharge royalty revenues and sales of its traditional tabletop games and miniatures.

On the downside, Games Workshop shares trade on a meaty price-to-earnings (P/E) ratio of 20.3 times. This sort of valuation could trigger a share price slide if trading news begins to spook investors.

Even accounting for this, I believe the FTSE 250 company remains a great buy for long-term investors like me. I even believe it could be promoted to the FTSE 100 elite index eventually.

This post was originally published on Motley Fool