This is a developing story. Check back for updates.

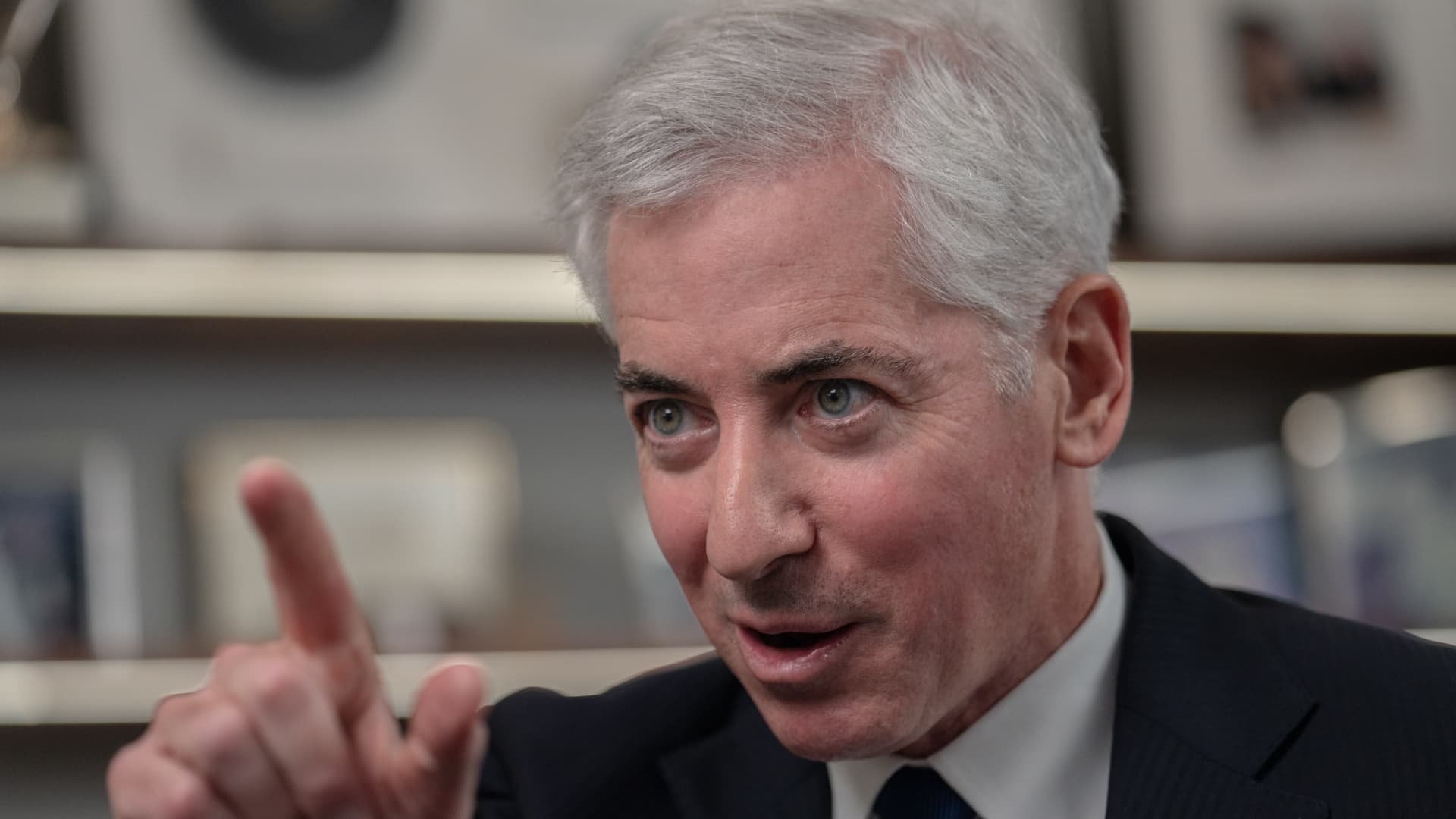

Bill Ackman’s Pershing Square USA withdrew plans for a an initial public offering after investor demand appeared to wane from original expectations.

But the hedge fund titan said he would be back with a revised plan for the offering for his fund, which he had wanted to model after Berkshire Hathaway.

Wrote Ackman in a statement:

“While we have received enormous investor interest in PSUS, one principal question has remained: Would investors be better served waiting to invest in the aftermarket than in the IPO? This question has inspired us to reevaluate PSUS’s structure to make the IPO investment decision a straightforward one. We will report back once we are ready to launch a revised transaction.”

The withdrawal comes a day after the fund said it would be seeking to raise $2 billion, far below the possible $25 billion cited in previous reports.

As of the end of June, Pershing Square had $18.7 billion in assets under management. Most of the money was under Pershing Square Holdings, a closed-end fund that trades in Europe.

On Monday, Bloomberg News reported citing sources that Seth Klarman’s Boston-based hedge fund Baupost Group opted against investing in Ackman’s new U.S. fund.

Ackman’s move to publicly list Pershing Square was seen as a way to capitalize on his growing presence among retail investors. Currently, he has more than 1 million followers on social media platform X. On the platform, he has expressed his views from the U.S. presidential election to antisemitism.

This post was originally published on CNBC Markets