The BAE Systems (LSE: BA) share price had been climbing for years when I finally bought the stock in March and again in May. Murphy’s law said it would crash in June, and so it did.

I’d been putting off buying BAE Systems shares for several years, fearing I’d arrive at the party too late. So it has proved. On 10 June, the shares peaked at 1,400p. They closed Friday at 1,268p, a drop of 10%. The stock is still up 39% over one year and 151.29% over five. I’m down 3.62%.

Still, these are early days. I buy shares with a minimum five-year view. Short-term volatility is inevitable. Obviously, I’m not selling. Instead, I’m wondering whether to take advantage of any further dip to buy more.

FTSE 100 bargain?

The underlying case for defence stocks is still strong, as war in Ukraine drags on and the US and China fall out. Yet much of this is priced in with the stock still trading at 20.25 times earnings, despite the recent dip.

Also, as Ukraine has shown us, weaponry is changing. War is now fought with drones, or “defence uncrewed systems”, as the Ministry of Defence calls them. The cheaper and more disposable they are, the better. They also need to be banged out fast, rather than developed over years.

This is a challenge to larger contractors like BAE, which generates most of its revenues from manufacturing ships, submarines and fighter jets. BAE doesn’t want to find itself fighting the last war.

The board is battling to keep up, buy UK-based quadcopter-drone manufacturer Malloy Aeronautics in February.

JPMorgan Cazenove is optimistic, saying it has “a long list of credible opportunities which are not in consensus estimates”, including “the potential upside from Saudi Arabia ordering more Eurofighter aircraft”.

I’d like more value

Another criticism of BAE is that it doesn’t pay that much income, with a low trailing yield of just 2.37%. However, dividends have picked up over the last three years. It paid 25.1p in 2021, then increased this to 27p in 2022 and 30p in 2023.

Better still, it hasn’t cut its dividend for 30 years. So today’s low yield is mostly due to the rocketing share price. Markets forecast income of 2.55% in 2024 and 2.78% in 2025.

