On average, the FTSE 100‘s dividend yield, is 3.2% right now. So, it follows that any of the index’s constituent stocks with a higher yield would be more desirable to the income investor, yes? Maybe, maybe not. In my opinion that would be so only if the dividend is sustainable and the stock’s price is not falling fast. If the latter is the case, I may make no net gains or worse, end up with a net loss on the investment.

British American Tobacco’s strengths

It is from this perspective that I am now considering whether or not to buy the tobacco stock British American Tobacco (LSE: BATS). It has a dividend yield of 6.4%, which is far above the FTSE 100 average. It is also above the inflation rate, which is pretty high at 5% right now. This in itself makes the stock worth considering.

5 Stocks For Trying To Build Wealth After 50

Markets around the world are reeling from the coronavirus pandemic… and with so many great companies trading at what look to be ‘discount-bin’ prices, now could be the time for savvy investors to snap up some potential bargains.

But whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. And if you’re 50 or over, we believe these stocks could be a great fit for any well-diversified portfolio.

Is it sustainable, though? Well, I have no reason to doubt it considering that the company has consistently paid dividends over the years. And going by its outlook for 2022, it is quite likely to continue paying them in the future too. I am basing this on the fact that it expects earnings per share to grow. It also mentions “maintaining growing dividends” elsewhere in its latest update.

Competitive price for the FTSE 100 stock

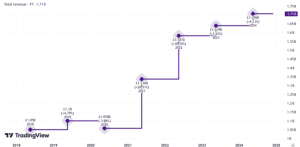

The next question is, what is the outlook for its share price? The British American Tobacco share price is up some 22% in the past year, which sounds positive. As per its latest results for 2021, its earnings are up from the year before. Also, as I mentioned earlier, it expects them to grow next year too. This could continue to push its share price up, particularly because its market valuation is still cheap. It has a price-to-earnings (P/E) ratio of around 11.7 times, which is lower than that for the FTSE 100 at around 18 times.

The long-term challenge

The one big challenge with tobacco stocks, though, is the long-term future. As the company itself points out in its update, global tobacco industry growth is expected to decline by 2.5% in 2022. It expects its own revenue and earnings to grow, but it is hard not to consider how long it can grow in a shrinking industry. Its tobacco alternatives’ division, called new categories, is growing fast, to be sure. But it is still quite small. Even with a 50%+ growth last year, it is less than 10% of the company’s total revenue. At this rate, it might be decades before this market matures, in my view. And what becomes of British American Tobacco in the interim? I am not sure.

My assessment

Perhaps it is for this reason that the FTSE 100 stock has seen quite a steep decline in share price over the past few years. It is down over 30% in the past five years. Also, it compares unfavourably to its FTSE 100 peer Imperial Brands, which trades at a multiple of sub-6 times. And also has a higher dividend yield of 7.8%. Between the two tobacco stocks, I would much prefer it to British American Tobacco and that is why I bought it. Though I am keeping an look out for further developments in the latter, I am not buying it yet.

Inflation Is Coming: 3 Shares To Try And Hedge Against Rising Prices

Make no mistake… inflation is coming.

Some people are running scared, but there’s one thing we believe we should avoid doing at all costs when inflation hits… and that’s doing nothing.

Money that just sits in the bank can often lose value each and every year. But to savvy savers and investors, where to consider putting their money is the million-dollar question.

That’s why we’ve put together a brand-new special report that uncovers 3 of our top UK and US share ideas to try and best hedge against inflation…

…because no matter what the economy is doing, a savvy investor will want their money working for them, inflation or not!

Best of all, we’re giving this report away completely FREE today!

Simply click here, enter your email address, and we’ll send it to you right away.

Manika Premsingh owns Imperial Brands. The Motley Fool UK has recommended British American Tobacco and Imperial Brands. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

This post was originally published on Motley Fool