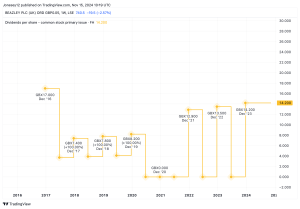

One of the attractions of owning shares in Legal & General (LSE: LGEN) is its dividend. Indeed, I would say the Legal & General dividend is a key attraction. After all, the financial services firm’s share price has sunk 13% over the past five years. During that period, the FTSE 100 index (of which it is a member) rose 12%.

Today (12 June), the company set out plans to raise its dividend annually in coming years. The City was not impressed and the share price is down 4% as I write this on Wednesday morning.

Income share with lucrative track record

Before we look ahead, let’s look backwards.

Legal & General has a long history of paying juicy dividends. The last time it cut its payout per share was in the wake of the 2008 financial crisis. Since then it has raised it every year except one, during the pandemic, when it held it flat.

It laid out a plan to raise the dividend per share by 5% annually between then and this year, which it has done.

In today’s announcement, the company confirmed it plans to raise the dividend per share by 5% this year. After that, until 2027, it plans to keep raising the payout – but by the markedly lower amount of 2%.

That is just a plan – dividends are never guaranteed. If another financial crisis rocks investor confidence, for example, there is a risk the dividend could be cut again.

Is this bad news or not?

The City did not react well to the plan. It suggests management has a weaker focus than before on dividend growth, so the reaction is understandable.

The company said it plans to “return more to shareholders” in 2024-27. That is poor wording as “more” here is unhelpfully vague. But as the company also plans ongoing share buybacks, my interpretation of this is that it expects total capital return to shareholders to grow in the period compared to the prior rate, due to a combination of dividends and buybacks.

Buying back and cancelling shares can mean companies are able to spend less in total on dividends even while raising the dividend per share (as M&G proved in recent years).

While I find the plan disappointing, it is also important to note that it is not a cut. The company still aims to keep growing the dividend per share each year, just at a lower clip than now.

Given that it has an 8.7% dividend yield now, that could mean it ultimately becomes even more lucrative down the road.

Dampened enthusiasm, but still a high yield

I still like the firm’s strong brand, large customer base and proven business model. Today’s announcement gave further reasons for optimism, from a focus on growing the asset management business to strengthening the appeal of what the firm offers retail customers from a lifelong perspective.

The high yield is still very juicy.

I cannot help feeling that the board is effectively downgrading the importance it attaches to growth in the dividend though. Still, if I had spare money to invest, I would be happy to buy the shares.

This post was originally published on Motley Fool