The IAG (LSE: IAG) share price has had an excellent start to 2022, up 12%, as I type. I think there could be more to come.

IAG share price: ready to fly?

Let’s start with the obvious, namely the gradual removal of Covid-19-related restrictions. The move by Australia to re-open its borders to double-jabbed passengers, for example, is clearly a shot in the arm for the British Airways owner. After all, long-haul flights tend to be more lucrative. And as confidence returns, IAG’s revenue and profits should bounce back.

5 Stocks For Trying To Build Wealth After 50

Markets around the world are reeling from the coronavirus pandemic… and with so many great companies trading at what look to be ‘discount-bin’ prices, now could be the time for savvy investors to snap up some potential bargains.

But whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. And if you’re 50 or over, we believe these stocks could be a great fit for any well-diversified portfolio.

Another reason to like IAG is that it’s actually a collection of carriers: the aforementioned BA, Iberia, value operators Aer Lingus and Iberia Express, and low-cost LEVEL and Vueling. This diversification allows the company to cater to many/all traveller types, potentially giving it an advantage in the recovery.

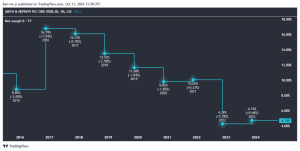

A final reason relates to the FTSE 100 stock’s current valuation. Right now, the IAG share price is around 19% up on where it stood one year ago, giving the company a market-cap of £8.8bn. However, at 178p, the stock is also far below the near-500p level hit almost four years ago. From this angle, investors may consider that the company has great rebound potential.

Sure, no stock has the right to move higher and we should be wary of anchoring ourselves to a previous value. However, the recent rotation into value stocks (which IAG arguably is) may continue for a while yet, especially if interest rate rises come thick and fast.

What could possibly go wrong?

Having listed three reasons for being bullish on IAG, we might assume that I’m busy loading up on the stock? Actually, this couldn’t be further from the truth.

The fact is, the airline industry is a notoriously awful place to invest. The sheer amount of money needed to keep planes in the air means that returns on invested capital (a key quality metric) tend to be low, relative to companies in sectors such as consumer goods and software.

To paraphrase fund manager Terry Smith, companies that are able to reinvest profits at a high rate of return for many years tend to be the best stocks to own. The converse is also true.

Another issue is the level of competition any airline faces. While possessing multiple carriers might be in its favour, retaining passengers will still be a challenge for IAG, not to mention a costly exercise. This seems like a good time to mention the company’s significant debt pile.

On top of this, strikes by airline/airport staff, bad weather and terrorist activity all have the potential to impact trading. Naturally, the possibility of another Covid-19 variant lurking in the background can’t be ruled out either. This wouldn’t be such a problem for me if IAG paid a dividend but that probably won’t happen for a good while.

Better buy

To summarise, I don’t doubt that there’s the potential to make money here. But this is most definitely not a business I’d want to own for years. For a Fool like me, that’s reason enough to avoid the stock. As an investor who adopts a ‘buy right and hold on’ mentality, IAG simply doesn’t tick enough of my boxes.

If I were to buy a travel-related recovery stock today, it would be (more of) this one.

FREE REPORT: Why this £5 stock could be set to surge

Are you on the lookout for UK growth stocks?

If so, get this FREE no-strings report now.

While it’s available: you’ll discover what we think is a top growth stock for the decade ahead.

And the performance of this company really is stunning.

In 2019, it returned £150million to shareholders through buybacks and dividends.

We believe its financial position is about as solid as anything we’ve seen.

- Since 2016, annual revenues increased 31%

- In March 2020, one of its senior directors LOADED UP on 25,000 shares – a position worth £90,259

- Operating cash flow is up 47%. (Even its operating margins are rising every year!)

Quite simply, we believe it’s a fantastic Foolish growth pick.

What’s more, it deserves your attention today.

So please don’t wait another moment.

Get the full details on this £5 stock now – while your report is free.

Paul Summers has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

This post was originally published on Motley Fool