Shares in banking giant Lloyds (LSE: LLOY) have taken off the in the last year.

The stock is up 22.3% year to date and 31.1% over the last 12 months. Patient shareholders, myself included, have been waiting a long time for the FTSE 100 bank to take it up a gear. It seems to me that’s finally happening.

But Lloyds’ impressive rise in the last year has me pondering what’s next for the stock. It’s nearing the 60p mark. Could it gallop past that with ease? Could 70p be on the horizon? Let’s explore.

Valuation

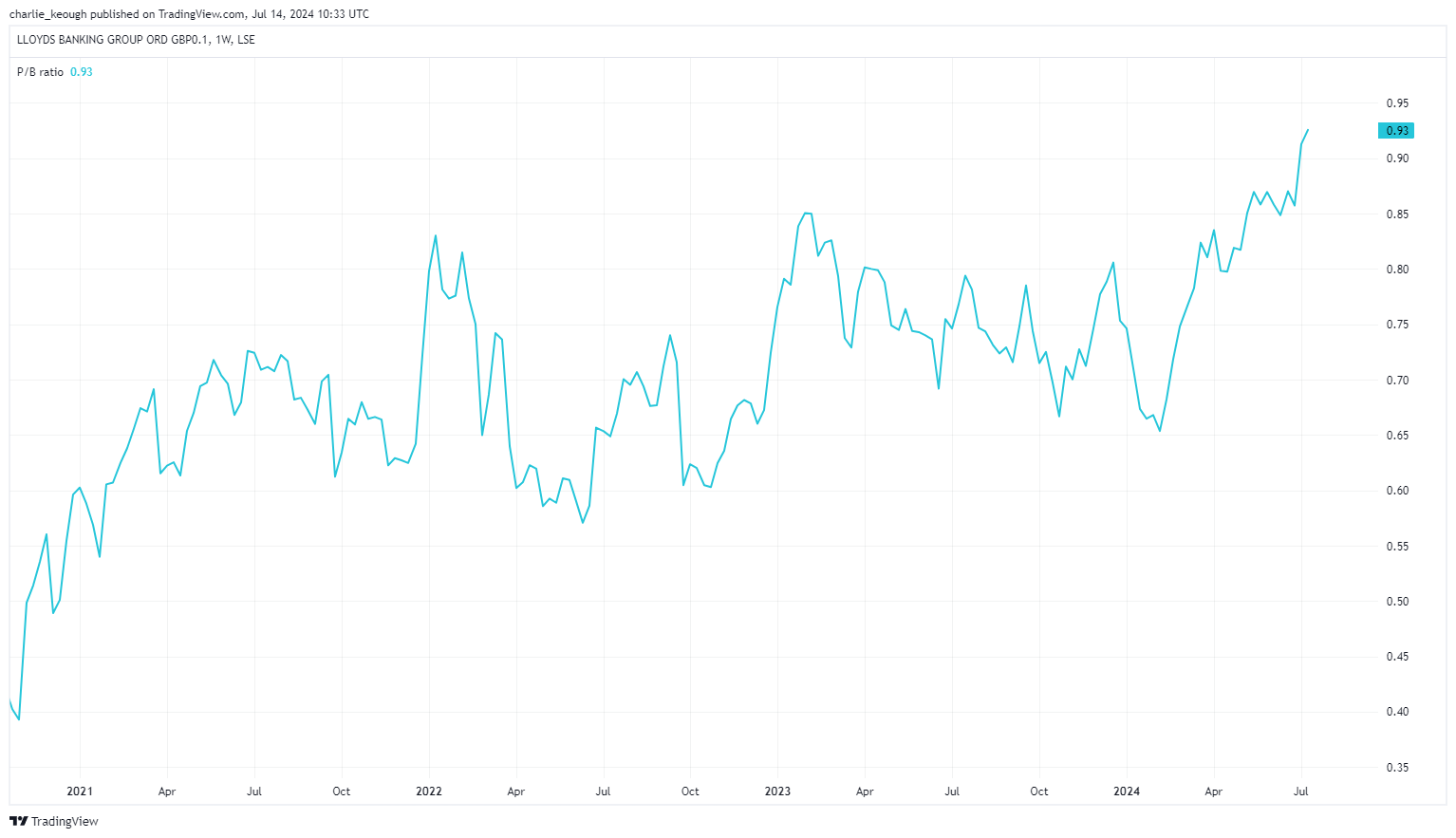

Even after its rise, Lloyds still looks like decent value for money. It has a price-to-earnings ratio of 10.2. Looking ahead, that falls to 8.2 for 2025 and 6.9 for 2026. As the chart below shows, its price-to-book ratio, at 0.9, sits just below the benchmark for fair value, which is 1.

Created with TradingView

Lloyds stock isn’t as cheap as it has been. That’s especially after its rally in the last week or so following the general election.

