I’ve had bags of fun with my Lloyds (LSE: LLOY) shares over the past year. I’m tempted to buy more, but I’m wary of overdoing it. Happily, I’ve found another dividend growth stock that could do even better.

It has to go some to beat Lloyds, which is one of my favourite portfolio holdings. The Lloyds share price has climbed 31.09% over 12 months. Throw in the trailing yield of 4.46%, and the total return is just over 35%.

Markets have woken up to the fact that the big banks are making big money. Lloyds profits totalled £7.5bn in full-year 2023. Its dividends look solid too. My Lloyds shares are forecast to yield 5.5% in the year ahead. That’s comfortably ahead of today’s FTSE 100 average of 3.86%. Better still, the Lloyds share price is covered exactly twice by earnings.

FTSE 100 income hero

Why don’t I just buy more and be done with it? Believe me, I’m tempted. Lloyds shares are still dirt cheap, trading at just 7.7 times earnings.

The next 12 months could be tougher though. We got a taste in Q1, with profits slowing to £1.2bn (still pretty good though). Net interest margins have narrowed and could get tighter once interest rate cuts feed through.

On the other hand, lower interest rates may boost the economy, cutting debt impairments and driving mortgage demand. I still like Lloyds and won’t be selling, but now I’m looking elsewhere for excitement.

I’ve got a good spread of FTSE 100 Dividend Aristocrats, but I’d like to generate a bit of share price growth too. So I’ve been searching for passive income stocks from the FTSE 250, and this one jumped out.

Online trading platform provider IG Group’s (LSE: IGG) a much smaller operation than Lloyds with a market-cap of £3bn rather than £37bn.

FTSE 250 bargain

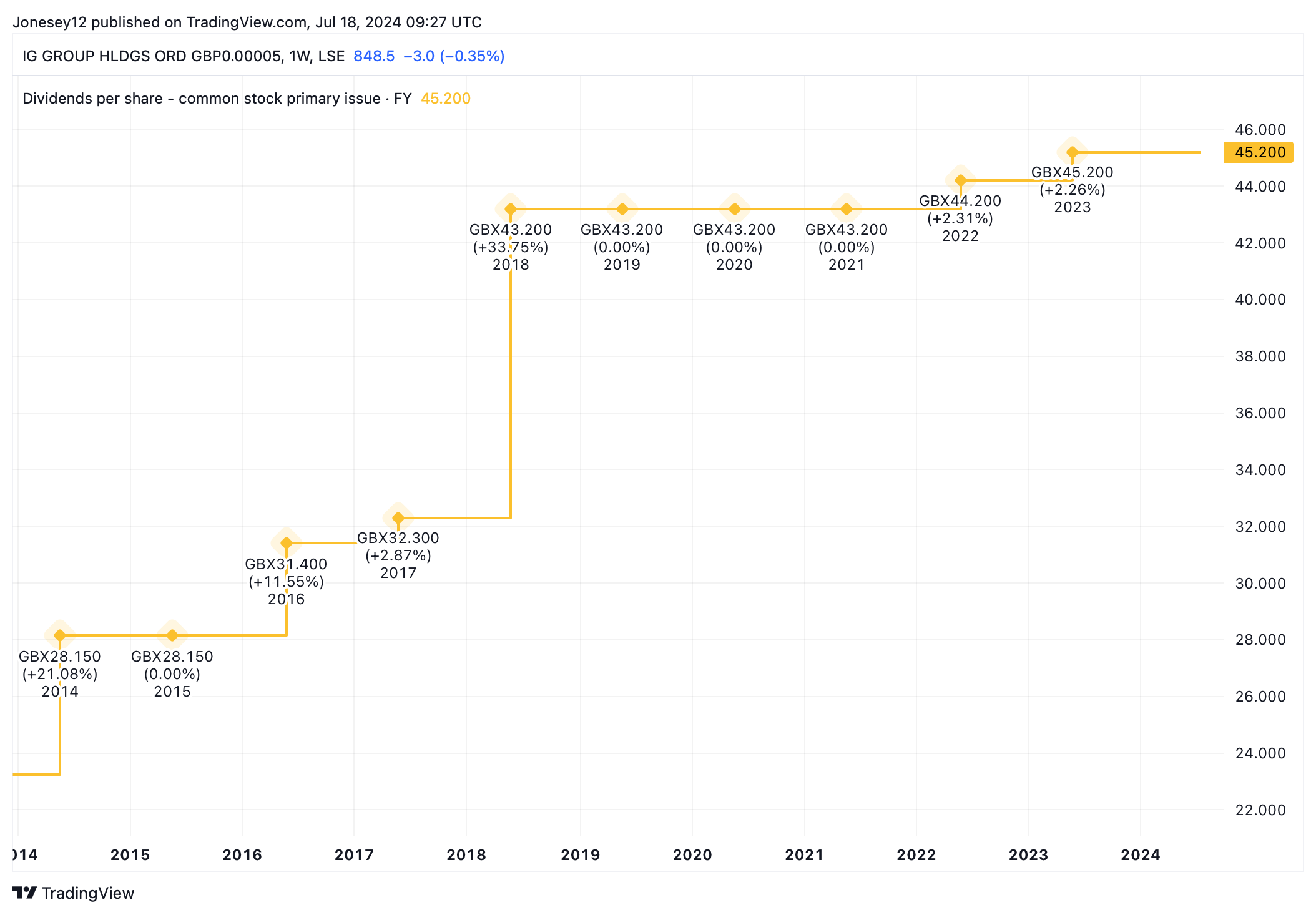

Yet the key metrics are surprisingly similar. IG looks cheap, trading at 8.9 times trailing earnings. The forecast yield is 5.4%. Cover is solid at 1.8 times earnings. Dividend per share growth flatlined for a while but is picking up now. Check out this chart.

