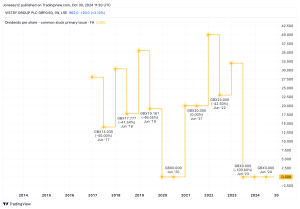

Shares in exercise equipment maker Peloton (NASDAQ: PTON), which have underperformed over the last year, have had a huge rebound this month. This time last week, Peloton’s share price was below $25. Today however, it’s at $39.

So what’s going on here? And should I buy the beaten-down growth stock now to capitalise on the upward momentum?

5 Stocks For Trying To Build Wealth After 50

Markets around the world are reeling from the coronavirus pandemic… and with so many great companies trading at what look to be ‘discount-bin’ prices, now could be the time for savvy investors to snap up some potential bargains.

But whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. And if you’re 50 or over, we believe these stocks could be a great fit for any well-diversified portfolio.

Why Peloton’s share price is soaring

In my view, there are a number of reasons Peloton’s share price has spiked recently. One is that there has been a change of CEO.

On 8 February, the company announced that Barry McCarthy, who has held senior leadership roles at Spotify and Netflix, has been appointed CEO and president, effective 9 February.

Peloton co-founder John Foley, who was previously the CEO, will now become executive chair. Investors were happy with the decision to replace Foley as CEO, as he has made a number of sub-optimal decisions in relation to product, pricing, demand, and capital allocation in the recent past.

Another reason Peloton’s share price has surged is that the company announced that it would be taking a series of steps to position the business for long-term growth and establish a clear path to consistent profitability.

These steps will see it cut 2,800 jobs and reduce its planned capital expenditures in 2022 by approximately $150m. It believes its actions can deliver $800m in annual run-rate cost savings.

Takeover speculation has also fueled the share price recently. In the last week, there’s been rumours that Peloton could be acquired by a larger company. Apple and Amazon are two companies that have been mentioned.

I personally don’t think Apple would be interested in Peloton. However, a deal could work for Amazon. It has the logistics network in place to deliver the exercise equipment, and could stream the content through Prime.

Finally, I believe we’ve seen a bit of a ‘short squeeze’ over the last week. Data from Nasdaq shows that in January, short interest here was above 10%. I think a bit of buying from investors has forced some of the short sellers to close their positions, which has pushed the share price higher.

Should I buy Peloton stock now?

As for whether I’d buy Peloton stock for my portfolio today, I’m not convinced the risk/reward proposition is favourable at present.

I do think there’s a market for Peloton’s premium exercise products. And I believe the company is heading in the right direction now it has replaced its CEO and announced cost-saving measures.

However, to my mind, there’s a lot of uncertainty in relation to future growth. Ultimately, it’s hard to know what kind of growth Peloton is capable of generating in a post-Covid world.

Another concern for me is competition. Not only is Peloton up against other similar work-out-from-home products, such as Lululemon’s Mirror, but it is also facing competition from gyms and exercise studios now that the world has reopened.

Given the uncertainty over future growth, I’m going to leave Peloton stock on my watchlist for now. All things considered, I think there are better stocks to buy at the moment.

Like some of these stocks, for example…

Inflation Is Coming: 3 Shares To Try And Hedge Against Rising Prices

Make no mistake… inflation is coming.

Some people are running scared, but there’s one thing we believe we should avoid doing at all costs when inflation hits… and that’s doing nothing.

Money that just sits in the bank can often lose value each and every year. But to savvy savers and investors, where to consider putting their money is the million-dollar question.

That’s why we’ve put together a brand-new special report that uncovers 3 of our top UK and US share ideas to try and best hedge against inflation…

…because no matter what the economy is doing, a savvy investor will want their money working for them, inflation or not!

Best of all, we’re giving this report away completely FREE today!

Simply click here, enter your email address, and we’ll send it to you right away.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Edward Sheldon owns shares in Amazon and Apple. The Motley Fool UK has recommended Amazon, Apple, Peloton Interactive, and Spotify Technology. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

This post was originally published on Motley Fool