The Diageo (LSE: DGE) share price has been slipping lower for what seems like an eternity. I’m sure this has tested the patience of many shareholders (myself included).

Unfortunately, today (30 July) brought no respite as the FTSE 100 booze giant released its preliminary results for FY24 (ended in June).

As I write, the stock’s down 10% to 2,291p, meaning it’s now fallen 33% over one year and 43% since the start of 2022.

I’m in the market for a couple of stocks in August. Should I take advantage of this big drop in the Diageo share price?

Worse-than-expected results

Heading into the print, Diageo was expected to report declines in the top and bottom lines, and that’s what we got.

Net sales slipped 1.4% year on year to $20.3bn due to an unfavourable mix of foreign exchange and weak sales. Organic operating profit of $6bn dropped by $304m (or 4.8%), which was worse than the 4.5% dip analysts were expecting.

The operating margin contracted 1.3% and basic earnings per share before exceptional items fell 8.6%.

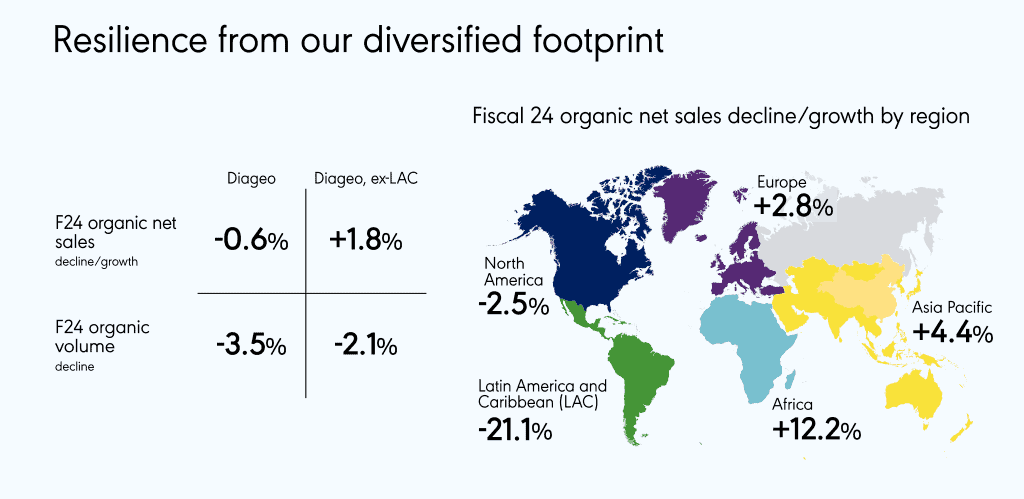

A whopping $302m of the operating profit decline was attributable to its Latin America and Caribbean region, where sales slumped 21.1%. Cash-strapped drinkers in Mexico and Brazil have been trading down from Diageo’s premium Scotch and tequila brands.

So the harsh share price reaction here’s partly due to the firm missing already-low expectations. But the current FY25 will also be “challenging“, according to management, with more “negative pressure” on the operating margin.

This guidance will have spooked investors, as would a now-uncertain timeline for medium-term sales targets.

Not all doom and gloom

There were some bright spots however. Diageo grew or held its total net sales share in more than 75% of its markets, including North America.

Luxury premium tequila brand Don Julio is growing rapidly in the US. And Guinness was the fastest-growing imported beer in US on-trade (bars, restaurants, hotels, etc) in the last 12 months.

Moreover, there was healthy growth in Africa, Asia Pacific and Europe.

Finally, the dividend was hiked 5% to $1.03 per share. The starting yield is now 3.5%, which I find attractive for a Dividend Aristocrat like Diageo.

No-brainer bargain?

The stock’s long traded at a steep premium to the FTSE 100, which reflected its global growth story. But the company’s stopped growing, at least for now. And slow-growing stocks don’t normally trade at 25 times earnings, like Diageo has in the past.

Right now, the stock’s trading at around 16.5 times earnings, a significant discount to its historic average.

My worst investments have been when I’ve doubled down on falling stocks. So there’s a risk I could be throwing good money after bad by scooping up more shares.

After all, we don’t know when sales will pick up, while the downwards momentum of the share price is worrying. There’s a lot of uncertainty here and it’s far from a no-brainer buy.

Yet we do know that many consumer-facing firms are facing similar difficulties — from Nike and McDonald’s to JD Sports Fashion. These issues aren’t specific to Diageo.

Therefore, I think there’s an attractive opportunity here for patient investors, and it’s one I’m considering taking.

This post was originally published on Motley Fool