After a choppy few years, is it finally time for the BP (LSE:BP) share price to take off? That’s the question I’m looking to answer today.

BP recently reported its 2021 full-year results and there was plenty to like. It swung back into profit from a loss in 2020. The energy giant reported a profit of $12.8bn in 2021, the highest in eight years. Higher oil prices and an economic recovery after pandemic restrictions were lifted could explain much of the performance.

5 Stocks For Trying To Build Wealth After 50

Markets around the world are reeling from the coronavirus pandemic… and with so many great companies trading at what look to be ‘discount-bin’ prices, now could be the time for savvy investors to snap up some potential bargains.

But whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. And if you’re 50 or over, we believe these stocks could be a great fit for any well-diversified portfolio.

The price of Brent crude oil is currently around $90 a barrel. That’s a whopping 50% higher than one year ago. Some of the gain can be explained by rising demand due to economic recovery. But some can be attributed to growing tensions between Russia and Ukraine. If the situation worsens in the region over the coming months, I wouldn’t be surprised to see crude oil prices rise further. That could mean a further boost for BP shares. But I’d also consider the opposite. The relaxation of tensions we all hope for could cap oil price gains… and the share price.

More cash for shareholders

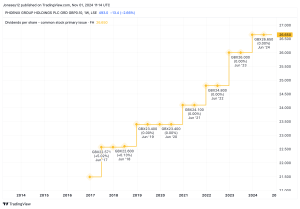

For a company like BP, I like to see share buybacks and chunky dividends. Both are methods of returning cash to shareholders. So I’m pleased to note that it announced $4.15bn of buybacks from 2021 surplus cash flow. It also announced a dividend for the fourth quarter of 5.46 cents per share. Including its other dividends for the year, I calculate the dividend yield to be 4%. I reckon that’s OK, but not the greatest. There are currently several dividend shares in the FTSE 100 that offer over 6%.

Based on BP’s current forecasts, at around $60 per barrel for Brent crude, it expects to be able to deliver share buybacks of approximately $4bn per year and raise dividends by 4% per year until 2025. That suggests there could be room to the upside for both if oil prices remain elevated, which could help the share price .

Performing while transforming

BP is undergoing something of a transformation to become an integrated energy company. It seems to be making progress, with over 5GW in offshore wind projects and further opportunities in hydrogen. That being said, the road from oil firm to diversified energy company could be bumpy. Much investment will be needed over many years. If it works out, it could be lucrative for shareholders. But if it doesn’t, then it could be set for years of mediocre returns.

Where next for the BP share price?

Although the past isn’t the best guide for the future, let’s take a look at the BP share price over the past 10 years. If I bought BP shares back then, I would have achieved an annual return of just 3% including dividends. That looks pretty underwhelming and disappointing compared with the 6.5% return I could have achieved with the average FTSE 100 share.

My analysis suggests to me that the BP share price could indeed take off over the coming months. But I’m not confident it will be sustainable beyond that. With so many other more promising FTSE 100 shares, I’m going to stay on the side-lines with this one.

5 Stocks For Trying To Build Wealth After 50

Markets around the world are reeling from the coronavirus pandemic…

And with so many great companies still trading at what look to be ‘discount-bin’ prices, now could be the time for savvy investors to snap up some potential bargains.

But whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times.

Fortunately, The Motley Fool is here to help: our UK Chief Investment Officer and his analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global lock-down…

You see, here at The Motley Fool we don’t believe “over-trading” is the right path to financial freedom in retirement; instead, we advocate buying and holding (for AT LEAST three to five years) 15 or more quality companies, with shareholder-focused management teams at the helm.

That’s why we’re sharing the names of all five of these companies in a special investing report that you can download today for FREE. If you’re 50 or over, we believe these stocks could be a great fit for any well-diversified portfolio, and that you can consider building a position in all five right away.

Click here to claim your free copy of this special investing report now!

Harshil Patel has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

This post was originally published on Motley Fool