A stock market crash could be on the horizon. UK shares, and others across the world, could drop in value. If a crash did happen, I’d look to add certain shares to my holdings that I believe could bounce back.

Stock market crashes can occur for a number of reasons. These include major world economies struggling with growth or battling inflation. In addition to this, geopolitical issues, such as the threat of war, can also cause a market downturn.

5 Stocks For Trying To Build Wealth After 50

Markets around the world are reeling from the coronavirus pandemic… and with so many great companies trading at what look to be ‘discount-bin’ prices, now could be the time for savvy investors to snap up some potential bargains.

But whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. And if you’re 50 or over, we believe these stocks could be a great fit for any well-diversified portfolio.

I believe all of these factors are currently present. The US and Chinese economies are struggling with inflation and growth issues, respectively, as well as a real estate crisis in the Chinese economy. As two of the world’s premier economies, if further trouble were to occur, the market could crash. The Russia-Ukraine tensions are a geopolitical issue to keep an eye on too.

Tech stock with a competitive edge

If a stock market crash were to occur, Auto Trader (LSE:AUTO) is one of a number of UK shares I would look to add to my holdings.

Auto Trader is recognised as the UK’s largest online vehicle marketplace. It makes money by charging sellers to list their vehicles to reach millions of consumers looking for their next car.

As I write, Auto Trader shares are trading for 655p. At this time last year, the shares were trading for 581p, which is a 12% return over a 12-month period.

UK shares have risks

Auto Trader’s main risk for me moving forward is that of competition. The recent rise of e-commerce and the digital revolution, which has been sped up further by the pandemic, has meant many competitors are now vying for market share. If a competitor with a better user experience or cheaper fees or another unique selling point were to come along, it could affect Auto Trader’s performance and any returns.

If any new variant of the Covid-19 virus were to appear, a slowdown in the sale of cars could affect any performance and returns. This happened previously for Auto Trader when the pandemic first struck.

A stock I’d buy

Auto Trader has a huge competitive edge in its respective market and has excellent brand recognition. The UK shares on my best stocks to buy list all possess a competitive edge or significant market share.

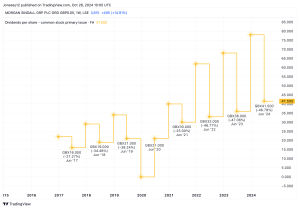

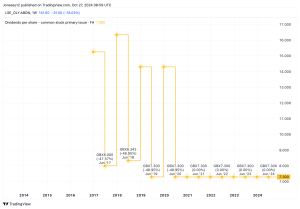

Due to its competitive edge, Auto Trader has excellent record of performance and dividend growth. I do understand past performance is not a guarantee of the future, however. Looking back at performance, prior to 2021, which was affected by the pandemic, revenues increased year on year for three years. More recently, it’s half-year results were excellent and the highest ever half-year revenues achieved.

Auto Trader pays a dividend that would make me a passive income too. Its yield stands at just 1.2%, but it has an annual growth record of 23% over a five-year period. I do understand dividends can be cancelled. This could be the case if a market crash were to occur. I would expect them to be reinstated over the longer term, though.

Auto Trader is one of a number of UK shares on my radar for possible additions to my holdings. I believe it could bounce back and provide a lucrative return for my holdings over time if cheapened by a crash.

FREE REPORT: Why this £5 stock could be set to surge

Are you on the lookout for UK growth stocks?

If so, get this FREE no-strings report now.

While it’s available: you’ll discover what we think is a top growth stock for the decade ahead.

And the performance of this company really is stunning.

In 2019, it returned £150million to shareholders through buybacks and dividends.

We believe its financial position is about as solid as anything we’ve seen.

- Since 2016, annual revenues increased 31%

- In March 2020, one of its senior directors LOADED UP on 25,000 shares – a position worth £90,259

- Operating cash flow is up 47%. (Even its operating margins are rising every year!)

Quite simply, we believe it’s a fantastic Foolish growth pick.

What’s more, it deserves your attention today.

So please don’t wait another moment.

Get the full details on this £5 stock now – while your report is free.

Jabran Khan has no position in any shares mentioned. The Motley Fool UK has recommended Auto Trader. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

This post was originally published on Motley Fool