Chart by TradingView

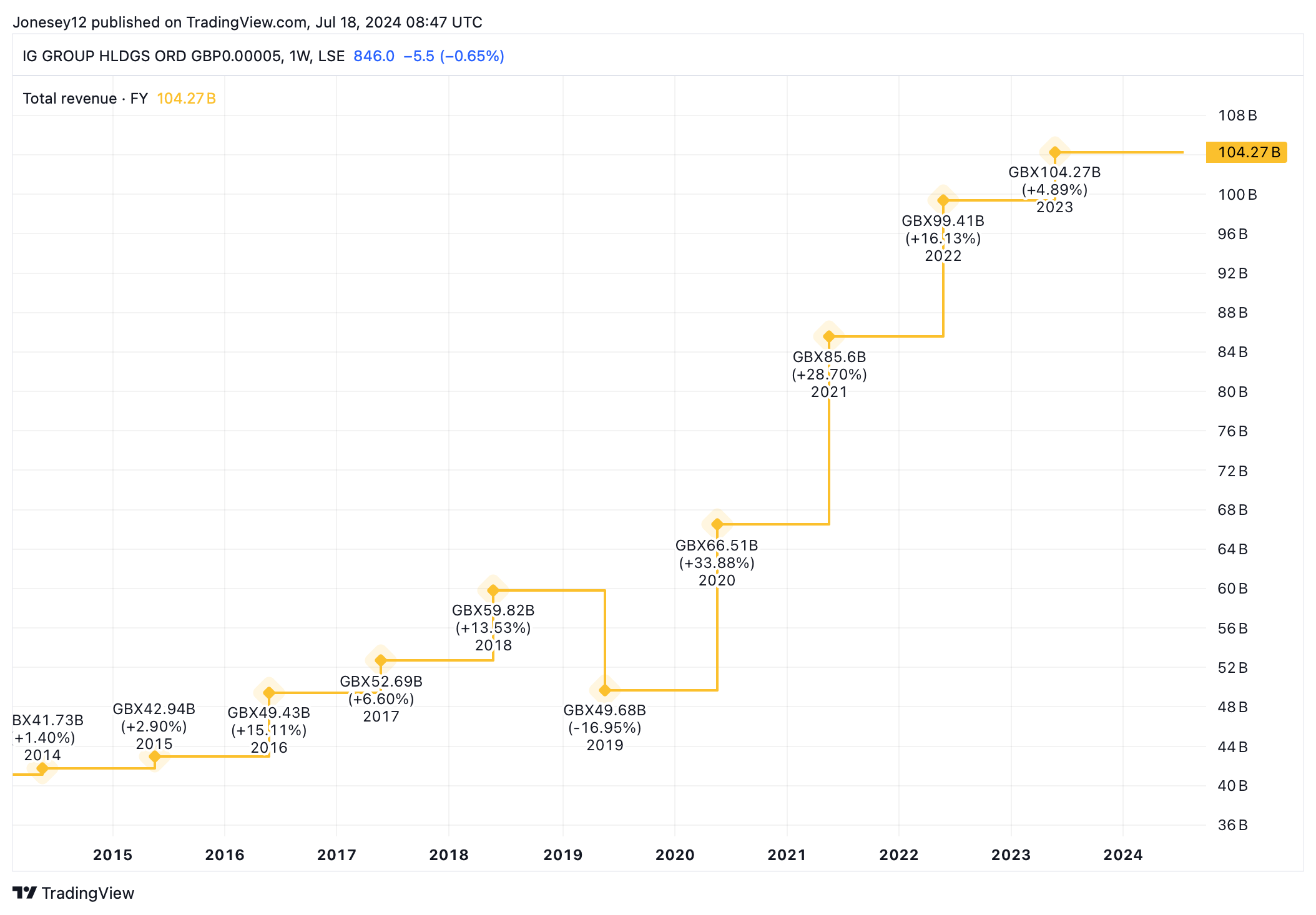

One difference is that Lloyds tends to do well when the economy’s stable and growing. IG, as a spread betting and contracts for difference (CFD) specialist, thrives on volatility. Lately, markets have been pretty range bound. Yet it’s still able to make money, with post-pandemic revenues rising steadily, as this chart shows.

Chart by TradingView

If markets get more volatile – and they could with the US presidential election looming and US-China trade war rhetoric rising – IG could do even better.

The IG share price has had a pretty good year, rising 27.7%. Again, a bit like Lloyds. Its full-year results are published on Friday 26 July, and that could be make or break time. In March, broker Shore Capital said it offered “deep value” but warned it had to generate £260m in Q4 to meet its forecasts. Q3 revenues were flat year-on-year at £240m, so that’s a challenge.

Next Friday, I’ll be up early to pore over its results with a view to getting in early. I want this income stock in my portfolio, right next to Lloyds.

This post was originally published on Motley Fool