BT (LSE: BT.A) shares have inflicted more pain on FTSE 100 investors than almost any other stock this millennium aside from Vodafone Group.

The share price peaked at just over 1,000p at the height of the dotcom boom in December 1999. It crashed to 181p by April 2003, and has bumped around that level ever since.

For years I checked up on BT shares only to find them still down. Suddenly, that’s changed. They’re now up 31.84% in the last three months. Over 12 months, they’re up 12.47%.

However, they’re still down by a third over five years and today’s price of 142p remains a fraction of its all-time high. I love buying stocks when they’re down and out, provided I think they can recover.

FTSE 100 recovery play

I’ve bought a heap of FTSE 100 recovery stocks over the last year (Diageo, GSK, JD Sports, Unilever to name but a few), but drew the line at BT.

Two things put me off. The first was its huge pension deficit, which led to its reputation as a ‘pension fund with a telecoms business attached’.

The second was its net debt. Today, it stands at £20.14bn, well above BT’s market cap of £13.81bn. And that’s after the recent share price hop.

Having considered buying BT shares on several occasions, it pains me to see them jump without me on board. However, there’s still an opportunity here. Trading at 7.61 times earnings, it still looks cheap.

BT still has a heap of challenges. Revenues have been slipping, as my table show. Pre-tax profit crashed more than 30% in 2024 (although this included a one-off £488m goodwill impairment).

| 2020 | 2021 | 2022 | 2023 | 2024 | |

| Revenue | £22.90bn | £21.33bn | £20.85bn | £20.68bn | £20.78bn |

| Pre-tax profit | £2.35bn | £1.80bn | £1.96bn | £1.79bn | £1.19bn |

| Dividends | 4.62p | Nil | 7.70p | 7.70p | 8.0p |

Yet I accept that this is a business in transformation, as management battles to slash costs and embed AI into its operations (cutting 55,000 jobs in the process). CEO Allison Kirkby says it’s ahead of schedule, hitting its £3bn cost and service transformation programme one year early.

Great income prospects

The board has largely completed its costly net fibre rollout and is now is looking to save a staggering £3bn a year by the end of the decade. That should help drive profits and secure BT’s mighty dividend stream.

Today’s trailing yield is 5.67%. That’s forecast to hit 5.78% in 2024 and 5.91% in 2025. So how secure is it?

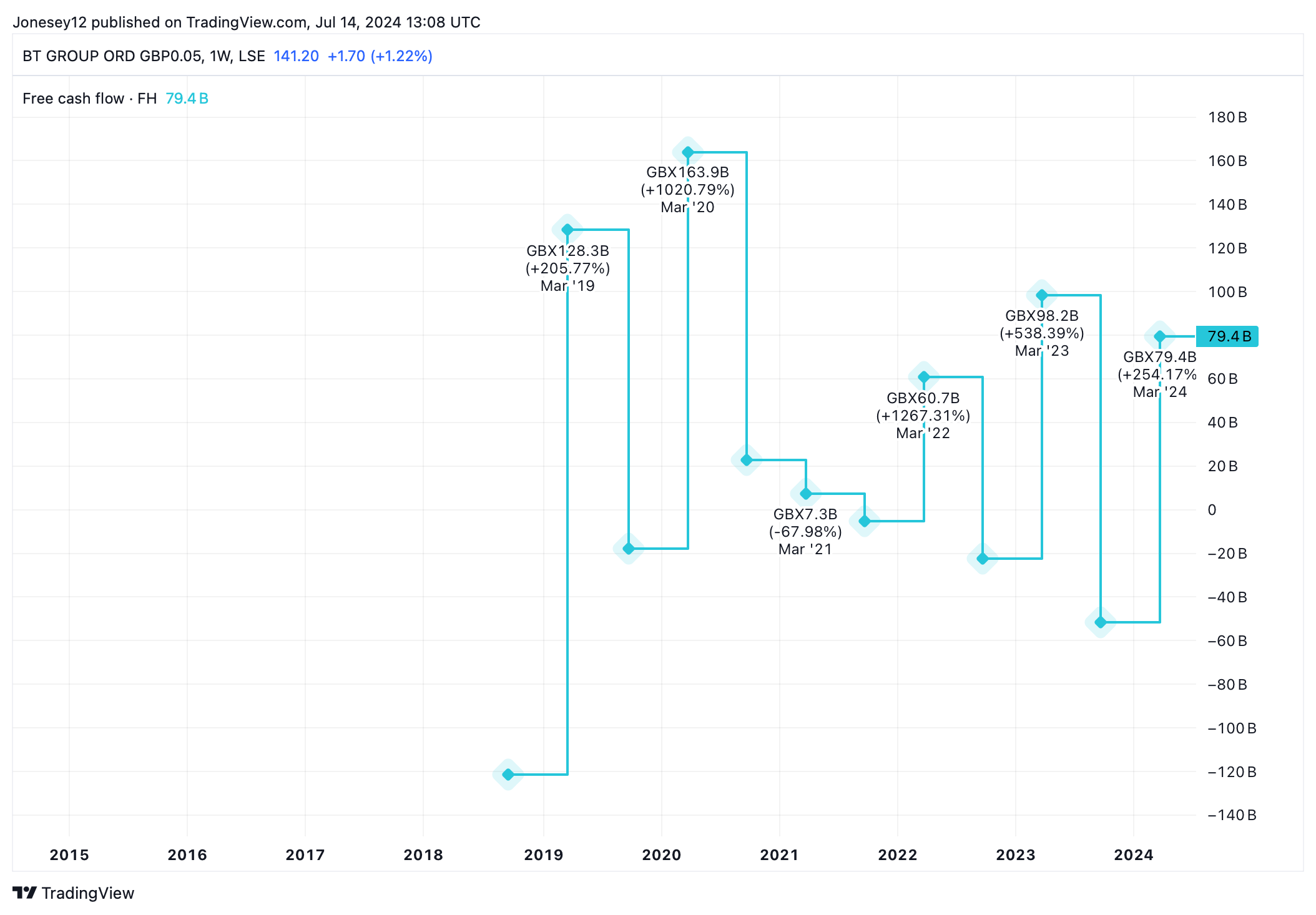

Free cash flow has been jumping all over the place, which has worried me in the past. Let’s see what the chart says.

Chart by TradingView

The future looks brighter, though. Normalised free cash flow hit £1.5bn in 2025, allowing BT to increase its full-year dividend by 3.9% to 8p per share. Cash flow should continue climbing to £2bn in 2027 and £3bn by the end of the decade.

Despite its challenges and slightly higher price – I reckon it’s time I got my act together and finally added BT to my portfolio. There’s both dividends and growth to be had here.

This post was originally published on Motley Fool