Key points

- The company’s fundamentals are going in the right direction

- The ITM share price could benefit as more industries seek greener alternatives

- Management is looking for long-term growth

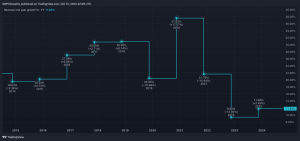

The ITM Power (LSE: ITM) share price has endured a torrid time of late. Over the past five years, this stock has tumbled 61.65%. This is a company that pursues greener, hydrogen-based energy. It specialises in energy storage systems and renewable hydrogen. With many investors now seeking green energy exposure, I want to know if the ITM share price could soar. Let’s take a closer look.

The fundamentals

In almost all of the business fundamentals, ITM looks to be improving. In the half-year report for the six months to 31 October 2021, revenue had increased massively to £4.2m from £200,000 in the same period in 2020.

5 Stocks For Trying To Build Wealth After 50

Markets around the world are reeling from the coronavirus pandemic… and with so many great companies trading at what look to be ‘discount-bin’ prices, now could be the time for savvy investors to snap up some potential bargains.

But whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. And if you’re 50 or over, we believe these stocks could be a great fit for any well-diversified portfolio.

Furthermore, gross losses narrowed from £2.8m to £2.6m. In a similar vein, the company’s cash burn was down 15.7%. For me, this is a good indication that this company is starting to get its finances under control, especially as it aggressively pursues growth in the hydrogen energy field.

However, adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) were actually losses and widened to £12.9m from £10.4m. In spite of this, Citigroup stated that it views “the risk/reward trade-off as attractive”.

Revenue over the years 2017 to 2021, grew from £2.42m to £4.28m. This means that revenue has grown at an annual compound rate of 12%. This is both solid and consistent and shows the company is working hard to monetise its hydrogen technology.

That said, its revenue is still relatively small compared to the firm’s market capitalisation of £1.5bn. In spite of this, liquidity does not appear to be an issue, with ITM easily raising £250m in October 2021.

Long-term vision

Just last month, the company secured funding of €1.95m from the German Government. This means the company will play a large role in developing hydrogen energy throughout Germany as part of the country’s National Hydrogen Strategy.

This contract runs until March 2025 and is an encouraging sign of ITM’s long-term potential. I believe this could have a positive impact on the share price in the near future.

Furthermore, the business sold a 24-megawatt electrolyser, which uses green hydrogen to produce ammonia, to Linde Engineering based near Oslo, Norway. This will be shipped in the fourth quarter of fiscal year 2022, with revenue commencing the next year.

This is further evidence the long-term potential, something I like to see in any stock in which I invest. I believe, therefore, that the ITM share price could benefit as more countries and companies move to greener solutions.

This company is still expanding and many of the fundamentals are heading in the right direction. As more and more industries switch to greener energy sources, demand for ITM products could increase. This demand could indeed translate into a soaring ITM share price. I will be buying shares now to benefit from long-term growth.

FREE REPORT: Why this £5 stock could be set to surge

Are you on the lookout for UK growth stocks?

If so, get this FREE no-strings report now.

While it’s available: you’ll discover what we think is a top growth stock for the decade ahead.

And the performance of this company really is stunning.

In 2019, it returned £150million to shareholders through buybacks and dividends.

We believe its financial position is about as solid as anything we’ve seen.

- Since 2016, annual revenues increased 31%

- In March 2020, one of its senior directors LOADED UP on 25,000 shares – a position worth £90,259

- Operating cash flow is up 47%. (Even its operating margins are rising every year!)

Quite simply, we believe it’s a fantastic Foolish growth pick.

What’s more, it deserves your attention today.

So please don’t wait another moment.

Get the full details on this £5 stock now – while your report is free.

Andrew Woods has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

This post was originally published on Motley Fool