The FTSE 100‘s home to a wide variety of exceptional stocks. By building a balanced portfolio of different shares, investors can balance risk and enjoy strong and stable returns over time.

Value stocks provide investors with the potential for significant long-term capital appreciation, as well as a margin for error. Growth shares can also outperform the market by increasing profits at breakneck speed. And dividend stocks can deliver regular income and stability, even during market downturns.

Here are three Footsie stocks from each category to consider today. I think each has the potential to deliver significant long-term returns.

Value

Vodafone Group (LSE:VOD) offers excellent value across a variety of metrics. It trades on a forward price-to-earnings (P/E) ratio of 10.1 times, which is one of the lowest across the telecoms sector.

The company also carries a market-beating 7.2% dividend yield for this year, even after its vow to cut dividends.

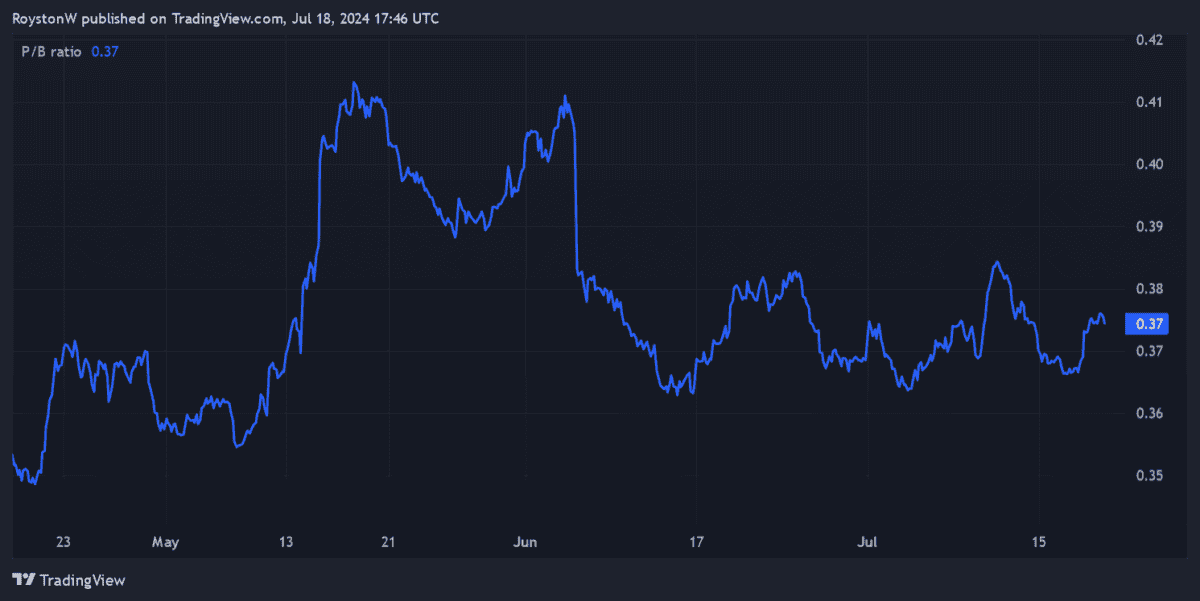

And finally, Vodafone shares trade on a price-to-book (P/B) value of around 0.4. Any reading below 1 indicates a share’s cheap relative to the value of its assets.

Vodafone’s been under pressure more recently due to changes to German telecoms laws. But more encouraging trading in its single largest market suggests now could be the time to buy.

It’s also undergoing a huge transformation to cut its headcount and boost investment in areas like Vodafone Business. This carries execution risk, but it could also lead to significant earnings growth over the long term.

Growth

Companies that operate in Nigeria have been hit by a series of currency revaluations recently. This has been the case with Airtel Africa (LSE:AAF), a telecoms operator that offers mobile money and data services across 14 countries.

Further falls in the Nigerian naira are possible. Yet City analysts still believe Airtel’s earnings will rebound sharply from this year onwards.

It’s tipped to swing from a $63m pre-tax loss in the last financial year to earnings of $805m this year. In fiscal 2026, the bottom line’s tipped to increase an extra 71% too, to £1.4bn.

With wealth levels and population sizes soaring across its markets, I think Airtel could deliver stunning profits growth in the long run. Telecoms industry body GSMA, for instance, believes 4G adoption in Sub-Saharan markets will double in the next five years.

Dividend

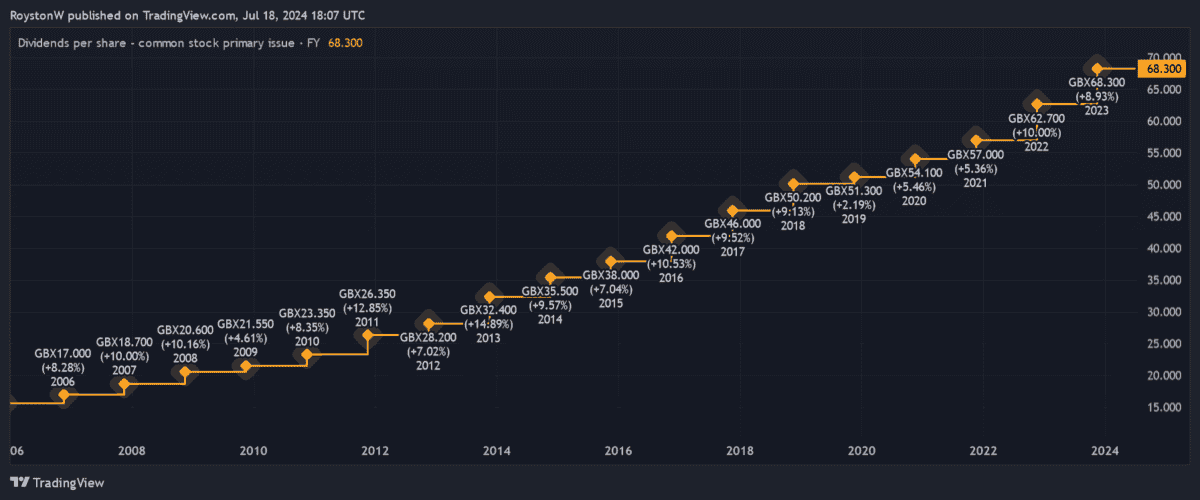

Bunzl (LSE:BNZL) doesn’t carry the largest dividend yields out there. For the next three years they range 2.2-2.5%.

However, the support services provider’s stunning dividend growth record still makes it a passive income hero, in my opinion. Annual rewards have risen for 31 years on the bounce, illustrating the firm’s exceptional cash generation and ability to weather economic downturns.

These increases have been pretty generous too, at around 9% per annum through the period.

Bunzl’s highly successful, acquisition-based growth strategy has provided the bedrock to grow dividends year after year. An M&A-led strategy like this can be risky, but the firm’s excellent record helps soothe any fears I may have.

This post was originally published on Motley Fool