Millions of people across the UK are voting in the 58th general election today (4 July). All the polls suggest a change in government. Here’s how that might affect FTSE 100 shares, at least if history is anything to go by.

The data

Excluding this one, there have been 16 general elections since the inception of the FTSE All-Share in 1962. This index captures about 98% of the UK’s market capitalisation, with the FTSE 100 making up most of that.

According to AJ Bell, the FTSE All-Share on average has recorded a double-digit gain in the year following a prime minister’s ejection from office.

Capital return from FTSE All-Share (%)

| 1 year before poll | 1 year after poll | Term of government | |

| Change in government | 6.0% | 12.8% | 47.9% |

| Incumbent wins | 11.8% | 0.9% | 31.1% |

As we know, the latest polls all point to the incumbent Conservative administration being replaced. Going on this historical data, that’s a bullish sign for the UK stock market.

Global index

At first glance, this makes sense. After all, new governments often come in promising to enact change and boost economic growth. This can bring a sense of optimism among investors.

Indeed, it would be counterintuitive if the forward-looking stock market didn’t react positively (assuming a new administration is pro-business, of course).

However, it’s important to remember that over 80% of the sales of FTSE 100 companies come from overseas. This means the index is far more prone to react to global events that have nothing to do with which party is sat in Downing Street.

For example, if the global economy tanked, Footsie stocks would be unlikely to record double-digit gains.

The long view

Thankfully, as a long-term investor, I tend not to worry about all this. If I invest £750 a month and achieve an average 10% annual return (a bit above the historical average for UK stocks), I’ll end up with just over £1m after 26 years.

That’s with dividends reinvested, taking advantage of the magic of compounding.

Of course, there will be ups and down during this period, and a fair few elections. But history teaches us that the stock market goes up over time.

Coca-Cola HBC

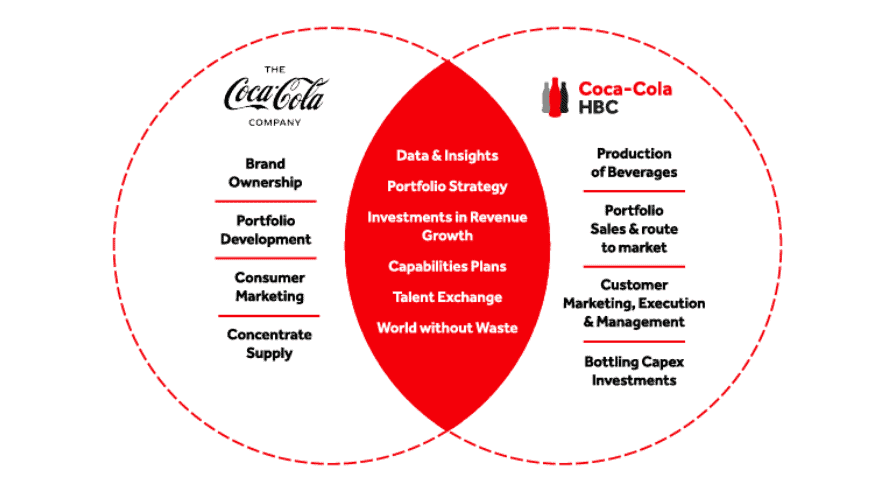

Regardless of who wins the election, one FTSE 100 stock I’d buy with spare cash is Coca Cola HBC (LSE: CCH). This is a key bottling partner with The Coca-Cola Company.

Their agreement grants Coca-Cola HBC the rights to produce, distribute and sell Coca-Cola products across 28 countries, mainly in Europe and parts of Africa. These include Coke, Fanta, Sprite, Costa Coffee, Schweppes, and energy drinks from Monster Beverage.

Meanwhile, the US drinks giant manages the overall brand strategy, supplies concentrates, and retains a large stake in the business.

In 2023, revenue grew 10.7% year on year to €10.2bn, while earnings per share (EPS) jumped 21.8% to €2.08. Analysts see revenue growing steadily to €11.7bn by 2026.

The stock looks cheap trading at 14.5 times forward earnings and offers a 3.1% dividend yield this year.

And while there’s always the risk of cash-strapped consumers trading down to cheaper brands, I’m reassured by the depth and breadth of the firm’s offerings.

These brands are tipped to continue growing in emerging markets like Poland, Nigeria and Egypt. Plus, as Coca-Cola adds more brands to its portfolio over time, this bottling partner is set up for further success.

This post was originally published on Motley Fool