Forget the horrors of Halloween! The past two months have been an absolute horror show for THG (LSE: THG) shareholders. The e-commerce firm, formerly known as The Hut Group, has seen its share price collapse spectacularly since early September. But after such a sharp slump, could there be hidden value in this stock today?

The THG share price soars

Manchester-based THG was founded in 2004 by executive chair and CEO Matthew Moulding with John Gallemore. The group originally sold CDs and video games online and then expanded into many aspects of online retailing. Today, THG has three main divisions (health, beauty and nutrition), selling such items as cosmetics and protein shakes. On 16 September 2020, THG floated on the London Stock Exchange (LSE). The company and shareholders raised £1.9bn in the LSE’s largest initial public offering since 2013. The THG share price duly obliged with a big ‘first-day pop’, listing at 500p and closing up 25% at 625p. This valued the business at £5.6bn.

One Killer Stock For The Cybersecurity Surge

Cybersecurity is surging, with experts predicting that the cybersecurity market will reach US$366 billion by 2028 — more than double what it is today!

And with that kind of growth, this North American company stands to be the biggest winner.

Because their patented “self-repairing” technology is changing the cybersecurity landscape as we know it…

We think it has the potential to become the next famous tech success story. In fact, we think it could become as big… or even BIGGER than Shopify.

Click here to see how you can uncover the name of this North American stock that’s taking over Silicon Valley, one device at a time…

THG collapses in just two months

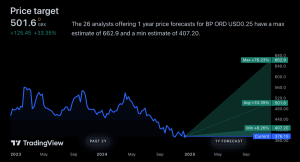

Investors continued to be bullish on THG shares, driving them steadily upwards over the following months. On 12 January this year, the stock hit a record intra-day high of 837.8p. But recently, it’s been all downhill for this go-go tech stock. In fact, the shares have collapsed shockingly over the past two months.

As recently as 7 September, the THG share price closed at 684p, down 153.8p. That’s 18.4% below its all-time high. As I write on Tuesday lunchtime, the stock is trading at 201.09p, having hit a record low of 198p earlier this morning. In other words, the shares have crashed by 70.6% in under two months. What’s more, the THG share price has collapsed by 76% from its January peak. Crikey.

Is this stock now too cheap?

I don’t own THG stock. Indeed, on 14 October, I said that “I have no plans to buy at the current THG share price…THG shares are far too risky for my blood.” At that time, the stock stood at 281.4p, so it has fallen by 28.5% since then. Given that the shares have fallen so far, so fast, could there be hidden value in this beaten-down stock?

To be honest, even after the recent share-price falls, I will steer well clear of THG. My problem is that there are far too many red flags over its corporate governance. First, Moulding is both CEO and chairman, when most companies split these roles (although THG is now actively seeking an independent chair). Second, the company doesn’t break out the profitability of its different divisions. Thus, we can’t know whether logistics arm, THG Ingenuity — supposedly the company’s hidden jewel — is worth as much as Moulding believes. Third, Moulding has bought various properties from THG, only to immediately rent them back to the group. The City frowns on this kind of self-dealing (as do I).

Lastly, news broke today that Blackrock, THG’s second-largest shareholder, has sold almost half of its stake. The asset manager sold 58m shares at 195p, raising £113m. This is a discount of 10.3% on Monday’s closing price. To me, this fifth red flag is another reason not to buy THG shares. Of course,

I could be wrong and THG’s stock could rebound. THG listing its fast-growing beauty division in 2022 and other asset disposals might revive the stock.

Cliffdarcy has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services, such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool, we believe that considering a diverse range of insights makes us better investors.

This post was originally published on Motley Fool