I think now’s a brilliant time to buy FTSE 100 income stocks, as so many look cheap today. Today, I’m targeting companies that have shown they’re keen to reward loyal shareholders by increasing their dividends year after year.

Sales and marketing firm DCC (LSE: DCC) may not spring out as a FTSE 100 dividend hero, with a trailing yield of just 3.53%. However, it’s a true Dividend Aristocrat, having hiked shareholder payouts for each of the last 19 years.

Dividend heroes

AJ Bell recently calculated that DCC had hiked its dividend by an average of 10.8% every year for the last decade. Now could be a good time for me to buy into this income stream. The DCC share price fell 4.42% last week, reducing its valuation to just 11.9 times earnings. Over one year, it’s up a solid 18.08%.

DCC is a hard company to categorise as it offers marketing services to global businesses and is also one of the largest bottled gas suppliers in the world. Some will see this as useful diversification. Others as a distraction.

Retirement boost

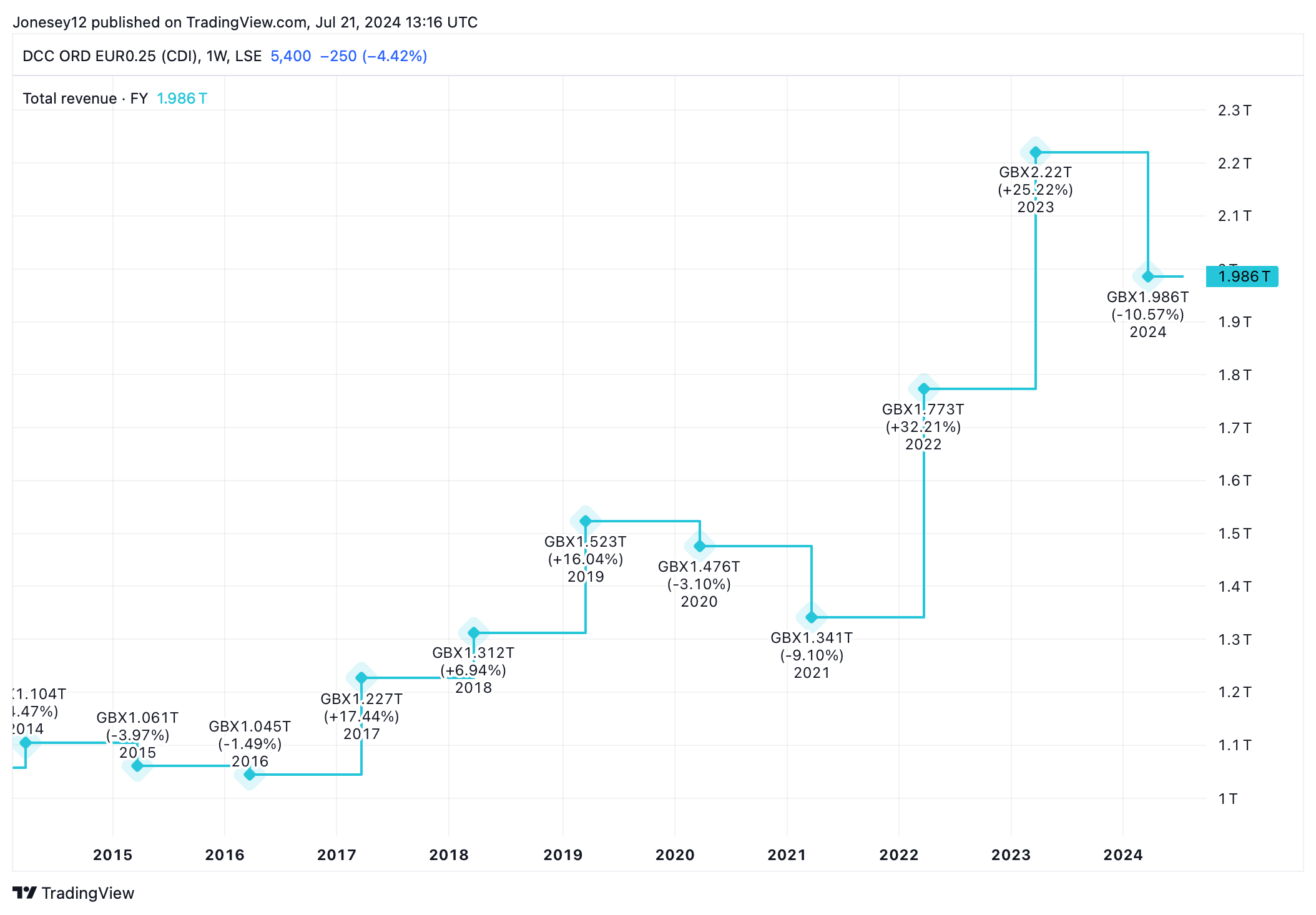

Revenues recovered sharply after the pandemic, boosted by the energy shock, but have slowed as gas prices ease, as this chart shows.

