In the first half of the year, shares in Baillie Gifford’s Scottish Mortgage Investment Trust (LSE: SMT) rose 12.2%. That means the trust performed better than the FTSE 100, which was up 5.7% during the same period.

Outperforming the index has become something of a running theme for Scottish Mortgage. In the last five years, with the Footsie up 8.6%, the fund has returned a meaty 61.8%. Even during 2020, when the FTSE 100 tanked 15.2%, the trust shot up 106.9%.

You get the gist. While of course, past performance is no indication of what a stock may do in the future, Scottish Mortgage has a pretty solid track record of providing very decent returns. And I’m optimistic it can keep this up as we navigate the second half of 2024.

Reason #1

There are a few reasons I say this. Reason one is that it now looks like there could be multiple interest rate cuts this year. Inflation for May fell to the 2% target. The market seems to be expecting the first rate cut to come in August. If inflation keeps at 2% or drops below that, it’s possible we’ll see the Bank of England make more than one cut this year.

Given its heavy weighting to growth stocks, cuts will massively benefit the trust. In high interest rate environments, these stocks suffer. Such companies carry a lot of debt, which becomes more expensive to service when interest rates are as high as they’ve been.

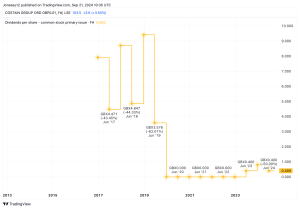

That’s why, when the Bank started hiking rates at the tail end of 2021, Scottish Mortgage’s share price sharply declined.

However, as rates come down, investors should hopefully regain an appetite for adding growth stocks to their portfolios. As a result, the trust should be provided with some momentum.

Reason #2

The second reason is that the trust looks cheap right now. According to Scottish Mortgage’s website, it’s currently trading at a 9.3% discount to its net asset value. That means by investing through Scottish Mortgage, I can in theory buy the companies it owns for cheaper than their market value. That sounds like a good deal to me.

I’m buying

Its for those reasons that I want to add more Scottish Mortgage shares to my portfolio this month. At their current price, they look like a catch.

That being said, the upcoming months will of course produce challenges. First, needless to say, any signs of a delay to rate cuts would most likely see its share price take a tumble. If inflation were to rise again, that could put the Bank off making a move in the coming months.

On top of that, around a quarter of the companies in its holdings aren’t traded on a public stock exchange. These companies can be difficult to value. Their actual value could be less than estimated. On the flip side, it could be more.

Nevertheless, rate cuts will come. Even if there’s a delay in the short term, that doesn’t worry me too much.

With its aim to “own the world’s most exceptional public and private growth companies” and “maximise total returns over the long term”, and with an impressive record of doing so, I reckon now could be a savvy time to consider the Footsie fund.

This post was originally published on Motley Fool