I’m wary of the BT (LSE: BT.A) share price. Despite looking cheap at 140p, I reckon it could be a value trap.

These are investments that look like brilliant buying opportunities on paper. However, they turn out to be misleading.

The stock is up 11.9% this year and 13.9% over the last 12 months. So, it’s gaining momentum. Even so, it has still lost 25.9% of its value over the last five years.

While I reckon it’s a stock for investors to avoid, could I be wrong? To answer that, I want to look at three factors.

Valuation

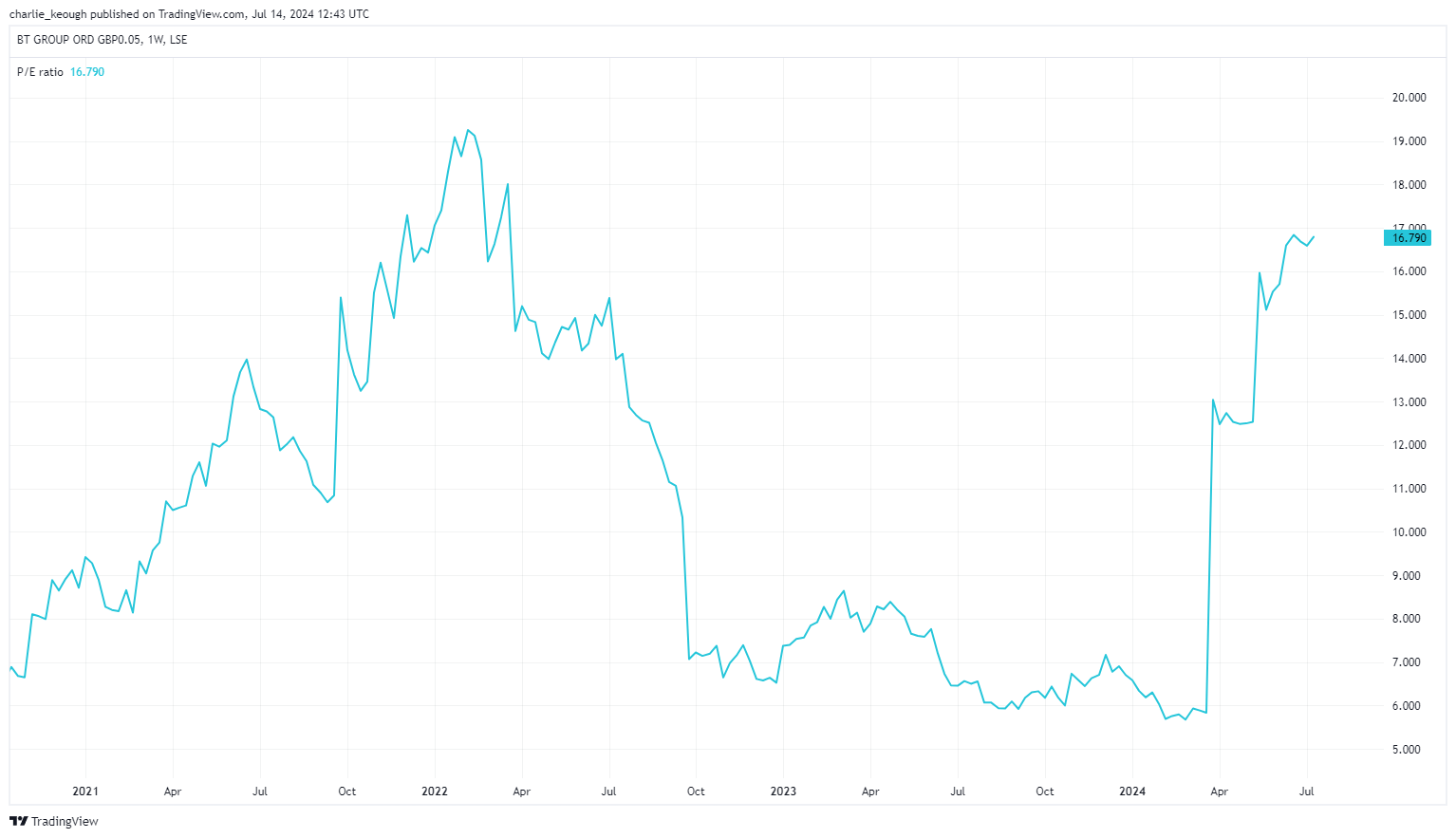

Let’s start by looking at its valuation. To do that, I’ll use the price-to-earnings (P/E) ratio. Looking at the chart below, the stock is currently trading on a P/E of 16.8. That’s above the FTSE 100 average (11).

Created with TradingView

Over the course of the year, BT shares have become considerably more expensive. That said, looking ahead paints a better picture. BT has a forward P/E of just 8.7. That’s pretty cheap.

