Dividend stocks can provide a marvelous way to generate a second income. However, the payouts are never guaranteed, which is why I hold 12 income stocks to spread risk.

Of these though, I have my favourites, with three currently accounting for nearly half of my dividend portfolio.

Legal & General

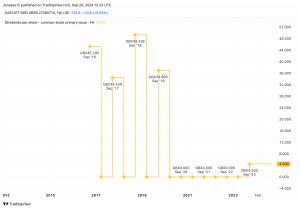

The largest income holding I have today is Legal & General (LSE: LGEN). Shares of the FTSE 100 insurance and asset management giant currently yield a very attractive 8.3%.

The company has an excellent track record of increasing its payout. It’s done so every year apart from one in the last decade — and even that was during the chaos of the pandemic.

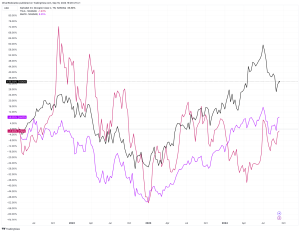

Yet the share price has fallen 15% over five years as higher rates have caused uncertainty. These generally lead to a decrease in the market value of existing bonds and other fixed-income assets, which L&G’s investment management division holds a lot of.

Also, higher rates make investors more risk-averse, leading to a decrease in demand for some of its investment products. This has dragged on profits.

However, the firm possesses a rock-solid balance sheet and still makes plenty of cash. And analysts expect the dividend to rise to 22p per share next year, giving an eye-popping forward yield of 9.6%.

The stock is also trading on a cheap forward price-to-earnings (P/E) ratio of just 9.8. I intend to hold it long term as demand for retirement solutions increase along with ageing populations.

HSBC

The second big hitter in my income portfolio is HSBC Holdings (LSE: HSBA).

Again, the stock looks undervalued to me, trading on a forward P/E multiple of seven. That’s around 35% less than the average of the FTSE 100, which itself is dirt cheap.

One concern for HSBC investors is China, whose economy has struggled since Covid. Ongoing trouble there could lead to sluggish growth for the company.

However, the potential reward is a well-supported dividend yield of 7%. It’s a risk worth taking, in my opinion.

Looking ahead, I’m excited about the bank’s strategic pivot towards Asia, the fastest-growing region in the world. Beyond mainland China, it has a growing presence in India and Singapore.

British American Tobacco

Lastly, we have British American Tobacco (LSE: BATS). This is quite a new buy for me, and one I thought hard about. That’s because overall tobacco volumes are falling globally, creating a risk to the firm’s long-term profits.

Unfortunately though, I doubt smoking will end anytime soon. Meanwhile, the company’s non-combustible vaping products are growing and should soon start generating reliable profits, potentially offsetting a decline in cigarettes.

The stock is trading on a forward P/E ratio of just seven, a massive discount to rival Philip Morris International (16.2). And this cheapness translates into a massive 9.3% forward yield for this year.

A final note on diversification

Now, I should clarify that this is just the income side of my portfolio. Factoring in my growth stocks and investment trusts, these three shares constitute way less than 45% of the whole (less than 10%, in fact).

Knowing this makes me feel comfortable adding to these stocks to boost my passive income. Once interest rates fall, share prices could recover, leading to lower yields. So I’m striking while the iron is hot!

This post was originally published on Motley Fool