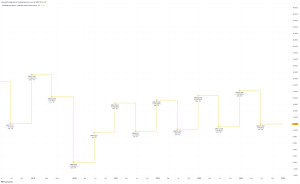

Bitcoin plunged 8% on Thursday amid broad sell-offs of risky assets, amid renewed fear of a Russian invasion of Ukraine.

Bitcoin

BTCUSD,

was recently trading at around $40,660, down about 40% from its all-time high in November, according to CoinDesk data.

“Bitcoin is the ultimate risky asset, and a Ukraine invasion would keep crypto selling pressure going another 10-15% over the short-term,” Edward Moya, senior market analyst at Oanda, wrote in a Thursday note.

President Joe Biden on Thursday told reporters that the threat of a Russian invasion of Ukraine is “very high” and said an invasion could occur “not now” but “in a manner of several days.”

Investors are also watching for any signs on how aggressive the Federal Reserve will tighten its monetary policy, as some investors are now pricing in about six interest-rate increases this year, though minutes of the January meeting released Wednesday provided few new details.

“The outlook for bitcoin remains mostly bullish, but if long-term growth prospects start taking a bigger hit from aggressive Fed tightening, institutional investors might scale down their bets,” Moya wrote.

U.S. stocks closed sharply lower on Thursday. The Dow Jones Industrial Average

DJIA,

booked its largest drop since November, shedding more than 600 points. The S&P 500

SPX,

dropped about 2.1% while the tech-heavy Nasdaq Composite

COMP,

declined about 2.9%.

This post was originally published on Market Watch