Chart by TradingView

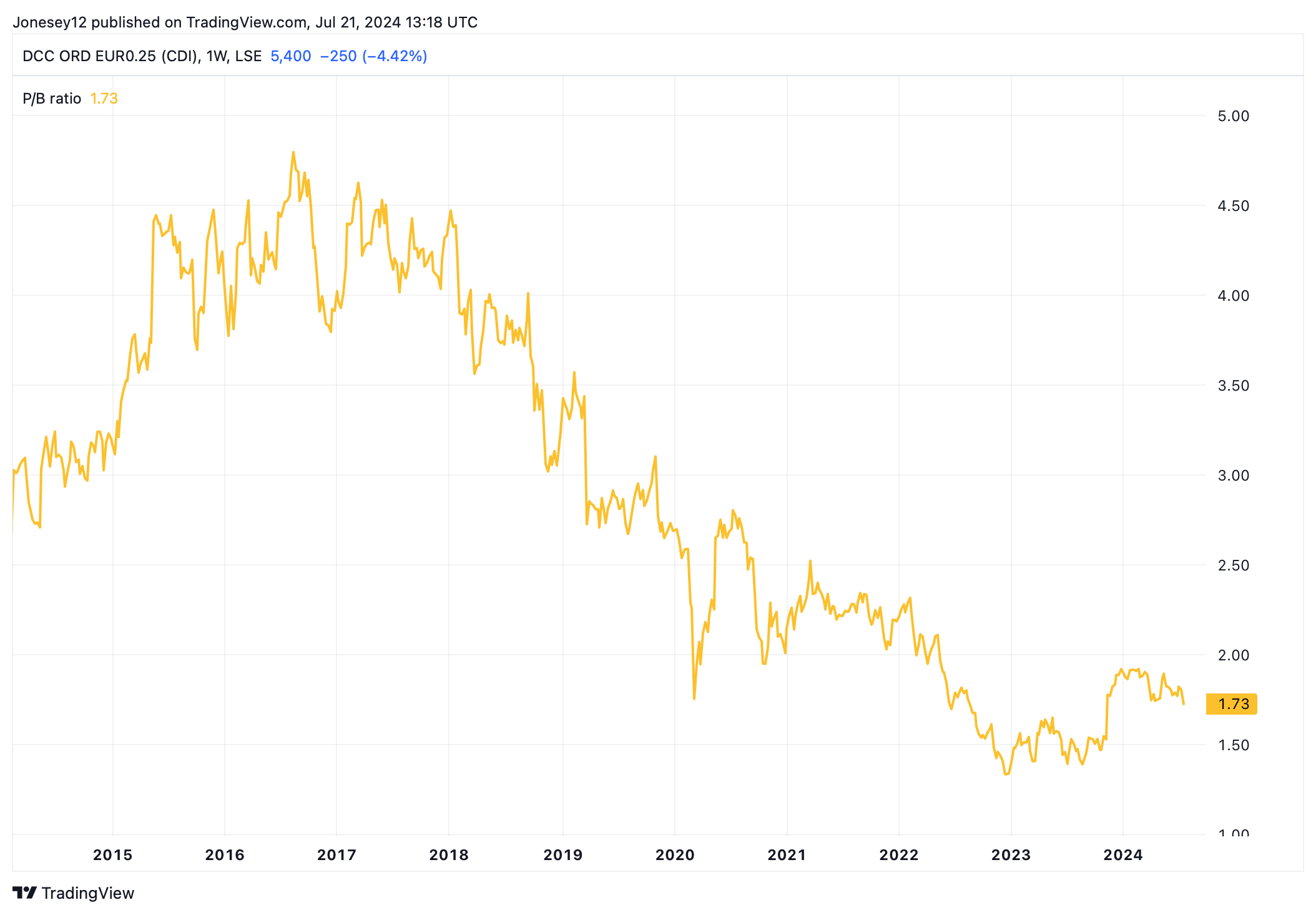

Yet at the same time, the stock has been getting dramatically cheaper, as measured by its price-to-book ratio. Check out this chart.

