AstraZeneca’s (LSE: AZN) share price has dropped around 4% from its 26 June 12-month traded high of £127.04.

However, this still leaves it about 28% up from its 12-month low of 12 February.

As a shareholder who bought at much lower prices, is now a good time for me to buy more?

How does it look technically?

AstraZeneca trades on the key price-to-earnings ratio (P/E) of stock valuation measurement at 38.8. This is still bottom of the list of its key international peers, which have an average P/E of 90.4.

This comprises Novo Nordisk at 45.2, AbbVie at 51.5, Eli Lilly at 127, and Merck at 138.1.

That said, its closest UK peer – GSK – has a P/E of 13.8, which according to my analysis is around 67% undervalued against its own peer group.

However, AstraZeneca is much bigger than GSK – ranked globally by market capitalisation respectively at number seven and number 18.

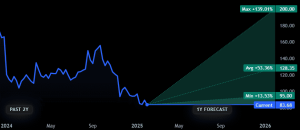

Using the same discounted cash flow methodology as I did for GSK, AstraZeneca is 42% undervalued at its current £122.55.

Therefore, a fair value for the shares would be £211.29, although they may go lower or higher than that.

Growth projections

Back in 2014, AstraZeneca announced its target of increasing revenues to more $45bn+ by 2023 (from the then-$26.5bn). Didid it make it? Yes, revenues came in at $45.8bn.

In its recent 21 May ‘Ambition 2030 and Beyond’ presentation, it said it will deliver $80bn in revenues by 2030.

It added that it is on track to deliver mid-30% core operating margin by 2026. After that, it will still target at least mid-30%, although it said this will be influenced by portfolio evolution.

Its Q1 2024 results released on 25 April showed revenue up 19% year on year to $12.679bn. That was driven by an 18% increase in product sales.

One risk to the firm’s projections is that a failure in any of its key drugs could be very costly. Also potentially very expensive would be any legal action arising from the ill effects of any of its medicines.

That said, consensus analysts’ expectations are that AstraZeneca’s earnings will grow 15.7% a year to end-2026. Earnings per share are anticipated to increase 16.5% a year to that point.

So will I buy?

As a long-term investor now rather than the trader I was when younger, I am in an investment for the duration, at least until I sell my remaining growth stocks and focus solely on high-dividend-paying ones.

That said, my average entry price for my AstraZeneca holding is a lot lower than the current price. To buy more at this level would dramatically increase the risk of any major adverse price moves on my profit.

Consequently, I am happy with my current position and will not buy more.

However, if I did not have this I would have no hesitation in starting a position at the current price. I think there is every chance that AstraZeneca will achieve its new growth targets, just as it did before.

And at roughly double the current revenues, these should drive the share price higher over time, in my view.

This post was originally published on Motley Fool