Millions of us in the UK invest for passive income. It’s something that can give us financial security, allowing us to focus on other aspects of our lives without constantly worrying about money.

While many people look at investing in buy-to-let housing or put their money in high-interest savings accounts, I don’t think there’s any better option than investing stocks, bonds, and funds.

So what’s so great about investing? High-interest savings accounts can only generate a maximum of 5% annually. And unless we have a large portfolio of buy-to-let investments, it’s not a diversified way to use our money. A leasing void, or a downturn in the housing market can make a buy-to-let investment entirely unprofitable.

How to invest for success

Unless we have a lot of starting capital, investing for passive income requires consistency, reinvestment, and wise choices.

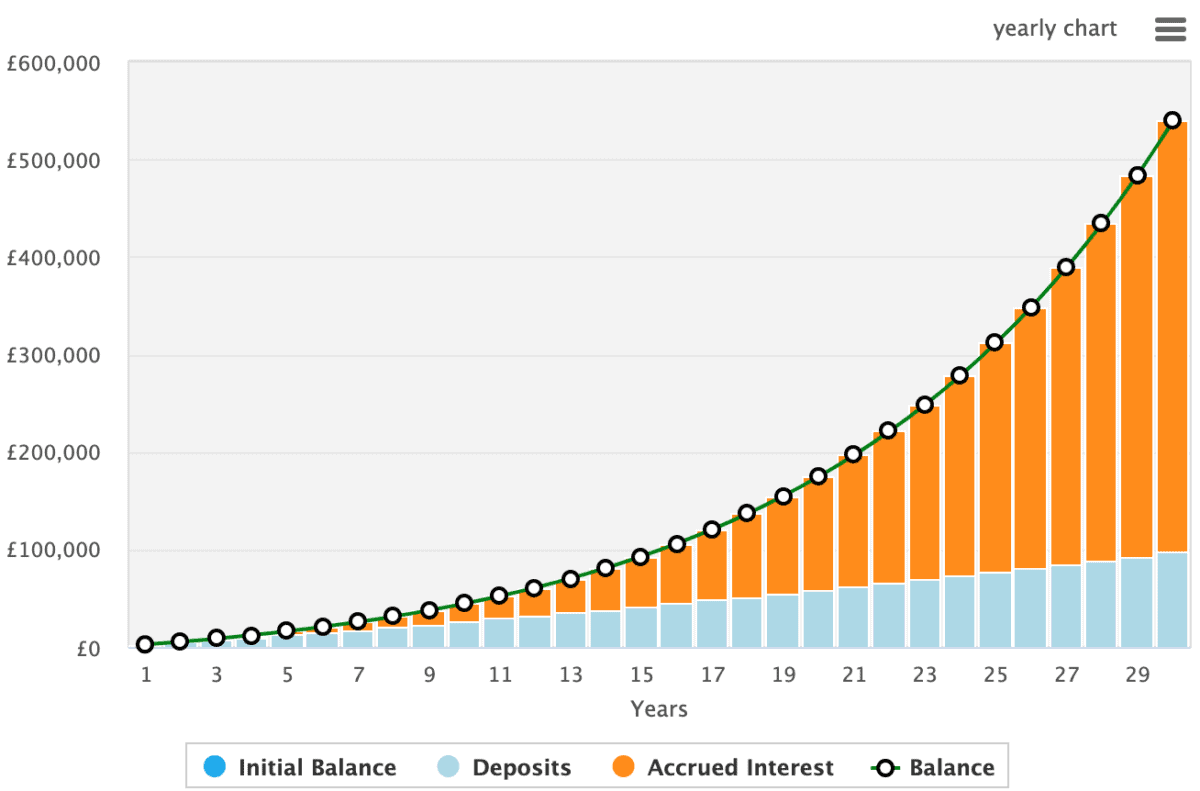

Investing £200 a month consistently can lead to significant wealth accumulation over time, thanks to the power of compounding.

I should start by selecting a diversified portfolio of stocks, index funds, or ETFs that align with my risk tolerance and financial goals. With just £200 a month, I could pick a new stock each month, or maybe choose to consistently investment in some of my favourite ETFs.

Compounding’s key. This happens naturally when I reinvest my returns, or simply invest in growth-oriented companies that reinvest on my behalf.

This allows my investments to generate earnings, which are then reinvested to produce their own earnings.

So here’s the equation. If I invest £200 a month, and increased this contribution by 2% annually while achieving 10% growth on average, after 30 years I’d have £539k.

That’s easily enough to generate a passive income worth £30k annually.

What’s more, the Stocks and Shares ISA protects our earnings and dividends from tax. This means my portfolio can grow quicker and my passive income will be tax-free.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Finding the right investments

If I invest poorly, I could lose money. And lots of novice investors do this.

So where should I put my money? Well, as I have plenty of time to research companies, I tend to pick individual stocks. However, that might not be for everyone. And ETFs are one way to go.

Investors wanting exposure to the booming artificial intelligence (AI) and data centre segment may consider the VanEck Semiconductor ETF (BIT:SMH).

The ETF offers exposure to the 25 largest US-listed companies producing semiconductors, or semiconductor equipment. This means its top investments include Broadcom, TSMC, Nvidia, and ASML.

Some investors may justifiably be concerned that this part of the market’s already looking expensive. However, I believe there’s more growth to come even though near-term valuations look a little stretched. It may mean being patient though.

The ETF is up 387% since its inception four years ago — that’s incredible growth — and it offers diversified exposure to a volatile but highly exciting sector.

This post was originally published on Motley Fool