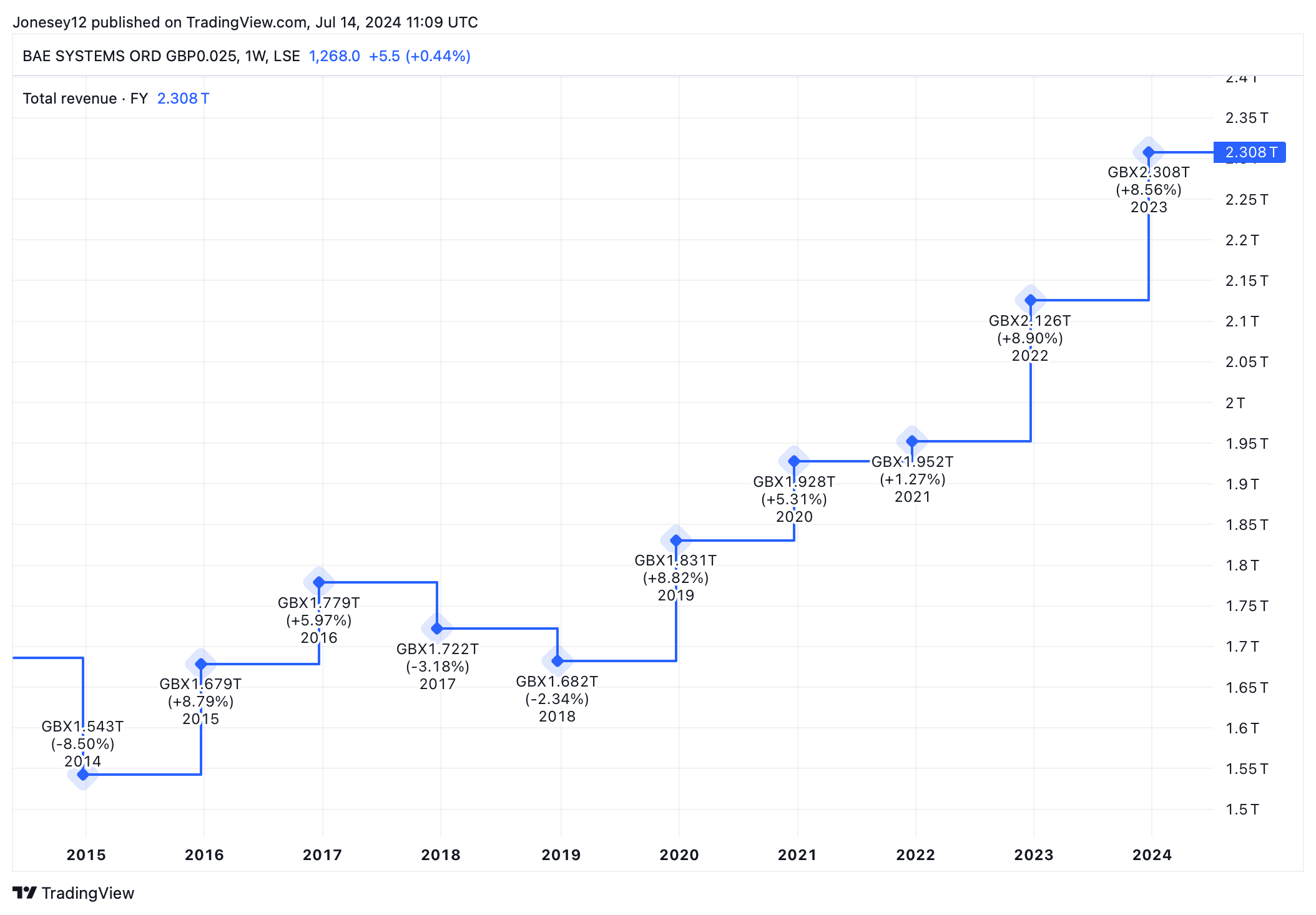

BAE Systems revenues are climbing today but can be bumpy, due to the size and long-term nature of its contracts. They were falling before Putin invaded Ukraine. Let’s see what the chart says.

Chart by TradingView

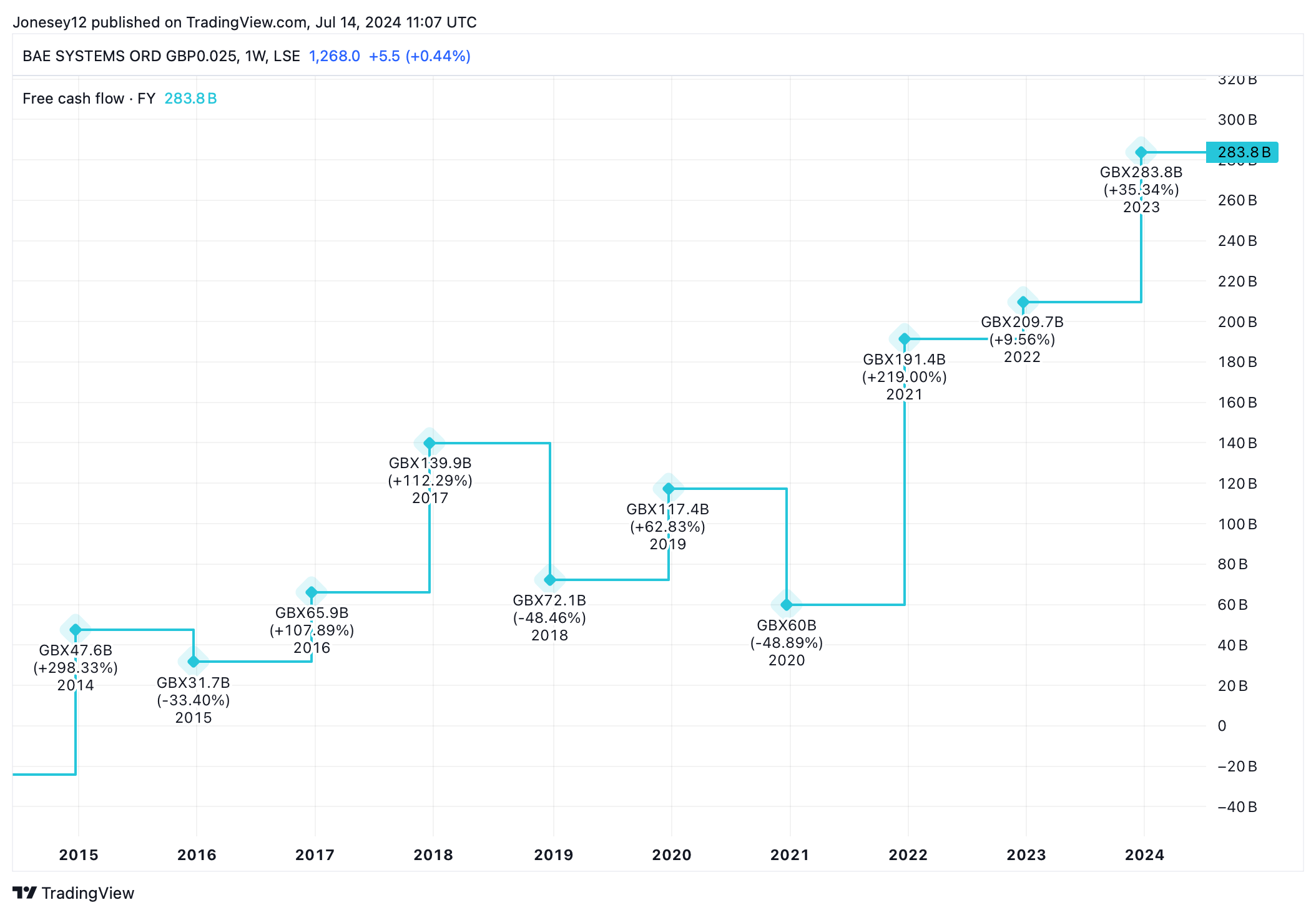

Free cash flow also slipped but is now pointing the right way too, which should help defend the dividend.

Chart by TradingView

I’m going to keep an eye on the BAE Systems share price, but I won’t buy more at the moment. I already have a pretty decent stake in the stock. I’ll want a bigger discount before diving in.

Now I’ll return to my old strategy, of buying stocks when they’re out of favour rather than high and flying.

This post was originally published on Motley Fool