For the sake of balance, I need to add some high growth stocks to my portfolio of mostly FTSE 100 blue-chips.

If I’m going to step up my efforts to build a million-pound retirement pot, I need to take a few more risks. So now I’m scouring the FTSE 250 in search of action. This opportunity immediately popped up.

I think the defence industry is attractive right now, as geopolitical insecurity grows. Yet FTSE 100 defence giant BAE Systems looks fully valued to me. I hold the stock but won’t buy more today. FTSE 250-listed aerospace, defence and security specialist Chemring Group (LSE: CGY) excites me more.

FTSE 250 opportunity

Given today’s global insecurity, I’d expect the Chemring share price to be flying. And it is, up 32.38% over the last year. That’s more than double the 15.46% return on the FTSE 250 as a whole. Over five years, it’s up 96.35%.

On 4 June, Chemring reported a 39% increase in its order book to a record £1.04bn. That’s the highest in its history due to what it calls the “fundamental rearmament upcycle”. However, underlying operating profit fell 5% to £25m after adverse weather hit its Tennessee manufacturing sites.

As a key NATO supplier, the group is nicely placed. Unfortunately, peace isn’t suddenly going to break out. European nations will have to rearm as Russia menaces again. The pressure will grow if Donald Trump is elected US president, and demands the continent stumps up more for its security.

Chemring will get a further boost if economic growth revives, allowing governments to spend more on defence. In 2023, Chemring posted full-year revenues of £472.6m. CEO Michael Ord is targeting £1bn by the end of the decade.

Ord reckons the group’s long-term growth prospects are strong as its leading technological offerings have erected high barriers to entry.

Net debt did increase from £25m to £75.3m in the first half, but that was due to the board’s decision to invest more in the company. Net debt to underlying EBITDA is comfortably below the board’s internal target.

Dividend income too

The stock doesn’t look too expensive today, trading at 18.4 times training earnings. There are also dividends to be had. The forecast yield of 2.1% doesn’t look amazing, but drill down and it’s a different story.

