Instead of leaving all my money sitting in a saving account, I’d rather put it to work to build a passive income stream.

Let me explain how I would go about it if I was starting from scratch today!

Work work work work work

The first thing I’d do is open a Stocks and Shares ISA. This is a great vehicle to invest with, in my view. Plus, as I’m going to aim for dividend stocks, these types of ISAs protect my juicy dividends from the tax man.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Next, I need to formulate an investment strategy. As I’m looking to capitalise on dividends, I’m looking for the best stocks with potential for regular payouts, as well as growth to protect my future pot of money.

If I had £20K today, and decided to add £200 per month to this to top it up, I could be left with £337,008 after 25 years, at a rate of return of 8%. This is thanks to the magic of compounding.

Drawing down 6% annually, and converting that into a monthly amount, I would have an extra £1,685 per month to spend later in life on whatever my heart desires.

From a bearish view, I need to remember that dividends are never guaranteed, and are only paid at the discretion of the business. They could be cancelled, so my stock picking is vital. Next, 8% isn’t overly ambitious. However, I could end up earning less, which would leave me with less money at the end of my plan.

Solar energy

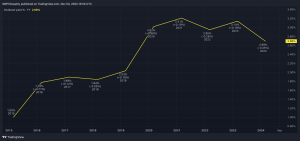

One stock I reckon could help me achieve my aim is US Solar Fund PLC (LSE: USFP).

I see energy, especially renewable greener alternatives, as an exciting growth market. Firms in this space could provide returns now, and in the future. US Solar’s wide presence across the pond is a draw for me. Plus, it has a good track record and an attractive current level of return.

The shares offer a dividend yield of close to 10% at present. This has been inflated slightly due to a falling share price, but I’m not overly concerned by that. I believe it’s linked to short-term economic volatility. Plus, it’s election year across the pond, and the possibility of Donald Trump winning could be an issue.

If the former president comes back into power, green initiatives in the US could be pushed back. This could hurt US Solar Fund’s earnings, growth, and returns.

Another risk is that solar assets aren’t easy or cheap to set up and maintain. This could have an impact on returns too.

Moving back to the good stuff, energy is a basic requirement for all, no matter the economic outlook. This can help keep earnings stable. As sentiment towards the need to move away from traditional fossil fuels continues to ramp up, I reckon growth could be on the cards for US Solar Fund.

Finally, the shares look undervalued to me. This is based on their current share price of 36p, and their net asset value of 75p per share.

This post was originally published on Motley Fool