Debt

So, BT looks like it has the potential to be good bang for investors’ buck. Let me now focus on an issue I have with the business, which is its debt pile.

On its balance sheet, it has a total net debt of £19.5bn. That’s a big amount and is around 1.25 times its market capitalisation. While interest rate cuts may be near, rates will stay elevated for the coming years. That will make this pile more expensive to service.

What’s more, its debt has been steadily rising. Last year, the business pinned the increase, totalling £800m, down to pension scheme contributions.

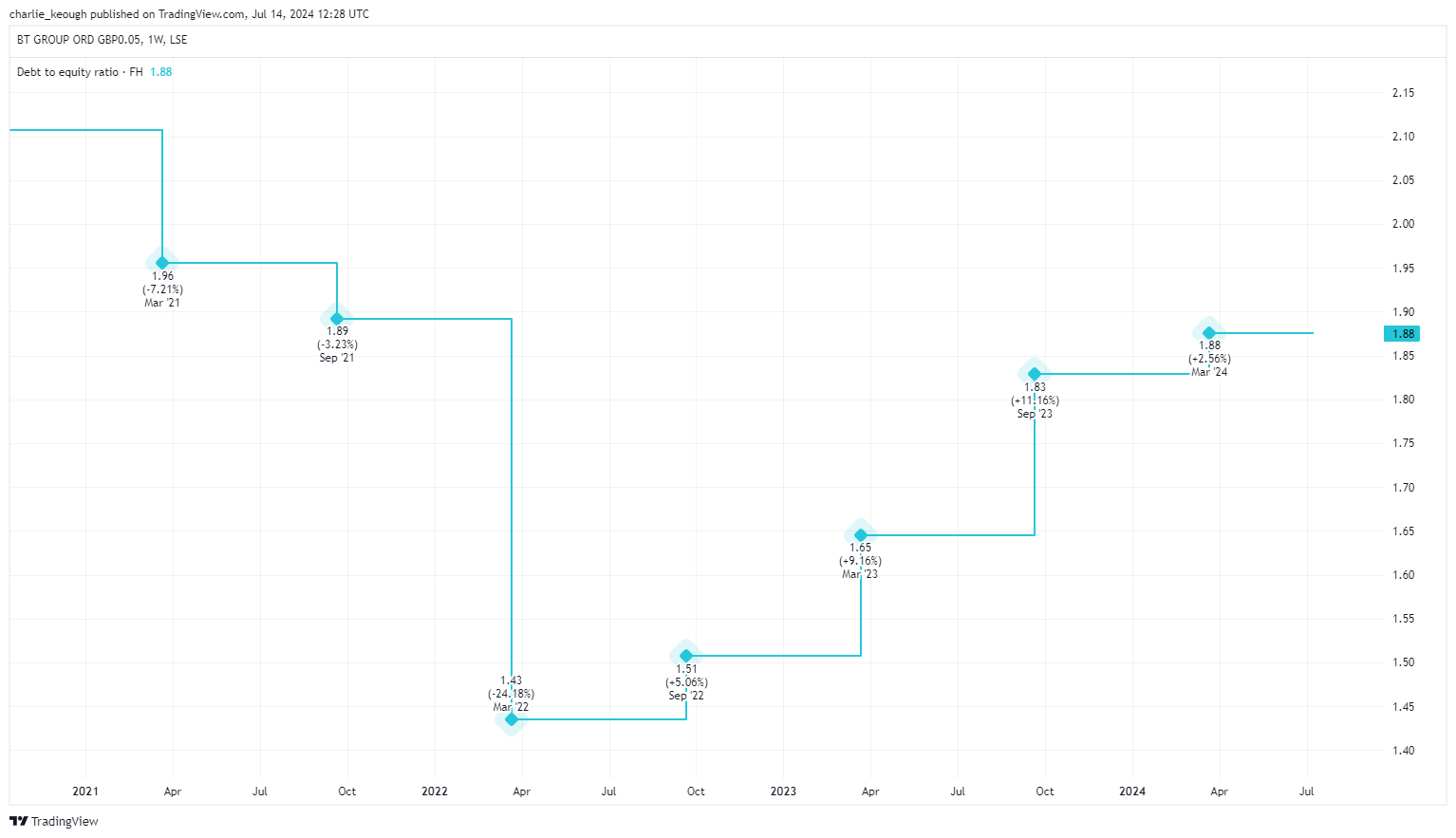

As the chart shows below, that means BT now has a debt-to-equity ratio of nearly 1.9, where 1-1.5 is considered healthy. In my opinion, that’s concerningly high.

