The FTSE 250 is a great place to shop when it comes to unearthing passive income. It’s home to a wide selection of stocks offering investors meaty dividend yields.

The average yield on the index is 3.3%. But there are 24 companies offering a payout of 7% or higher. While the FTSE 100’s average yield is slightly higher at 3.6%, there are only seven businesses onthat index offering a 7% yield or more.

While the FTSE 100 grabs most of the headlines, I think the FTSE 250 can be a cracking place to begin when building a stream of second income.

Of course, a high yield doesn’t necessarily make a stock a buy. Dividends are never guaranteed. Chunky payouts can be unsustainable and therefore a trap investors want to avoid at all costs.

With that in mind, here’s one FTSE 250 stock I like and one I’d avoid.

I’d avoid

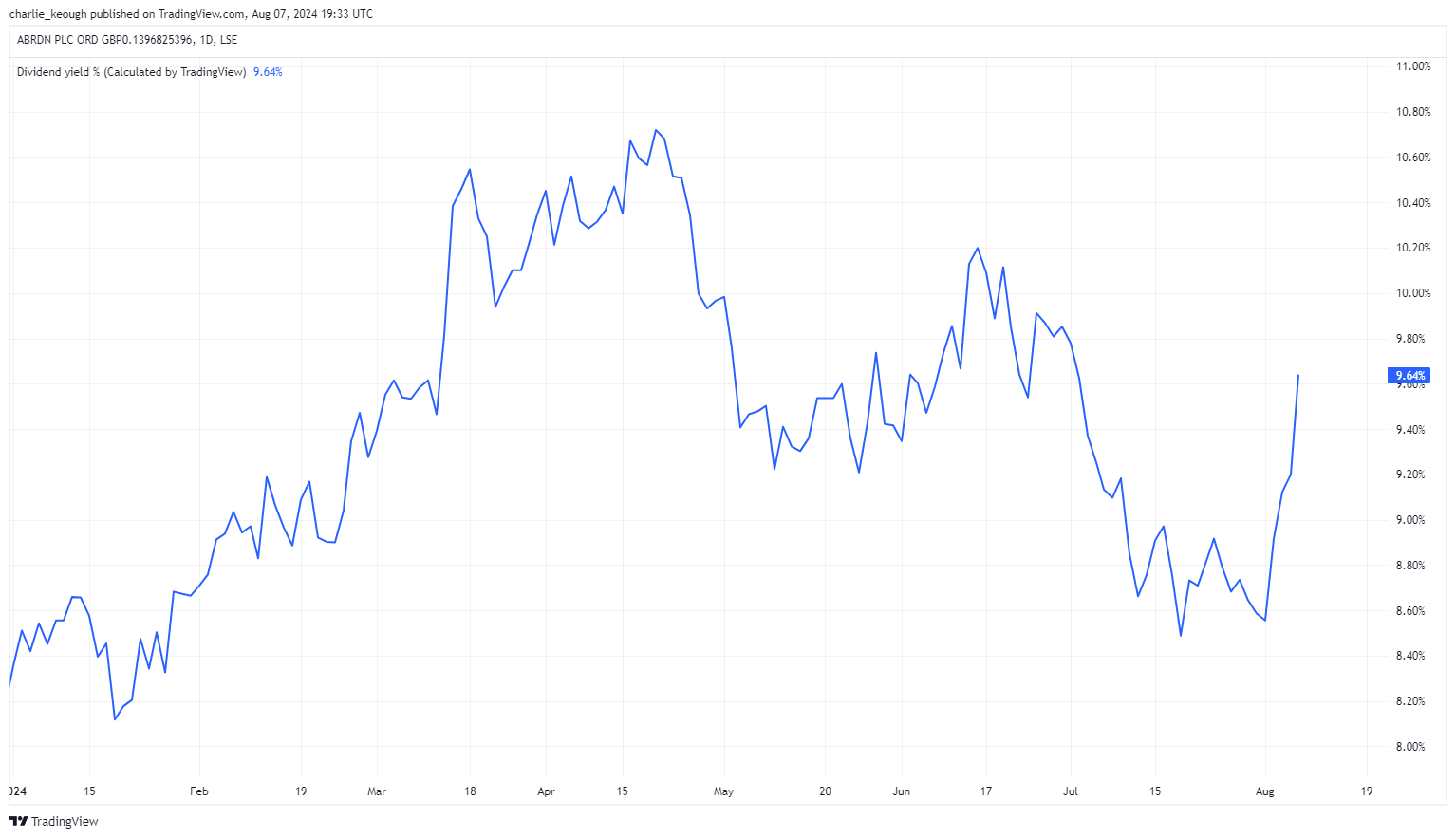

Let’s start with the stock I’d steer clear of. Despite its impressive 9.6% payout, I’m staying away from asset manager abrdn (LSE: ABDN).

Created with TradingView

There are a few signs I look for when assessing stocks. One is dividend coverage. Right now, abrdn’s is around one. A ratio of two or above signals that a dividend should be sustainable. Bearing that in mind, I’m not confident abrdn will be able to keep paying shareholders moving forward.

On top of that, its share price performance could be cause for concern. In the last 12 months, the stock is down 30.6%. This year it’s lost 13.3% of its value. That’s worrying.

Long-term shareholders won’t be best pleased either. In the last five years, abrdn’s share price is down 39.5%. Could it be that abrdn is a value trap?

Of course, I’m not completely writing off the stock. There are aspects of the business that I like. For example, it operates in an industry that’s set to experience growth in the coming years.

Alongside this, abrdn is undergoing a transformation programme. In its latest results, interim CEO Jason Windsor said the firm continues to “lay the foundations for growth”.

But even despite that, it’s one I’ll be avoiding.

One to consider

On the other hand, one stock I own and am keen to buy more of is ITV (LSE: ITV). It yields 6.4%, covered nearly two times by earnings.

Created with TradingView

Alongside that, I like the steps management has taken to enhance shareholder returns. One example is the recent £235m share buyback it has set in motion. As of June 30, it had purchased £53m worth of shares.

Its share price performance over five years is uninspiring though. It’s down 27.3% during that time. However, it’s been gaining some momentum recently. In the last year, it’s up 5.8%. Year to date it has easily outperformed the FTSE 250, climbing 24.5%.

The business has come under pressure from the rise of digital streaming providers such as Netflix. But I like the moves ITV is taking to counteract this, including investing in its streaming platform ITVX. I reckon investors should consider buying some shares today.

This post was originally published on Motley Fool