‘Metaverse stocks’ mean shares in firms that are expected to gain from the metaverse that everyone is talking about at present. Investors are scrambling to get in on the ground floor. But it’s not obvious what will and what won’t thrive in this new arena. Facebook owner Meta is a prominent metaverse stock but has already plummeted in value. That’s why I’m taking an interest in companies needed to build the metaverse’s infrastructure.

Cryptocurrency

One metaverse stock involves cryptocurrencies. I laughed at the idea when I first heard about Bitcoin in 2013, assuming it was a craze that would simply fade away. Boy was I wrong. There are still many nay-sayers. But as more and more institutional investors include cryptocurrencies in their portfolios, I can’t help but believe they’re here to stay. So, I’ve decided to add Argo Blockchain (LSE: ARB) to my portfolio.

5 Stocks For Trying To Build Wealth After 50

Markets around the world are reeling from the coronavirus pandemic… and with so many great companies trading at what look to be ‘discount-bin’ prices, now could be the time for savvy investors to snap up some potential bargains.

But whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. And if you’re 50 or over, we believe these stocks could be a great fit for any well-diversified portfolio.

In basic terms, ARB is a crypto-mining service provider. That means it owns and manages the computer servers required to keep track of blockchain transfers. Argo is compensated in newly created Bitcoin, the most valuable cryptocurrency in the market.

Following a 700% increase in December 2020, the company’s stock price fell in 2021. It is presently trading at 75.69p and is expected to fall further in the immediate term as Bitcoin’s value drops and cryptocurrencies possibly enter a bear market. But I’m not worried. Argo Blockchain will continue to accumulate Bitcoin until the next ‘halving event’ in 2024. The number of new Bitcoins created will be halved once this occurs. This is part of a procedure designed by Bitcoin’s developer to keep inflation under control. A bull market is usually triggered by this supply shock.

The biggest unknown is whether Argo blockchain will last until 2024. The company’s cost of revenue is uncomfortably high. It has only been profitable since 2020. It should have enough cash to withstand the next downturn market if it sells its Bitcoin now, but it’s a risk I need to keep in mind.

Metaverse computing power

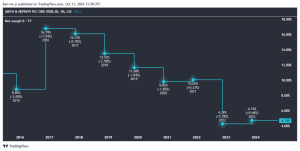

Without the computer power to keep it operating, the metaverse can’t function. So, I’ll be including Nvidia (NASDAQ: NVDA) in my portfolio. From GPUs to transistors and the software that runs on them, Nvidia produces and manufactures numerous critical components that make computing possible. Nvidia stock is presently trading at $251, up 100% from this time last year and over 700% since 2017. I’m concerned that some of this is due to investor euphoria. The stock’s price-to-earnings (P/E) ratio of 77.51 is alarmingly high. I’m not usually comfortable with anything above 20, but a comment from Wells Fargo analyst Aaron Rakers has allayed some of my fears: “We estimate that the metaverse could equate to a $10bn incremental market opportunity for Nvidia over the next five years.”

Normally, I’m wary of overly optimistic projections. But there’s no way of knowing how huge the metaverse will become. It may either break apart or open up a whole new universe of possibilities. The sky’s the limit when it comes to technology.

I’d love to be a part of it if it turns out to be the latter.

Is this little-known company the next ‘Monster’ IPO?

Right now, this ‘screaming BUY’ stock is trading at a steep discount from its IPO price, but it looks like the sky is the limit in the years ahead.

Because this North American company is the clear leader in its field which is estimated to be worth US$261 BILLION by 2025.

The Motley Fool UK analyst team has just published a comprehensive report that shows you exactly why we believe it has so much upside potential.

But I warn you, you’ll need to act quickly, given how fast this ‘Monster IPO’ is already moving.

Click here to see how you can get a copy of this report for yourself today

The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of investment advice. Bitcoin and other cryptocurrencies are highly speculative and volatile assets, which carry several risks, including the total loss of any monies invested. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

James Reynolds has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

This post was originally published on Motley Fool