With a bit of spare cash to hand, I think it is possible to set up passive income streams by investing in dividend shares. It is an approach I like as it allows me to benefit from the hard work and success of big companies listed on the stock market.

If I had £300 and decided to use it to start building passive income streams today, here are two shares I would buy.

5 Stocks For Trying To Build Wealth After 50

Markets around the world are reeling from the coronavirus pandemic… and with so many great companies trading at what look to be ‘discount-bin’ prices, now could be the time for savvy investors to snap up some potential bargains.

But whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. And if you’re 50 or over, we believe these stocks could be a great fit for any well-diversified portfolio.

Direct Line

Insurer and financial services company Direct Line (LSE: DLG) is a household name. Thanks to its red telephone logo and extensive advertising, it has built a powerful presence in the minds of millions of people. That is good from a business perspective because it reduces the need to spend vast sums building a customer base.

Insurance is often a lucrative industry. There can be surprises though. For example, one risk at the moment to insurers like Direct Line is that increasing second hand car prices will hurt profits. But typically, the economics of insurance are attractive and and straightforward. People have to insure their vehicles and most insure their homes, so there is a constant stream of revenue. Insurers like Direct Line have sophisticated models to estimate how much they will need to pay out in claims, so they can typically make a healthy profit.

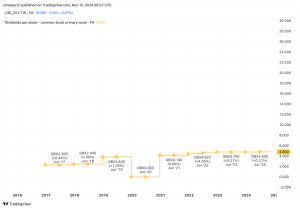

At Direct Line that also makes for a juicy yield. Currently, the firm’s dividend yield is 7.4%. So if I invested a spare £150 into it, I would hope for around £11.10 a year in passive income.

Imperial Brands

I would invest the other £150 into tobacco manufacturer Imperial Brands (LSE: IMB). Its portfolio includes well-known names like John Player Special and Lambert & Butler. Thanks to this premium portfolio, the company has pricing power. That enables it to raise prices to help offset the impact of inflation or a fall in the number of cigarette smokers.

Such falling numbers remain a big risk for the company though. It is currently focussed on increasing its market share in a handful of cigarette markets. That buys it time while cigarette demand declines in many markets. But in the long term, it may need to spend more heavily on newer formats like smoking alternatives.

Meanwhile the company continues to generate huge sums in free cash flow. That funds a dividend yield of 8%. By putting £150 into Imperial today, I would therefore hope to generate £12 a year in dividends.

Making a move on passive income

Simply thinking about buying shares will not earn me any money. But if I move to action and split £300 evenly across Direct Line and Imperial Brands, I would hopefully start earning around £23 a year in passive income for doing nothing.

Dividends are never guaranteed, so they could be cut if a business runs into difficulties. That is why I would spread the money across two shares rather than put it all in one.

Inflation Is Coming: 3 Shares To Try And Hedge Against Rising Prices

Make no mistake… inflation is coming.

Some people are running scared, but there’s one thing we believe we should avoid doing at all costs when inflation hits… and that’s doing nothing.

Money that just sits in the bank can often lose value each and every year. But to savvy savers and investors, where to consider putting their money is the million-dollar question.

That’s why we’ve put together a brand-new special report that uncovers 3 of our top UK and US share ideas to try and best hedge against inflation…

…because no matter what the economy is doing, a savvy investor will want their money working for them, inflation or not!

Best of all, we’re giving this report away completely FREE today!

Simply click here, enter your email address, and we’ll send it to you right away.

Christopher Ruane owns shares in Imperial Brands. The Motley Fool UK has recommended Imperial Brands. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

This post was originally published on Motley Fool