I’m still sifting through the FTSE’s quarterly reshuffle, and find myself drawn to the latest addition to the FTSE 250, Alpha Group International (LSE: ALPH).

Should I buy or avoid the shares? Let’s take a closer look.

Welcome to the big leagues!

First floated on the FTSE AIM back in 2017 – and initially known as Alpha FX – the business offers fintech solutions to corporations. These solutions help with FX risk management, cash management, mass payments, and more.

It’s no surprise to me that Alpha shares are moving up the ladder, especially when I can see how well the business has done. Over a five-year period, the shares are up 195% from 745p five years ago, to current levels of 2,200p. Coming up to date, the shares are up a modest 4% over a 12-month period from 2,110p at this time last year, to current levels.

To buy or not to buy?

The share price doing so well has been due to impressive growth and performance, which are some of the current draws for me to buy some shares personally.

Alpha has managed to widen its presence across 50 countries globally, and boost profit levels. In fact, its profitability levels are quite remarkable, if you ask me. Between 2018 and 2023, the firm’s return on capital employed (ROCE) hit the 26% mark. Plus, the business has a healthy looking balance sheet right now, after such a good period.

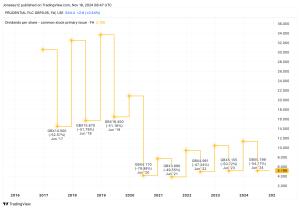

Next, Alpha shares offer a dividend yield of 0.72%. I know what you’re thinking, that’s not going to do much for my passive income stream. However, I’m buoyed by the firm’s dividend growth record, as well as the fact it’s currently undertaking share buybacks too. If Alpha can continue its impressive growth, I can see returns growing nicely. It is worth mentioning that dividends are never guaranteed.

So far, so good, the signs are all positive. However, it would be remiss of me not to mention potential pitfalls. To start with, the current valuation of Alpha shares is a risk. They trade on a lofty price-to-earnings ratio of 29. Any dent in earnings or a trading downturn could send the shares tumbling.

Furthermore, despite great success to date, competition in the sector is intense. Alpha may not yet possess the same brand recognition and financial might of some of its counterparts. This is something that could dent earnings, returns, and continued growth.

What I’m doing now

Based on the above, it’s not hard to understand Alpha’s promotion. In my view, it looks warranted.

From an investment perspective, I’d be willing to buy some shares when I next have some investable funds. Although the shares look a tad pricey, my mantra of being willing to pay a premium for a quality business comes into play here. The old adage ‘you get what you pay for’ comes to mind.

I wouldn’t be surprised to see Alpha’s continued success, and will be watching closely. Heading into the FTSE 250 today, maybe the UK’s premier index next?

This post was originally published on Motley Fool