Scanning the FTSE 250, I noticed that Britvic (LSE: BVIC) and Bakkavor (LSE: BAKK) shares are among the best performers in 2024 so far.

Let’s take a look at whether I could still buy some shares today to help boost my holdings.

Britvic

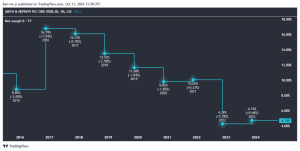

The soft-drinks producer has seen its shares rise a mammoth 50% in 2024 to date from 840p at the start, to current levels of 1,262p. I reckon a big part of this ascent has been two failed bids from drinks giant Carlsberg as part of a takeover bid.

Over a 12-month period, the shares are up 49% from 846p at this time last year, to current levels.

There is every chance that another bid could be incoming, and existing shareholders could be compensated handsomely. Alternatively, there is a chance that this may not happen.

In the case of the latter, there’s a good investment case for an established business with an excellent track record of growth, return, and a dominant market position. A dividend yield of 2.6% at present is decent. However, I do understand that dividends are never guaranteed, and past performance is never a guarantee of the future.

The one issue I have when considering buying some shares now is Britvic’s lofty valuation. The shares now trade on a price-to-earnings ratio of 20. Is this because of the takeover bid? I think so. Could the shares plummet if any future bids aren’t successful? This is a possibility.

At present I’m going to sit on the sidelines and watch how things develop. However, I must admit, I’m a fan of the business.

Bakkavor

Bakkavor is a fresh-food producer of items such as pasta, pizza, salads, and more. It has experienced a resurgence in 2024 to date.

The shares are up a huge 81% from 81p at the start of the year, to current levels of 147p. Over a 12-month period, they’re up 58% from 93p at this point last year, to current levels.

Bakkavor looks like a good business to me. It is capitalising on a burgeoning sector, as we lead increasingly busier lives. Plus, it has a wide presence, operating in lucrative segments including the UK, US, and China.

I reckon the shares took off after a positive update for 2023 released in March. The key takeaways from the report for me were that revenue, profit, free cash flow, and dividend-per-share all increased compared to 2022. Plus, net debt decreased. In addition to this, a Q1 update in May also made for positive reading.

From an investment perspective, the shares offer a forward dividend yield of 6.6%. Plus, analysts reckon this could grow. However, I do understand that forecasts don’t always come to fruition.

Taking a look at the valuation, Bakkavor shares trade on a price-to-earnings ratio of just 15, which still looks decent to me.

From a bearish view, inflationary pressures could put a dent in profit margins and potential returns. There’s clear evidence in the firm’s past track record of external events, such as a pandemic or geopolitical conflicts, impacting earnings and returns.

At this point, I’d buy Bakkavor shares when I next have some funds to invest.

This post was originally published on Motley Fool