Both the S&P 500 and Nasdaq Composite indexes reached new all-time highs yesterday (9 July). While that’s undoubtedly great news for Warren Buffett’s massive Berkshire Hathaway stock portfolio, it also brings a more concerning valuation indicator into focus.

In fact, this metric is now at a record high, potentially serving as a red flag investors.

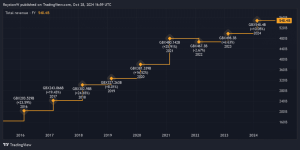

The ‘Buffett Indicator’

Back in 2001, Warren Buffett revealed what he considered to be “probably the best single measure of where valuations stand at any given moment“.

This valuation metric, now commonly known as the ‘Buffett Indicator’, divides the total market capitalisation of a country’s stock market by its annual gross domestic product (GDP). It tries to roughly gauge whether the market is overvalued or undervalued.

A high market cap-to-GDP ratio (over 100%) suggests that stocks are overpriced relative to the economy, signalling potential risk. A disconnect between economic reality and share prices, essentially.

Today, this ratio stands close to 200%. That’s well above the 159% seen just before the dot-com bubble!

Going on this then, it might be very risky to start ploughing money into US stocks today. Perhaps that’s why Buffett’s Berkshire has been a net seller of stocks for six consecutive quarters.

Some nuance is needed

Now, I should point out some caveats here. The first is that no metric is perfect in isolation. Indeed, while many market watchers still follow the indicator carrying his name, Buffett has actually backed away from it.

One problem is that most large companies generate significant profits from international markets, making GDP potentially less relevant.

Moreover, while Buffett and his investing team may sell or trim positions, they don’t offload all their stocks completely. Berkshire’s ideal holding period for a stock remains “forever“.

Finally, the Buffett-inspired metric highlighted here relates to shares listed across the pond. It doesn’t apply to most UK stocks, which continue to look cheap by historical standards.

How I’m responding

Right now, I’m focused on beefing up other areas of my portfolio where I see more value. One is in FTSE dividend stocks, many of which continue to carry huge yields.

A great example is British American Tobacco (LSE: BATS), a stock I’ve been scooping up recently.

This is one of the world’s largest cigarette firms and owns brands like Dunhill and Lucky Strike, as well as leading vaping brand Vuse.

The headline attraction with the stock is its mammoth 9.4% dividend yield. If forecasts prove correct, this rises to nearly 10% by 2026. That would be nearly £100 back in dividends from every £1,000 I invest!

Now, forecasts don’t always prove correct and dividends are never guaranteed. And one reason the yield is so high is due to declining cigarette sales, particularly in the US. This remains a real risk.

However, to counter this, British American Tobacco is raising prices to keep profit margins (and dividends) fat. More importantly, it’s building up its non-cigarette unit, which includes vapes and tobacco pouches.

These products now make up around 12.5% of revenue and the division achieved profitability in 2023, two years ahead of schedule.

Finally, the low forward price-to-earnings (P/E) ratio of 6.8 appears to offer a decent margin of safety. It’s a 58% discount to US rival Philip Morris International.

This post was originally published on Motley Fool