Spirax Group (LSE:SPX) appears to be running out of steam. Underwhelming half-year results released today (8 August) sent the Spirax Group share price plunging over 7% through the £8 barrier and back to levels not seen since April 2020. Ouch!

However, could investors be missing some silver linings amid today’s gloomy news? CEO Nimesh Patel has indicated the board expects “stronger growth in the second half” for the thermal energy specialist. This suggests the pain might be short-lived.

So is this FTSE 100 stock a potential recovery play or a value trap to avoid? Here’s my take.

What does Spirax Group do?

Some businesses are easy to understand. Others are more complicated for industry outsiders to get their heads around.

Spirax falls into the latter camp, so it’s worth delving into the business model before digesting the first-half results.

In essence, the firm’s all about steam products. It manufactures applications for industrial fluid control systems and electric thermal solutions. It’s also a market leader in peristaltic pumps — products designed to transport fluids without contamination.

Steam can be used to heat or sterilise most industrial processes. Consequently, its customer base spans companies in multiple sectors, from food production and oil refining to drug manufacturing and power generation.

A weak first half

Citing a “weak macroeconomic environment“, the company delivered a disappointing 3% fall in revenue to £827m for the first six months.

To compound difficulties, operating profit margins also contracted slightly and adjusted pre-tax profits slumped 10% to £137.9m.

The instant reaction’s been nasty. As I write, the Spirax Group share price is down almost 9% today. Over five years, the stock’s delivered a negative return excluding dividends.

The warning signs were there. Back in May, Spirax Group highlighted falling industrial production in key markets, including the US, Germany, and South America.

That trend’s persisted. Goldman Sachs puts the odds of a US recession by year-end at 25%, which could scupper any hopes of a share price rebound.

Recovery prospects

Nonetheless, the group remains optimistic. It believes industrial production will “recover through the balance of the year, weighted towards the second half.” Time will tell.

Both the biopharma and semiconductor industries are potential sources of growth. The former’s showing signs of a rebound from its post-pandemic slump and the latter continues to benefit from the AI boom.

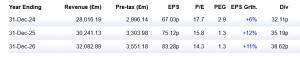

In addition, the share price fall has reduced the company’s valuation. The shares now trade at a forward price-to-earnings (P/E) ratio of a little over 25. That’s below the five-year average of 33 times earnings. On this metric, the stock looks undervalued at present.

Nonetheless, it’s worth exercising caution. That multiple’s still considerably higher than the average across FTSE 100 stocks, which currently sits below 15.

Buy the dip?

Spirax Group is a quality business with a wide moat. Yet I’m worried about the broader macroeconomic climate.

A recent dividend rise adds weight to the investment case, but the timing of a recovery in the company’s major markets is still very uncertain.

Considering the engineering giant also saw a profit dip during 2023, I’m avoiding this stock for now. Spirax Group will feature on my watchlist, but I want to see concrete evidence of a recovery before investing.

This post was originally published on Motley Fool