As I write this, the FTSE 100 is at 8,370 – not far from its previous high of 8,474. Despite this, I think UK shares look like great value compared to the rest of the world.

US equities are high-quality but expensive, while emerging markets have lower prices but different risks. In my view, looking for stocks to buy in fom the UK brings the best of both worlds.

US stocks

There’s no question the S&P 500 contains some of the biggest and strongest companies in the world. The likes of Amazon and Berkshire Hathaway are unmatched elsewhere.

The trouble is that it’s no secret these are really excellent businesses with huge earning power. And they typically come with prices that reflect this.

At the moment, the FTSE 100 trades at an average price-to-earnings (P/E) ratio of 15, compared with 27 for the S&P 500. That means investors have to pay a lot more for US equities on average.

There are exceptions on both sides – some UK shares look expensive and there US stocks that I think are cheap. But in general, the likes of Microsoft and Meta Platforms don’t come cheap.

Emerging markets

On the other hand, shares in companies from emerging markets look cheap by comparison. The P/E ratio of the FTSE Emerging Index is around 15, which is much lower than the US.

Emerging market investing can be risky, though. One type of risk is political – as owners of Alibaba shares will know, geopolitical tensions can weigh heavily on investment returns.

Another concern is currency. The Argentinian peso has lost 95% of its value compared to the pound over the last five years, making the cash generated by the likes of MercadoLibre less valuable.

Argentine Peso/British Pound 2019-24

Created at TradingView

FTSE 100 shares don’t always eliminate this risk – Airtel Africa has been hit by the declining Nigerian naira and Burberry has seen declining sales in China. But this isn’t always the case.

Staying close to home

With the UK markets, I think there are opportunities to buy stocks that offer the best of both worlds. Rightmove (LSE:RMV) is a good example.

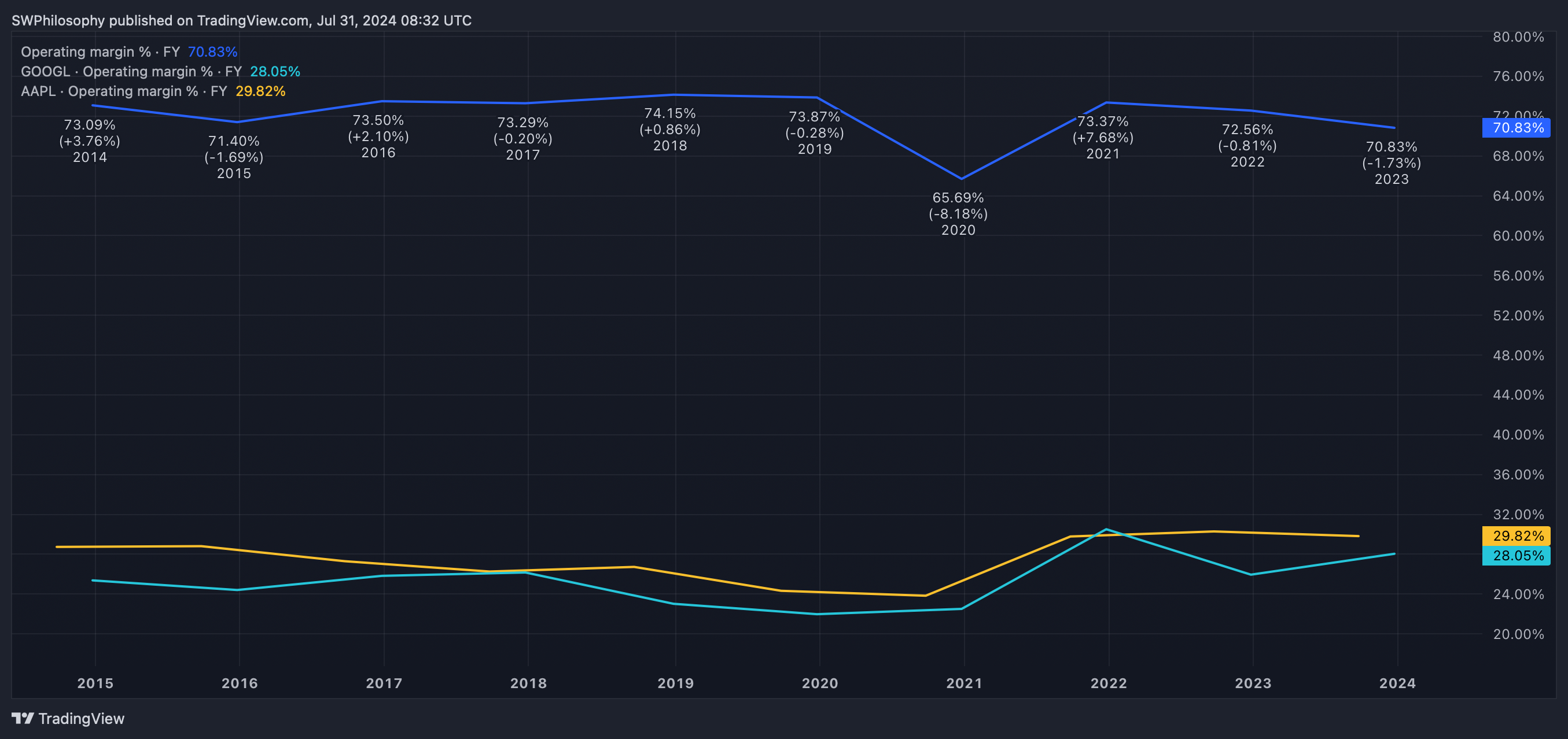

The stock is expensive by UK standards, but the firm’s operating margins rival even the strongest US companies. And a P/E ratio of 23 isn’t high compared to the likes of Apple and Alphabet.

Rightmove vs. Apple vs. Alphabet Operating Margins 2014-24

Created at TradingView

With the business generating 99% of its revenues from the UK, there’s no obvious currency risk. And the political situation is more stable than in some other countries.

Of course, there are still risks – Rightmove’s fortunes are closely tied to the UK housing market. That isn’t something the company can control, but it’s set to do well if house prices keep rising.

Investing in the UK

I’m not saying every FTSE 100 stock is a good buy and nothing anywhere else is worth considering. There are UK shares I’m avoiding and US stocks I’m considering buying at the moment.

What I do think, though, is that the chances of finding a great investment are higher in the UK than elsewhere. A combination of low prices and political stability should be attractive to investors.

This post was originally published on Motley Fool