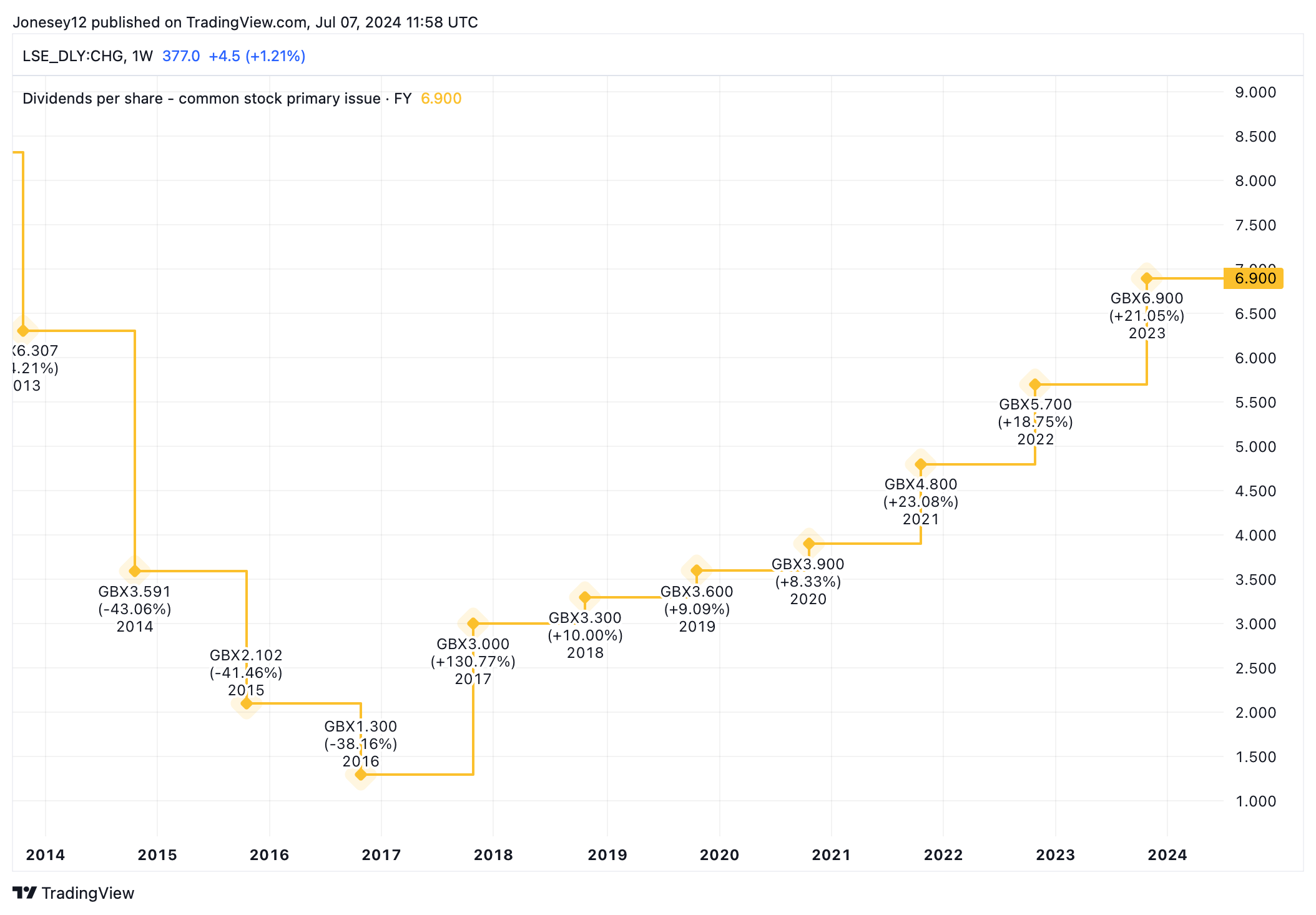

Over the last three years, the board has hiked the dividend per share by 23.08%, 18.75% and 21.05%. Let’s see what the chart says.

Chart by TradingView

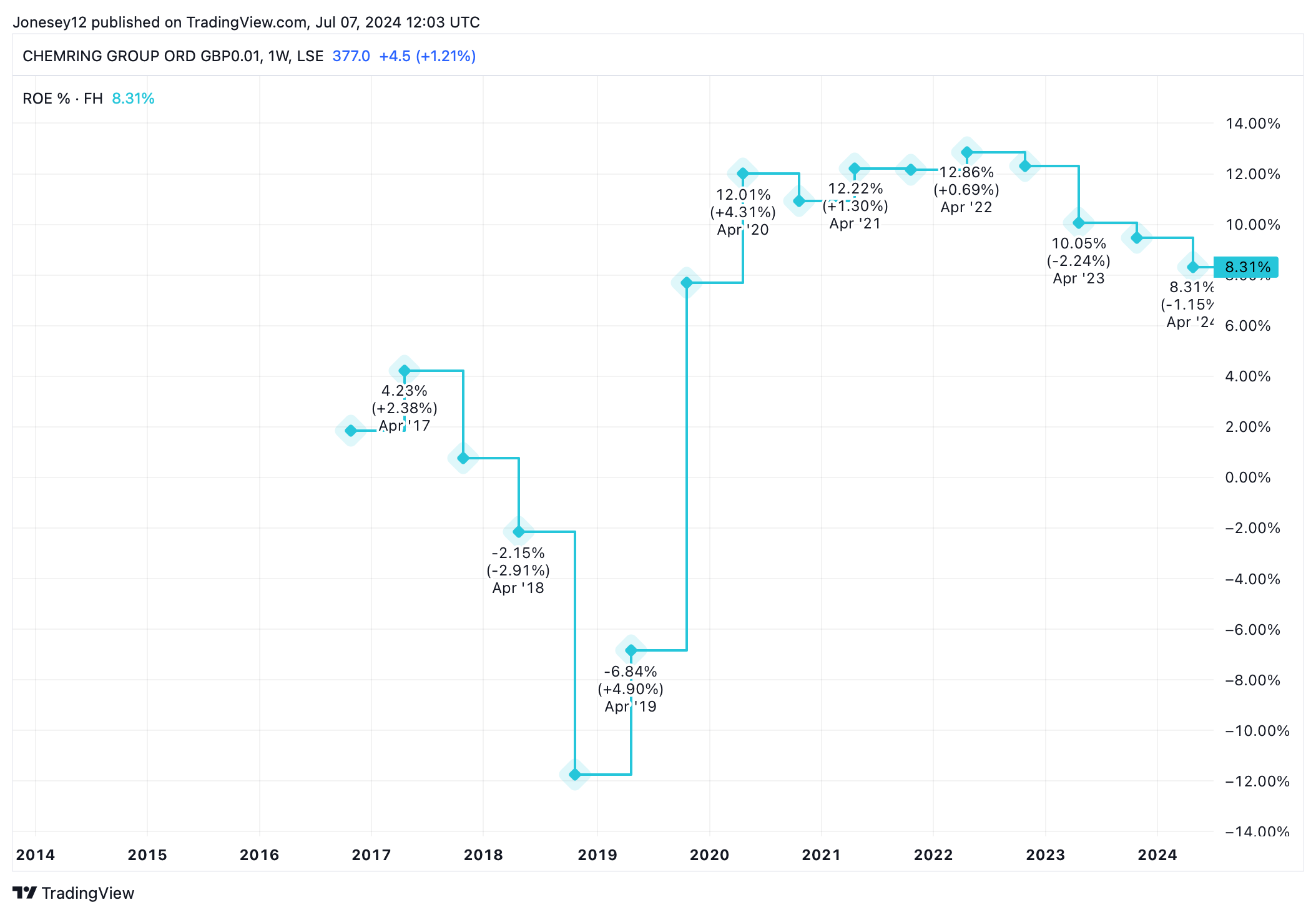

My main concern is that I don’t like buying a company after it’s had a good run. It would have been far better to buy Chemring before Russia invaded Ukraine. Return on equity has been pretty solid, hitting 12.86% a couple of years ago. However, it has since dipped to 8.31%. Again, let’s look at the chart.

Chart by TradingView

Yet I think there’s an exciting opportunity here, and given the state of the world, I’m not sure it’s worth hanging on for a lower entry point. I’ll buy Chemring as soon as I have cash to spare.

This post was originally published on Motley Fool