There are few better signs than seeing your stock picks surge after reporting earnings, and that’s what’s happening to the Beazley (LSE:BEZ) share price on Thursday (8 August).

The company’s earnings for the first half of the year — six months to 30 June — topped analysts’ estimates, with profits doubling versus the same period in 2023.

It’s also one of the most undervalued companies on the FTSE 100, according to Wall Street analysts. I actually wrote about Wall Street’s love for the stock in June, but didn’t buy as I already own two UK insurers.

An analyst favourite

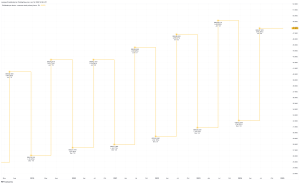

According to analysts, Beazley stock’s vastly undervalued. In fact, the average share price target for the stock’s 887.14p. That’s 29.8% above the current share price — at the time of writing, it’s up 10.4% after publishing results.

Moreover, all seven of the institutional analysts covering the company think it’s a Buy. This bodes well for the insurer.

It’s also worth noting that analysts often look to update their ratings on stocks after earnings reports. And after a huge earnings beat like this one, I’d expect analysts to pump that share price target even higher.

Interestingly, Wall Street analysts are actually more bullish than those in the City. The combined share price target’s 842p

Earnings in detail

Beazley more than doubled its profit in the first half of 2024, posting a record pre-tax profit of $728.9m for the six months.

The company’s annualised return on equity surged 100 basis points to 28%, and the value of premiums written grew to $3.12bn.

Beazley also improved its combined ratio guidance to around 80% for the year and announced a $325m share buyback.

The firm’s share price had already gained 21% year to date, driven by strong underwriting expertise and resilience in cyber risk management.

What’s so great about the stock?

Beazley’s attracted a lot of plaudits from analysts in recent years. The company’s focus on non-life insurance, leveraging its expertise in areas like cyber risk, marine, political risks, and property insurance, has proven particularly successful post-pandemic.

Analysts have been keen to highlight the sector-topping return on equity — which now sits even higher at 28% — and that the firm’s trading with a relatively low price-to-book (P/B) ratio — around 1.4 times.

According to RBC Wealth Management, and as inferred by the target price of other analysts, the stock should be trading around 1.8 times book value.

Of course, no company’s perfect, and no investment’s risk-free. Beazley’s US business has highlighted potentially negative impacts from political disruption and protests that may occur later in the year.

It’s also true that inflation has driven claims up, and while we’re back to long-term Bank of England targets, there are areas of the market where inflation remains a concern. Higher and unpredictable inflation has caught insurer out in recent years.

The bottom line on Beazley

Analysts said this stock was undervalued and was set to outperform, and it was right. I believe this stock may get some further boosts in the coming days as analysts hike their share price targets.

I might have missed out on some growth, but it’s a stock I certainly need to consider investing in. It’s also trading around 6.4 times forward earnings, with further growth expected throughout the medium term. That’s very appealing.

This post was originally published on Motley Fool