The stock market delivered strong returns for investors in the first half of 2024. Owning a well-constructed diversified portfolio, meant it wasn’t hard to generate a return of 10%, or more.

As we start the second half of the year, I remain bullish on stocks. However, there are a few areas of the market that look really interesting to me right now.

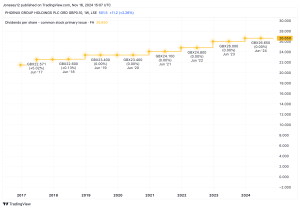

Dividend stocks

Dividends aren’t my main area of focus. With 15-20 years until retirement, I’m mainly seeking growth (and not income) at the moment.

However, looking at the market today, the outlook for dividend stocks is attractive, to my mind. That’s because interest rates are likely to fall in the second half of the year.

As rates come down and savers discover that they can’t get the same level of interest on their cash savings, dividend stocks should come back into focus. Especially those that have a history of dividend increases. This should push share prices up, leading to attractive total returns (gains plus income) for investors.

One dividend stock I like (and own) is Unilever. It doesn’t have the highest yield, but I reckon it should do well overall as rates fall.

The healthcare sector

A sector I like the look of as we start the second half of the year is healthcare. It lagged the overall market in H1 and I reckon it may play catch-up in H2.

One reason I like this sector is that it stands to benefit from portfolio rebalancing. As investors take profits from tech and redeploy them into other areas of the market, it could do well.

Another is that there are some amazing innovations within the healthcare space right now. From robotic surgery to weight-loss drugs that can help people lose up to 20% of their body weight, we’re seeing a lot of exciting developments.

To increase my exposure to the sector, I’ve recently been channelling capital into a healthcare fund. This gives me exposure to around 70 stocks across the industry.

UK mid- and small-caps

Finally, I think mid-sized and smaller UK companies look pretty attractive right now. These areas of the market were smashed when interest rates rose a few years ago. If rates come down in the second half as predicted, these stocks could experience a major rebound.

One stock that stands out to me in this space is Gamma Communications (LSE: GAMA). It’s a leading provider of business communication solutions.

Before interest rates spiked, this stock was trading above 2,300p. Today however, it can be snapped up for around 1,400p.

That’s an attractive price for this stock, in my view. Looking at analysts’ earnings estimates, the forward-looking P/E ratio is just 17.5 at present, which is very reasonable given the company’s rate of growth (analysts expect 9% revenue and earnings growth this year).

Of course, an economic slowdown remains a risk here. This could result in businesses spending less on new technology.

Taking a three-to-five year view however, I reckon this stock should do well. It’s worth noting that analysts at Berenberg have a price target of 1,980p on it. That’s 40% higher than the current share price.

This post was originally published on Motley Fool