Economic instability has been a defining factor of the 2020s but the FTSE 100 has done well to escape its wrath. Adding 442 points this year, it recently hit an all-time high above 8,400. But does that mean the index is now packed full of overbought shares? I don’t think so.

The lingering effects of Covid have left many otherwise valuable shares lagging behind their earnings. Many companies that performed spectacularly well in the first two decades of this century still struggle to regain the highs of 2020.

But with interest rates primed to fall and the global economy recovering, some of these businesses could be back on track soon. With that in mind, here’s a stock I think’s perfectly positioned to reap the rewards of a revitalised economy.

Diageo

As one of the world’s largest distributors of premium alcohol brands, Diageo (LSE: DGE) relies rather heavily on consumers with disposable cash. The London-based firm markets everything from high-end Scottish whisky to mainstream brands like Smirnoff and Guinness. But recently, sales have suffered as consumers seek out lower-priced alternatives.

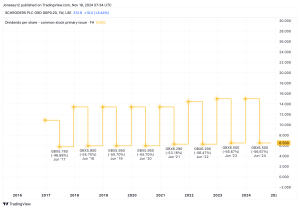

The share price has been in decline since late 2022, falling from around £40 to £25 today. Diageo has attributed the loss mainly to falling rum sales in the Caribbean and Latin America, likely a result of post-pandemic economic tightening. It’s now only a few percentage points away from hitting a new five-year low, with £24.20 being the lowest it fell after Covid.

I think this is a key price point that could attract investment. Coupled with an improving economy makes it an attractive prospect.

But it’s not in the clear yet

I think Diageo has all the makings of a company that could (and should) be doing well. But there are some concerns. The upcoming UK general election could flip things on their head if it delivers a surprise result. Even if it doesn’t, it’s hard to gauge the resultant economic effects. Some analysts expect it won’t make much difference. Others believe an unconvincing win or a coalition government could cause further disruption.

Alcohol may also be falling out of favour among younger generations. Statistics reveal that changes in social behaviour mean younger people aren’t drinking as much as their parents. While this is likely a net positive for society, Diageo will need to consider pivoting into non-alcoholic brands if it hopes to pick up the slack.

The decline in earnings has forced it to rack up debt, now at a precipitous £17.15bn. With only £8.85bn in shareholder equity, that’s not an ideal amount. But with earnings expected to grow from here, analysts forecast a 39% increase in return on equity (ROE) over the next three years. That should help alleviate some debt if the economic recovery doesn’t falter.

A turning point

The combination of the UK election, the current price level and the promise of an improving economy put Diageo at a turning point. The current price looks undervalued to me but this month should provide a better idea of where it’s headed.

I’m expecting a recovery and will be ready to buy more shares if that happens.

This post was originally published on Motley Fool