Netgear Inc. shares fell in the extended session Wednesday after the network equipment and router company forecast an outlook below Wall Street expectations because of supply-chain problems.

Netgear

NTGR,

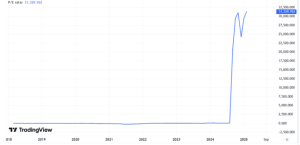

shares fell 8% after hours, following a 0.7% decline in the regular session to close at $31.38.

“We face a number of near-term headwinds, starting with lengthening product transit times due to numerous disruptions on the logistics front, which are impacting many industries,” said Bryan Murray, Netgear chief financial officer, in a statement. “We are also seeing logistics costs rapidly increasing with ocean freight costs currently standing at eight times normal historical rates.”

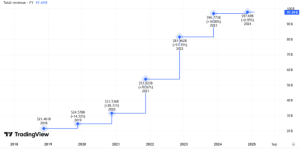

The company forecast fourth-quarter revenue of $250 million to $265 million, while analysts expect $328.6 million.

The company reported third-quarter net income of $9.6 million, or 31 cents a share, compared with $17.8 million, or 85 cents a share, in the year-ago period. Adjusted earnings, which exclude stock-based compensation expenses and other items, were 50 cents a share, compared with $1.13 a share in the year-ago period.

Revenue fell to $290.2 million from $308.8 million in the year-ago quarter.

Analysts had forecast third-quarter earnings of 42 cents a share on revenue of $295 million.

This post was originally published on Market Watch