Could Bloomsbury Publishing (LSE:BMY) be one of the best shares for me to buy now for my holdings? Let’s take a closer look.

Harry Potter publisher

Bloomsbury is a leading independent publishing house, established in 1986. It is perhaps best known for publishing the famous Harry Potter series of books and still owns the rights and benefits from sales to this day. Many of its authors have won the Nobel, Pulitzer, and Booker prizes for writing. It has offices in London, New York, New Delhi, Sydney, and Oxford.

5 Stocks For Trying To Build Wealth After 50

Markets around the world are reeling from the coronavirus pandemic… and with so many great companies trading at what look to be ‘discount-bin’ prices, now could be the time for savvy investors to snap up some potential bargains.

But whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. And if you’re 50 or over, we believe these stocks could be a great fit for any well-diversified portfolio.

As I write, Bloomsbury shares are trading for 389p. At this time last year, the shares were trading for 293p, which is a 32% return over a 12-month period.

For and against investing

FOR: One of the most important factors I look at in all my potential best shares to buy now is performance and track record. I do understand past performance is not a guarantee of the future, however. Looking back, Bloomsbury has increased revenue and gross profit year on year for the past four years. Coming up to date, a trading update released last month, providing a snapshot of upcoming full-year results, mentioned revenue and profit will be “comfortably ahead” of guidance for the year ending 28 February.

AGAINST: Competition in the publishing business is fierce and everyone is looking for the next big book or franchise that could be turned into the next Harry Potter. If a new smash hit is written by a competing publisher, this could affect demand for Bloomsbury’s products. This will affect performance and any returns I’d hope to make.

FOR: Nigel Newton founded the company in 1986 and is still involved now as CEO and a significant shareholder. I like when founder-owners have a vested interest in the company and possess a track record of navigating a company to success. This fills me with confidence and tells me his interests are aligned with that of shareholders, as he has his own money invested as a shareholder too.

AGAINST: Some of my best shares to buy now regularly acquire businesses in the same market. This can be to beat them as they are competing directly, or the other businesses can enhance its own offering. Bloomsbury has acquired three businesses in 2021. Sometimes, acquisitions don’t work out, however, so I must be wary of this. They may not integrate into the main business or firms like Bloomsbury may end up overpaying and paying the price financially.

One of my best shares to buy now

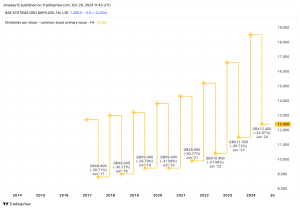

Overall, I like Bloomsbury shares for my holdings and would buy the shares at current levels. I think the current share price represents value with a price-to-earnings ratio of 15. In addition to this, I could make a passive income too through its dividend payments. I am aware that dividends can be cancelled, however. I do believe Bloomsbury is one of the best shares I could buy now and I’m keen on seeing full-year results in the coming months too.

FREE REPORT: Why this £5 stock could be set to surge

Are you on the lookout for UK growth stocks?

If so, get this FREE no-strings report now.

While it’s available: you’ll discover what we think is a top growth stock for the decade ahead.

And the performance of this company really is stunning.

In 2019, it returned £150million to shareholders through buybacks and dividends.

We believe its financial position is about as solid as anything we’ve seen.

- Since 2016, annual revenues increased 31%

- In March 2020, one of its senior directors LOADED UP on 25,000 shares – a position worth £90,259

- Operating cash flow is up 47%. (Even its operating margins are rising every year!)

Quite simply, we believe it’s a fantastic Foolish growth pick.

What’s more, it deserves your attention today.

So please don’t wait another moment.

Get the full details on this £5 stock now – while your report is free.

Jabran Khan has no position in any of the shares mentioned. The Motley Fool UK has recommended Bloomsbury Publishing. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

This post was originally published on Motley Fool