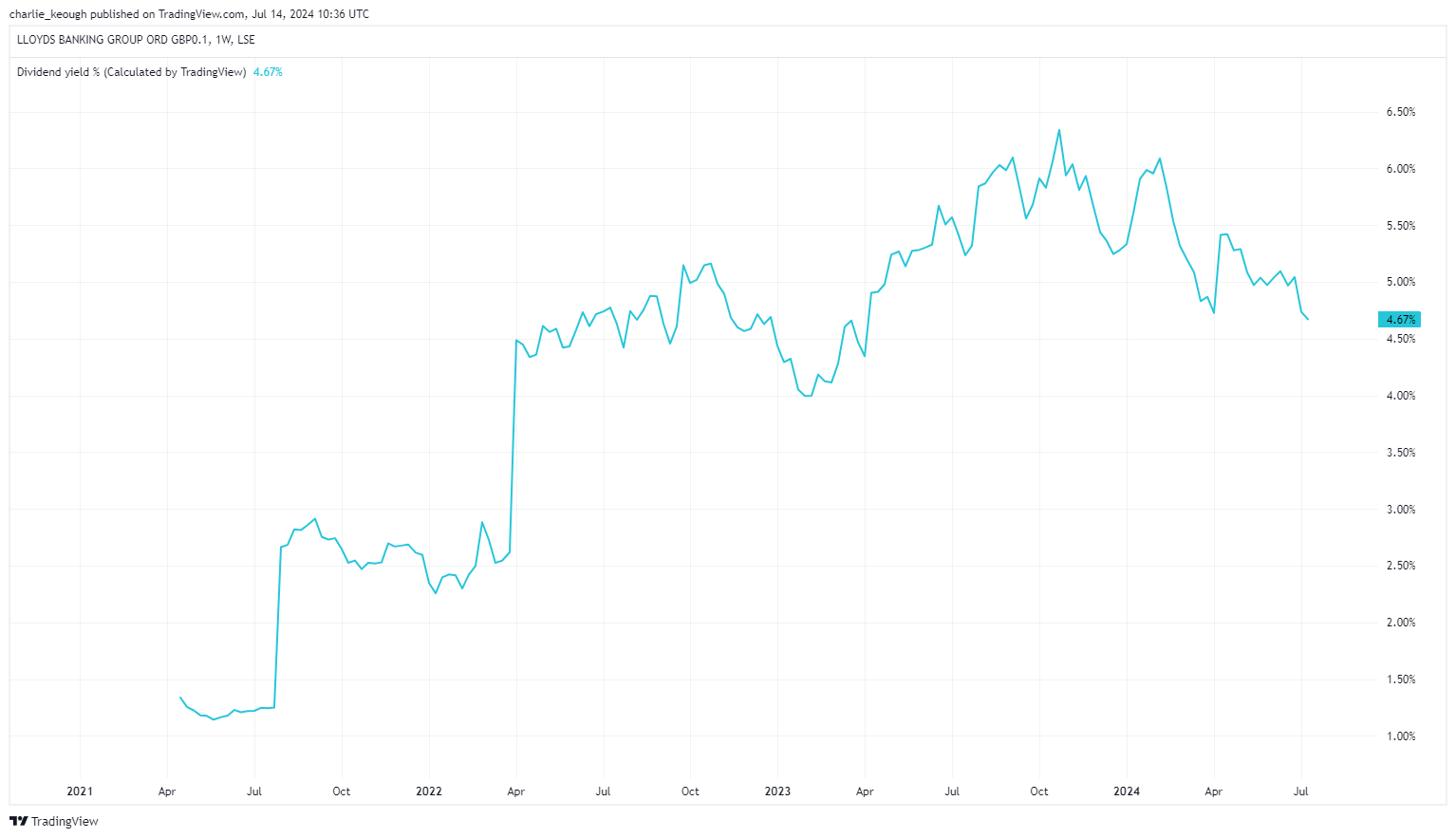

When I picked up some shares in July last year, they were trading on a measly six times earnings. What’s more, as seen below, in the last year its dividend yield has risen as high as 6.3%. That’s a lot bulkier than today’s 4.7%.

Created with TradingView

A bright future

But that doesn’t mean Lloyds wouldn’t be a savvy buy today. Investors are clearly looking ahead to what could be a prosperous period for the bank. And rightly so.

We have some stability now with Labour’s recent landslide win. Stability is massive for investor confidence and more widely the economy. Lloyds derives its revenues solely from the UK. While that poses a risk as its reliant on the domestic economy performing, it also means when it excels then so does Lloyds.

The housing market has also been under immense pressure over the last couple of years, but many are optimistic we’ll begin to see signs of this pressure easing in the coming months. That should drive demand for mortgages, which — given Lloyds’ position as the UK’s largest mortgage lender — should provide it with a boost.

Margins

Of course, the bank’s recent share-price surge has also been boosted by expanding margins due to larger interest rates. When the Bank of England starts cutting them, which could be as early as next month, Lloyds’ margins will shrink. We were given a warning sign of this in Q1. For the period its underlying net interest income fell by 10% to £3.2bn, including a lower net interest margin of 2.95%.

I’d buy more

Even so, I’d still buy more Lloyds shares today if I had the cash and I reckon its shares have more to give. The upcoming months have the potential to be prosperous and although I’d imagine that’s already baked into its share price, I still think the stock looks good value.

Am I expecting a similar performance over the next 12 months? No. But am I optimistic Lloyds could be a great staple for my portfolio in the years and, hopefully, decades to come? Most certainly.

Its 4.7% yield may not be as attractive as it was but is still a healthy stream of extra income.

This post was originally published on Motley Fool