Chart by TradingView

Last month, JPMorgan Cazenove went ‘overweight’ on the stock and set a 6,700p price target. That’s almost 25% higher than today’s 5,405p. It said DCC should benefit from the growing European solar installation market and rising sales in its healthcare segment. I’ll buy it when I have the cash.

I’d like to match it with FTSE 100 distribution and outsourcing group Bunzl (LSE: BNZL). It’s also a Dividend Aristocrat whose low 2.21% yield masks the fact that it has hiked payouts for 24 consecutive years.

The shares have put on a good show lately, rising 12.9% over one year and 48.05% over five.

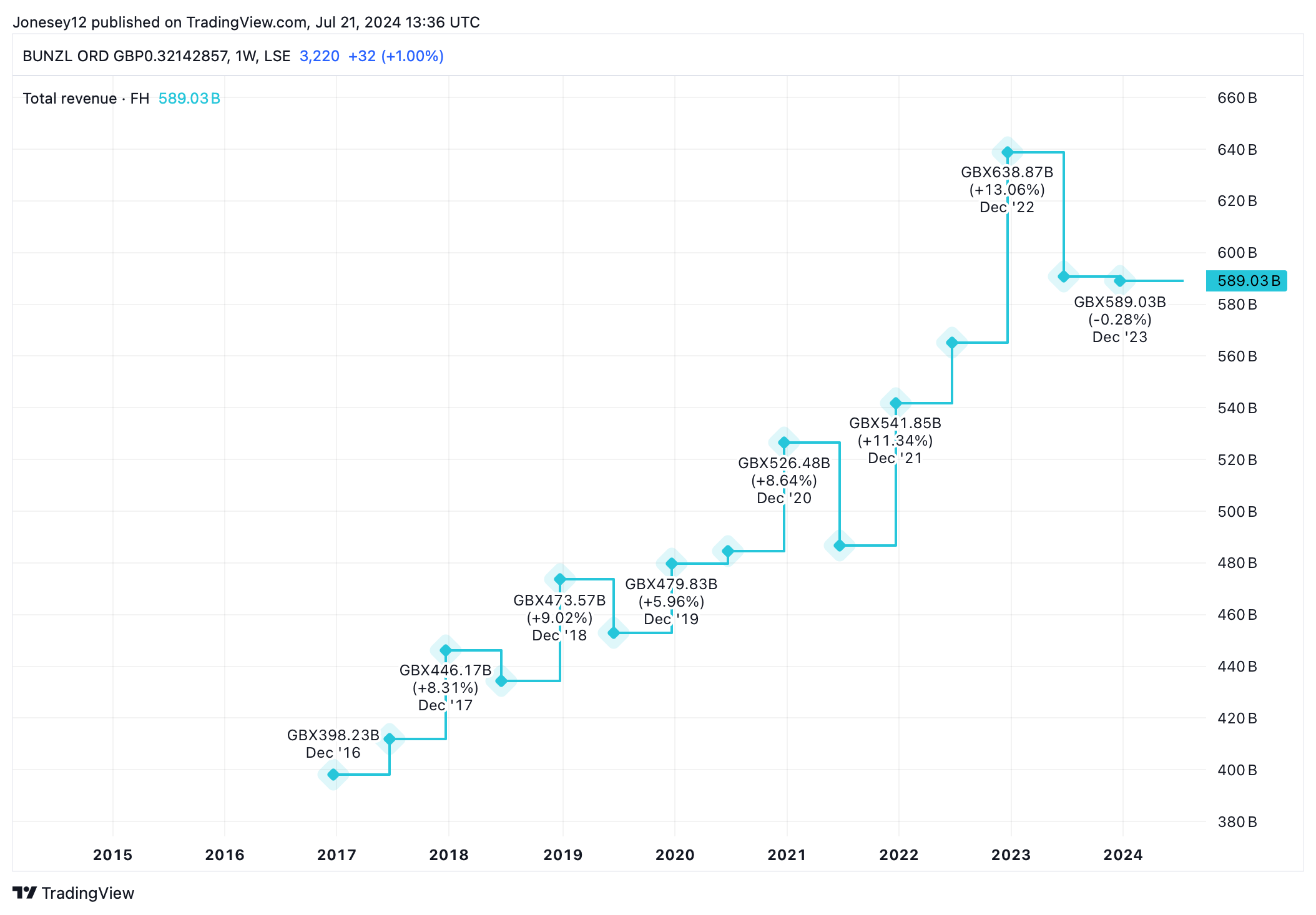

Last month, Bunzl said first-half revenues fell 3% to 4%, largely due to exchange rate swings, but would pick up in the second half. This chart shows a slowdown, but the long-term picture is encouraging, in my view.