Created with TradingView

Created with TradingView

Impressive dividend

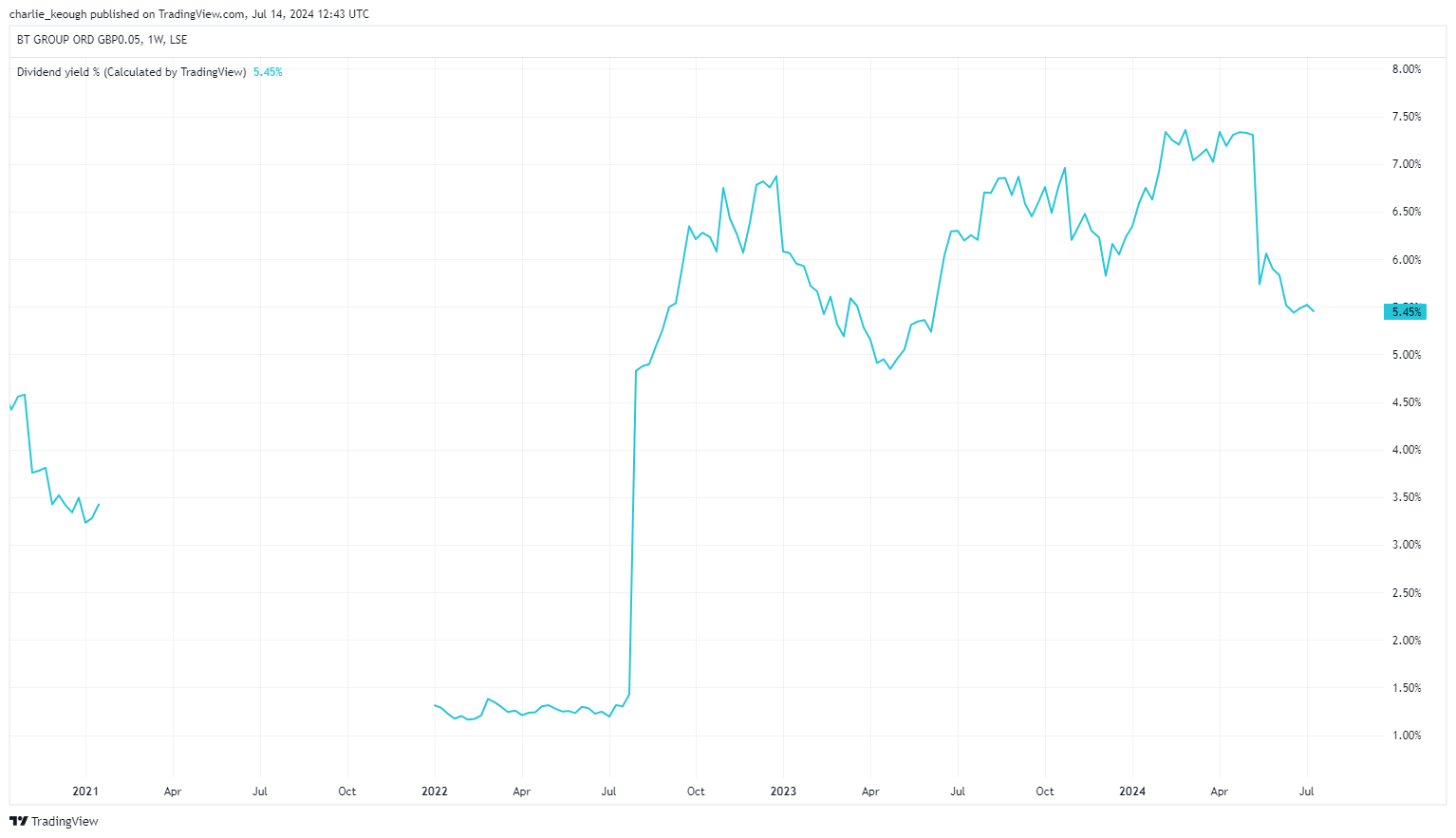

The final factor I want to highlight is its dividend yield. As seen below, the stock boasts a 5.5% payout, comfortably clearing the FTSE 100 average (3.6%).

Created with TradingView

Its rising share price has meant its yield has fallen. Nonetheless, there’s the potential for it to rise. Last year, its dividend jumped 3.9% to 8p per share.

A value trap?

There are aspects of BT to like. For example, its full-year update offered some positives. On 16 May, the business announced it had “reached the inflection point” for its long-term plan, including passing peak capex for its full fibre broadband rollout.

But then again, I see further drawbacks. Its top line has been falling in the last few years. And it grew just 1% for 2023. Its pre-tax profits have also been sliding. Last year they dropped by 33.5% to just shy of £1.2bn.

On my watchlist

Despite looking like decent value, I’m conscious BT’s debt could harm its growth potential in the years ahead. I’ll be keeping a close eye on whether the figure comes down in its Q1 results, due for release on 25 July, and its half-year update, on 7 November. The stock will stay on my watchlist for the time being.

This post was originally published on Motley Fool