Chart by TradingView

The board forecasts strong margin growth this year, boosted by its relentless acquisition drive (it’s spent £600m this year and counting).

Its two recent purchases, Brazilian medical device distributor RCL Implantes and Canadian hygiene products specialist Clean Spot, indicate Bunzl’s global reach and range.

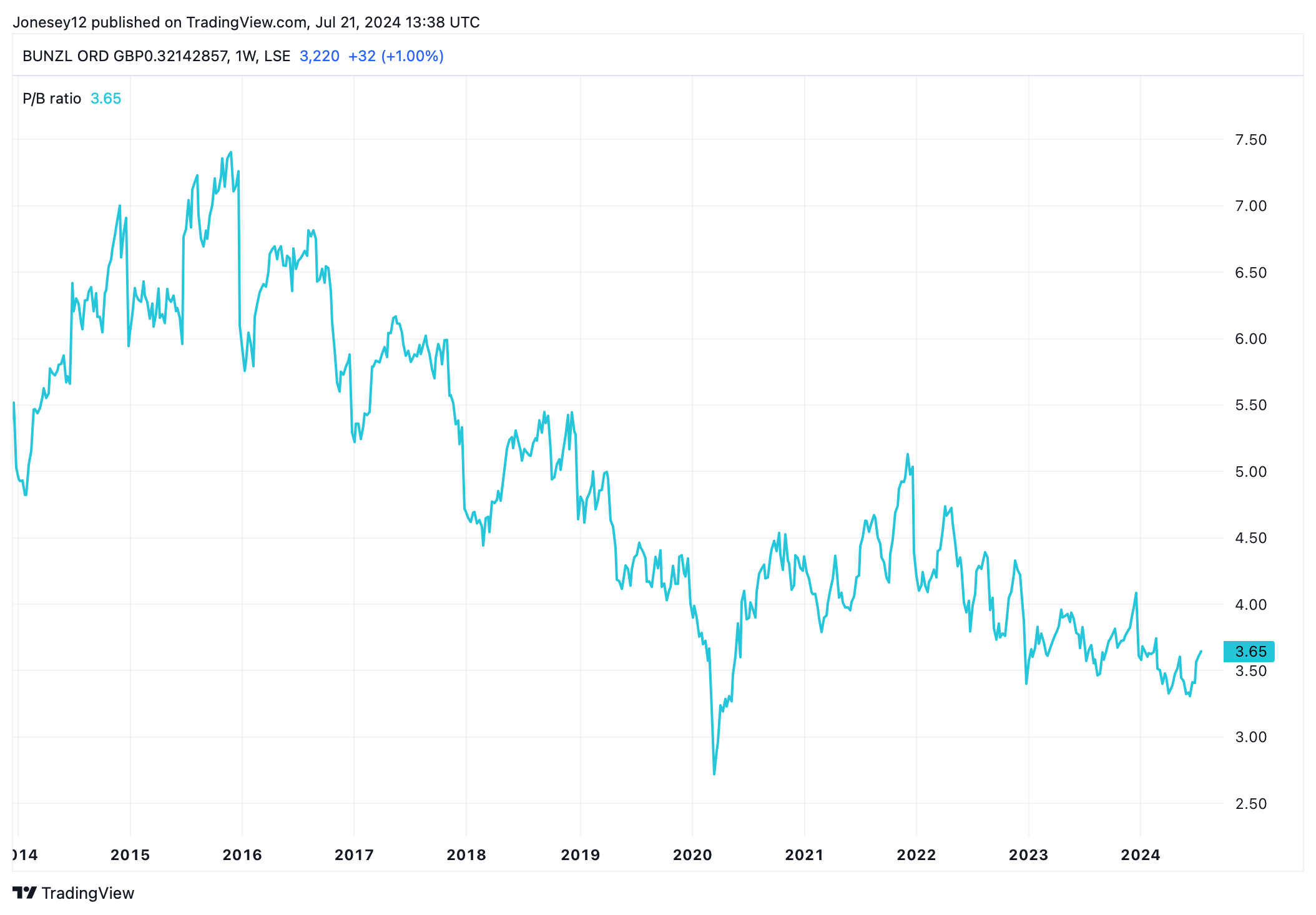

Bunzl is cheap by its standards, trading at 16.12 times earnings. The price-to-book ratio has been sliding too, as this chart shows.

Chart by TradingView

I think now looks like a good time to add Bunzl to my retirement portfolio too. I’ll reinvest all my dividends today and start drawing them as income at some point after I retire.

This post was originally published on Motley Fool